Understanding Home Equity Loans: How They Work, Benefits, and When to Use Them

A home is more than just a place to live — it’s also one of the largest financial assets you can build. As your property value increases or your mortgage balance decreases, you grow something called home equity. One of the most common ways to tap into this value is through a Home Equity Loan.

This guide explains how home equity loans work, who they are best suited for, their advantages, and important risks to consider before applying.

What Is a Home Equity Loan?

A Home Equity Loan (also known as a second mortgage) allows homeowners to borrow money against the current equity in their property. Equity is the difference between the home’s current market value and the remaining mortgage balance.

For example, if your home is worth $400,000 and your remaining mortgage balance is $250,000, your equity is $150,000. A lender may allow you to borrow 70–85% of that equity.

Home Equity Loans come with a fixed interest rate, fixed monthly payments, and a set repayment term, making them predictable and easy to budget for.

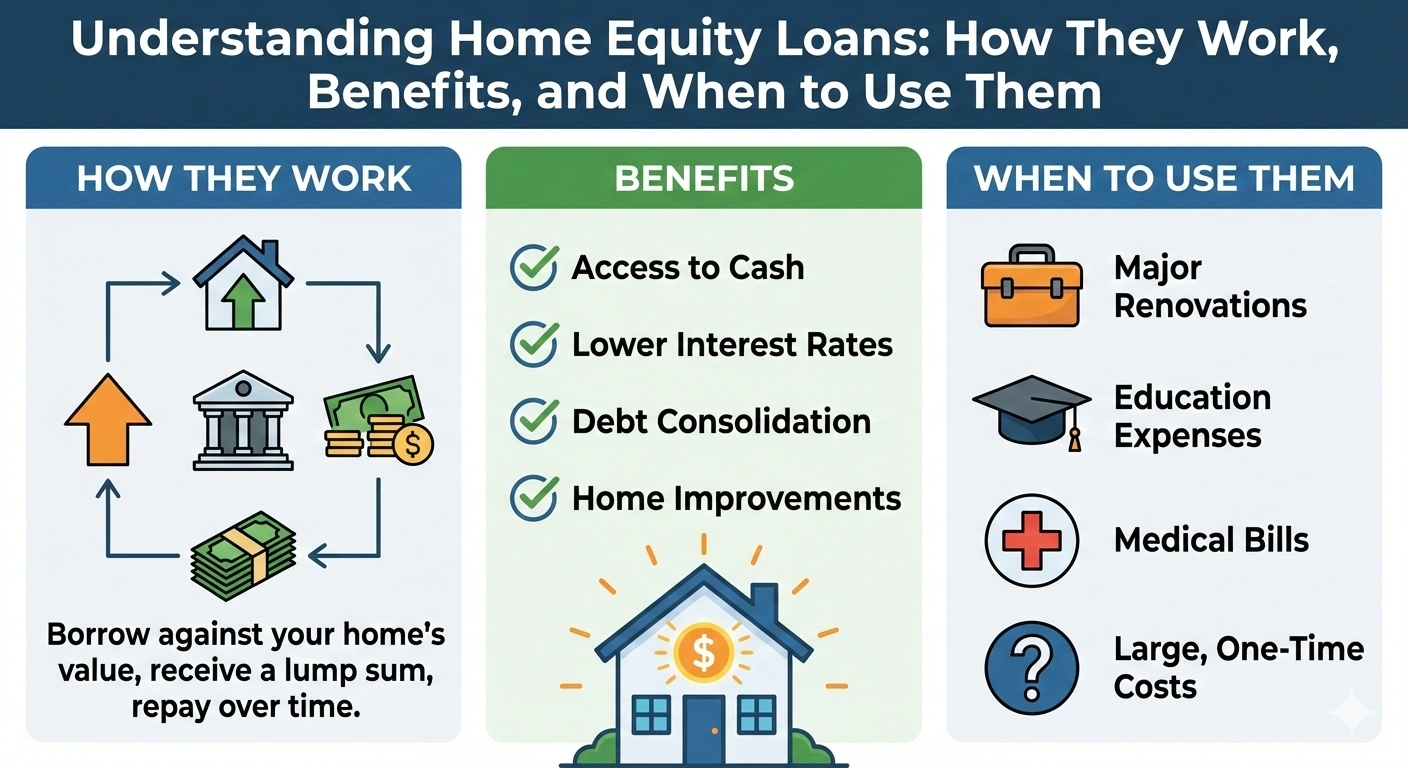

How Home Equity Loans Work

- You apply through a bank, credit union, or mortgage lender.

- The lender evaluates your home value, credit score, income, and debt-to-income ratio.

- Once approved, you receive a lump-sum amount.

- You repay it through fixed monthly installments over 5–30 years.

Eligibility Criteria

- Strong credit score (varies by country/lender).

- Enough available home equity.

- Stable income and low debt.

- A clean mortgage repayment history.

Benefits of Home Equity Loans

- Lower interest rates compared to personal loans or credit cards.

- Fixed payments make budgeting simple.

- Lump-sum funding ideal for large expenses.

- Can be used for home improvement, debt consolidation, education, medical costs, or major purchases.

