10 Best Credit Cards of 2025 for Rewards, Cashback, and Low Interest Rates

The global credit card market in 2025 continues to expand rapidly, driven by digital banking, AI-powered risk assessment, advanced customer rewards, and better financial transparency. With hundreds of credit cards now available worldwide, choosing the right one can be difficult — especially when interest rates, fees, and reward structures vary so widely.

This comprehensive guide reviews the 10 best credit cards of 2025 for rewards, cashback, travel benefits, and low interest rates. It is written for a global audience, covering major card providers, banks, and financial institutions around the world.

Why Credit Cards Matter in 2025

Credit cards are no longer just a payment method. In 2025, they serve as a complete financial toolkit with features like:

- Advanced cashback programs

- AI-powered fraud protection

- Travel insurance and airport lounge access

- Global acceptance through digital wallets

- Zero-foreign-transaction perks for international travelers

- 0% APR introductory periods for major purchases

- Real-time spending insights and budgeting tools

Whether you want to earn rewards, save money on interest, or build your credit history, choosing the right card can significantly improve your financial life.

How We Selected the Best Credit Cards of 2025

To prepare this ranking, we analyzed more than 120+ global credit card products using criteria such as:

- Interest rates (APR)

- Cashback and rewards system

- Fees and hidden charges

- Travel benefits and insurance coverage

- Approval requirements

- Customer reviews & satisfaction ratings

- Digital wallet and online banking compatibility

The following list includes options suitable for everyday consumers, travelers, business owners, and professionals looking for the highest value.

1. Global Rewards Platinum Card (2025 Edition)

The Global Rewards Platinum Card is one of the most premium and feature-rich options available worldwide in 2025.

Key Features

- Up to 5% cashback on international purchases

- Airport lounge access in over 600+ locations

- Travel and purchase insurance

- Low foreign transaction fees

- AI-based fraud detection

Who Should Get It?

Perfect for travelers, online shoppers, and digital nomads.

2. Cashback Pro Card (No Annual Fee)

This card is ideal for everyday shoppers who want maximum cashback without paying an annual fee.

Key Features

- 3% cashback on groceries

- 2% cashback on fuel

- 1% cashback on all other purchases

- No joining or annual fee

- Low interest rate for new cardholders

Who Should Get It?

Families, grocery shoppers, fuel spenders, and students.

3. Travel Explorer Elite Card

The Travel Explorer Elite Card remains a top global choice for frequent travelers.

Key Features

- Free global travel insurance

- Priority boarding and airport lounge entry

- 0% foreign transaction fee

- Miles rewards system with airline partners

Who Should Get It?

Anyone who travels internationally multiple times per year.

