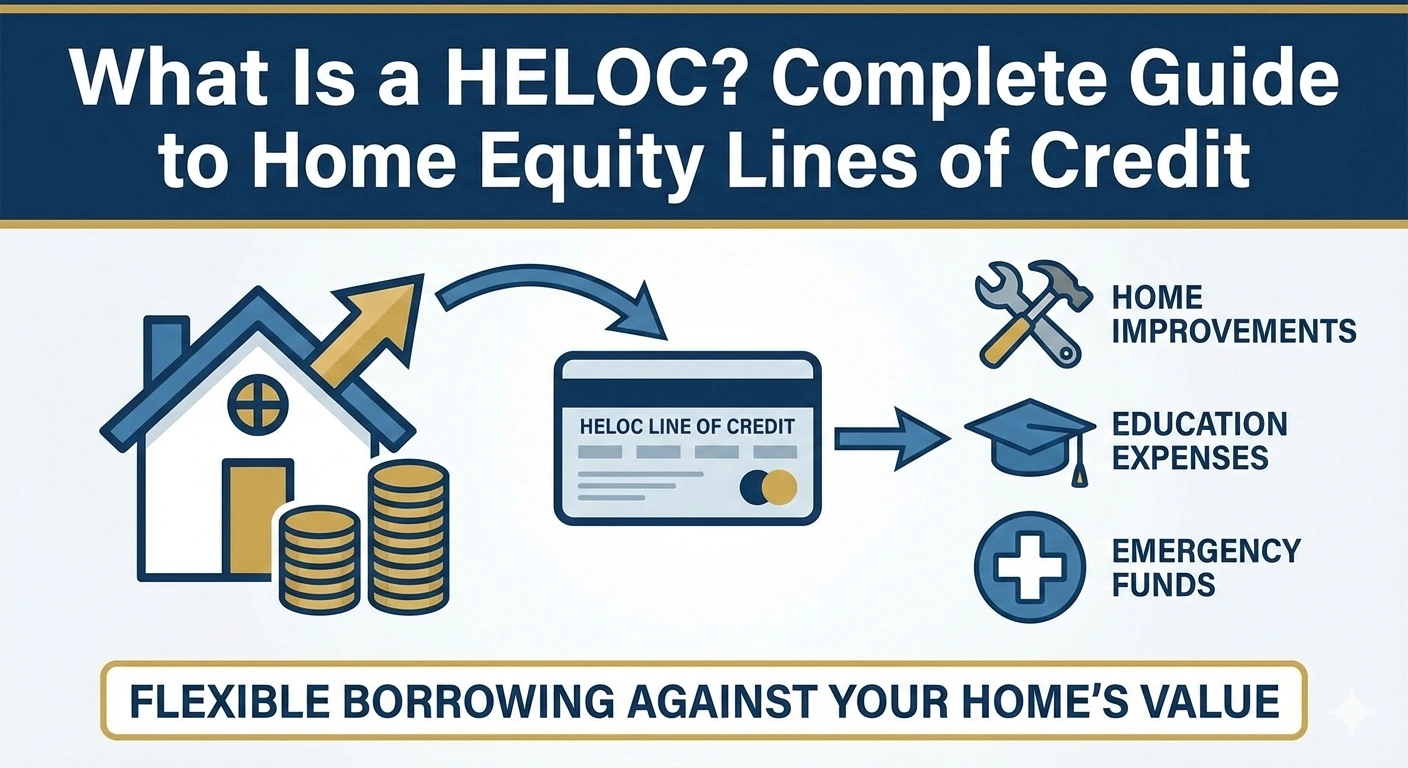

What Is a HELOC? Complete Guide to Home Equity Lines of Credit

A Home Equity Line of Credit (HELOC) is one of the most flexible borrowing tools available to homeowners worldwide. Unlike a traditional home equity loan, which provides a lump-sum payment, a HELOC functions like a credit card backed by your home. You can borrow, repay, and borrow again as needed — making it ideal for ongoing and variable expenses.

This comprehensive guide covers how HELOCs work, global eligibility standards, benefits, drawbacks, and practical use cases so homeowners can make informed borrowing decisions.

What Is a HELOC?

A HELOC (Home Equity Line of Credit) is a revolving credit line secured by your home’s equity. Instead of receiving one fixed loan amount, you get access to a credit limit based on your available equity, income, and credit health.

The HELOC has two main phases:

- Draw Period – Typically 5–10 years. You can borrow funds, repay them, and borrow again.

- Repayment Period – Typically 10–20 years. Borrowing stops, and you pay back remaining balances.

How HELOCs Work

During the draw period, homeowners can withdraw funds at any time using checks, online banking, or a lender-issued HELOC card. Many HELOCs have variable interest rates tied to market indexes like prime rate.

Typical HELOC features include:

- Revolving credit access

- Minimum monthly interest-only payments during draw period

- Variable or hybrid interest rates

- Ability to convert a portion into a fixed-rate loan (varies by lender)

Eligibility Criteria

Lenders generally review the following factors globally:

- Home equity level – Typically 15–20% minimum.

- Credit score – Higher scores result in better rates.

- Income stability – Ability to repay.

- Debt-to-income ratio (DTI) – Usually under 40–45%.

- Property appraisal – Determines current market value.

Benefits of a HELOC

- Flexibility – Borrow only what you need, when you need it.

- Lower interest rates compared to credit cards and personal loans.

- Interest-only payments during draw period improve cash flow.

- Reusable credit line for long-term projects.

- Potential tax benefits in some countries (depending on local regulations).

Common Uses for HELOCs

HELOCs are highly versatile, making them suitable for:

- Home renovations (ongoing projects with variable cost)

- Emergency expenses

- Debt consolidation

- Major purchases like vehicles or equipment

- Education costs

- Real estate investments

Risks & Considerations

- Home at risk — Your property serves as collateral.

- Variable interest rates can increase monthly payments unexpectedly.

- Overspending risk due to revolving credit access.

- Reduced equity impacts future refinancing or selling plans.

- Possible annual fees, transaction fees, or early closure fees.

HELOC vs. Home Equity Loan

- HELOC: Revolving credit line, variable rates, flexible usage.

- Home Equity Loan: Lump-sum loan, fixed rates, predictable payments.

Choose a HELOC if you expect ongoing expenses or want financial flexibility. Choose a home equity loan for one-time large expenses requiring fixed payments.

Best Practices for Using a HELOC

- Borrow strategically, not impulsively.

- Use funds only for value-building or essential expenses.

- Monitor interest rates regularly.

- Plan for the repayment period in advance.

- Compare lenders for best interest rates and fee structures.

Is a HELOC Right for You?

A HELOC is ideal if you:

- Have significant home equity.

- Expect fluctuating or ongoing costs.

- Prefer flexible borrowing instead of fixed loans.

- Can manage variable-rate debt responsibly.

However, if you prefer predictable payments, a fixed-rate option like a Home Equity Loan may be better.

Final Thoughts

HELOCs are powerful financial tools, offering unmatched flexibility to homeowners. But they require careful planning and responsible borrowing. Understanding the terms, risks, and interest rate structures is essential before leveraging home equity.

A well-managed HELOC can help you renovate your home, consolidate debt, or fund major life goals without unnecessary financial stress.

Admin

Admin

Admin

Admin