- In some countries, interest may be tax-deductible (depending on local rules).

Common Uses for Home Equity Loans

- Home renovations and repairs

- Debt consolidation (lowering high-interest debt)

- Major life expenses like weddings or tuition

- Emergency medical bills

- Investments like purchasing land or a second property

Risks & Considerations

- Your home is collateral — failure to repay may lead to foreclosure.

- Increasing your debt-to-income ratio.

- Closing costs and appraisal fees may apply.

- If property values drop, you may owe more than the home is worth.

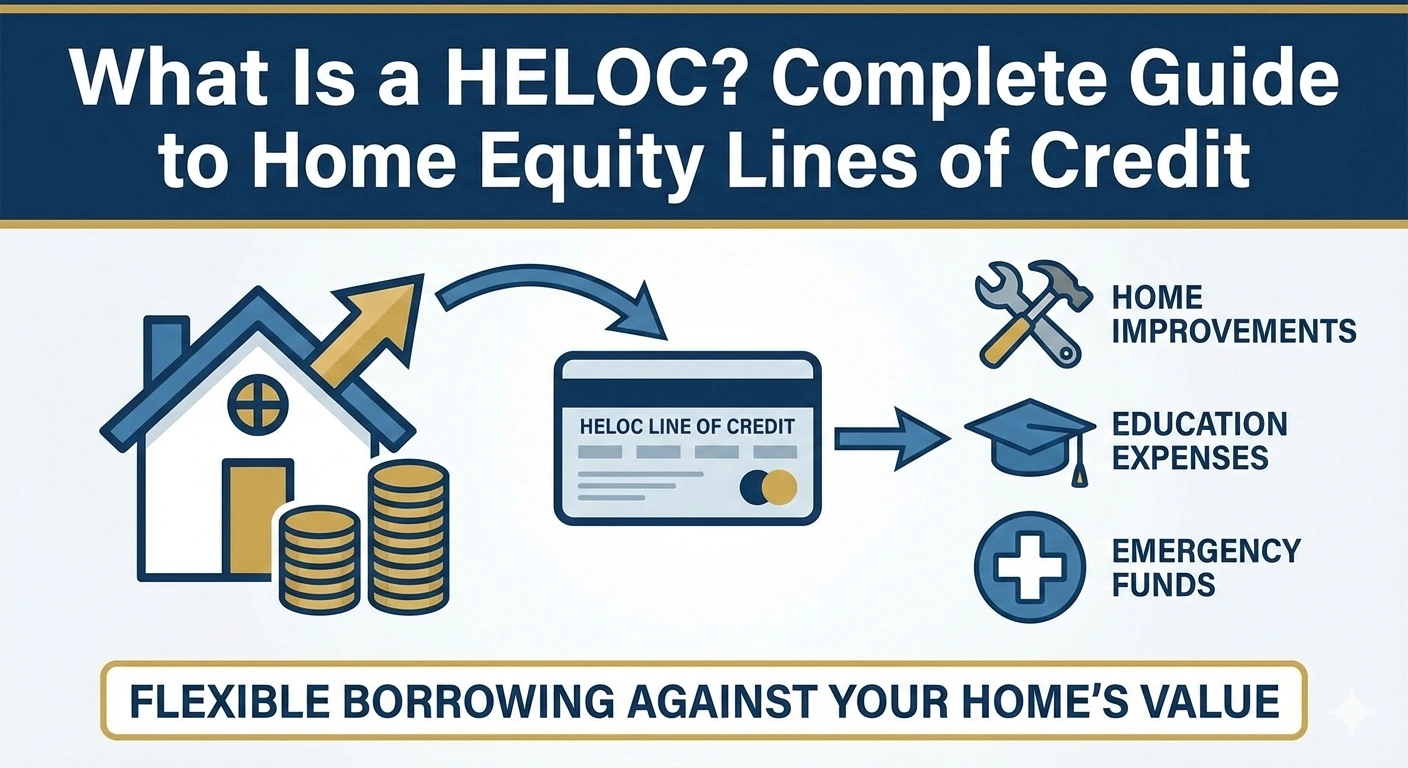

Home Equity Loan vs. HELOC vs. Cash-Out Refinance

Homeowners often confuse these three borrowing options:

- Home Equity Loan: Lump sum, fixed rate.

- HELOC (Home Equity Line of Credit): Revolving credit, variable rates.

- Cash-Out Refinance: Replaces existing mortgage, new single loan.

Each has benefits, but Home Equity Loans are best for one-time major expenses requiring predictable repayment.

Is a Home Equity Loan Right for You?

You may benefit if you:

- Have strong equity in your home.

- Need a large, one-time amount.

- Prefer fixed monthly payments.

- Have stable income and financial discipline.

However, if you expect irregular expenses, a HELOC might be more flexible.

Final Thoughts

Home Equity Loans can be powerful financial tools when used wisely. They offer low rates, predictable repayment, and access to significant funds. However, because your home is on the line, it’s essential to borrow responsibly, compare lenders, and assess long-term affordability.

Always consider getting financial advice before using your home equity — it’s one of your most valuable assets.

Admin

Admin

Admin

Admin