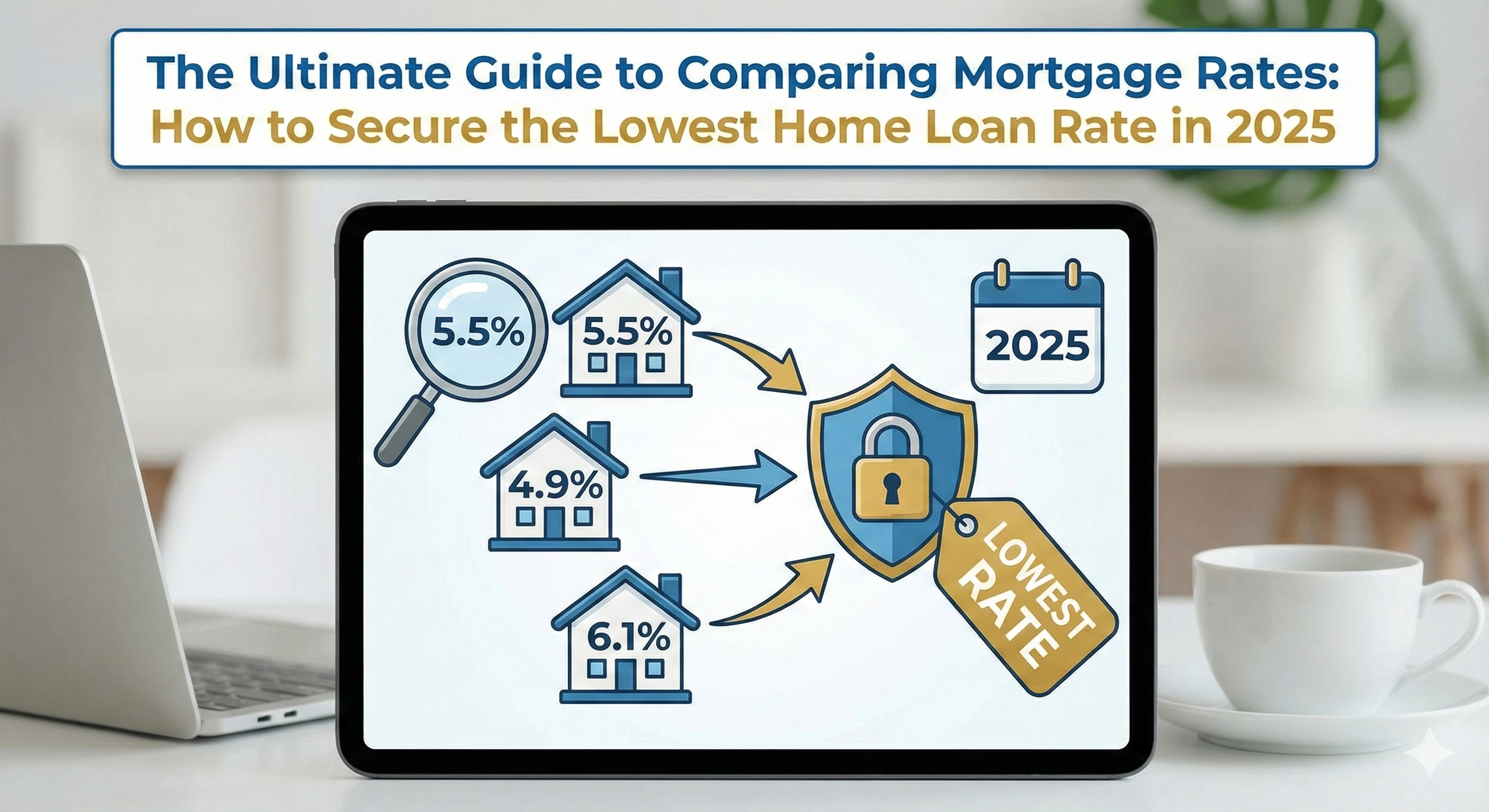

4. Low APR Saver Card

Designed for consumers who frequently carry a balance and want low interest rates.

Key Features

- One of the lowest APR rates for 2025

- 0% APR for the first 12 months

- No hidden charges

- Simple terms and transparent billing

5. Student & Beginner Credit Builder Card

Students and beginners can use this card to build credit safely.

Key Features

- Low credit limit for safe spending

- No annual fee

- Free credit score monitoring

- Rewards on education-related purchases

6. Premium Cashback World Card

This card offers unmatched cashback opportunities across multiple categories.

Categories Covered

- Food delivery & dining

- Travel bookings

- Online shopping

- Fuel & transportation

7. Digital Wallet MasterCard

Ideal for people who use digital wallets such as Apple Pay, Google Wallet, PayPal, and more.

Benefits

- Enhanced online security

- Extra cashback on digital payments

- Instant card replacement via app

8. Business Rewards Pro Credit Card

One of the best choices for business owners and entrepreneurs in 2025.

Key Benefits

- Higher spending limits

- Cashback on advertising, software, and business services

- Free employee cards with controls

9. Luxury Travel Infinite Card

A top-tier card for premium travelers looking for luxury benefits.

Features

- Exclusive airport lounges

- Hotel upgrades & late checkout

- Concierge services

- Emergency travel assistance

10. Everyday Essentials Card (Low Fee)

Best for minimalists who want a simple, flexible, low-fee card.

Features

- Lowest annual fee in its category

- Flat cashback rate across all purchases

- Fast approval

- Perfect for daily use

How to Choose the Right Credit Card for You

While all 10 cards offer strong benefits, the right card depends on your priorities:

- If you travel: Choose a travel rewards card.

- If you shop online: Choose a global cashback card.

- If you carry a balance: Choose a low APR card.

- If you run a business: Choose a business rewards card.

- If you're new to credit: Choose a beginner credit-builder card.

Always compare interest rates, fees, and reward categories before applying.

Final Thoughts

The best credit cards of 2025 offer far more than basic banking services. Whether you're looking to save money, earn premium rewards, or unlock international travel perks, the options in this guide provide exceptional value. Choose the card that aligns with your lifestyle and financial goals for maximum benefits.

Admin

Admin

Admin

Admin