Family Protection Life Insurance Plans: A Complete Global Guide (2025)

Life insurance is one of the most important financial planning tools for families around the world. Whether you're protecting young children, safeguarding long-term financial stability, or ensuring that your partner is secure, a Family Protection Life Insurance Plan provides unmatched peace of mind.

This in-depth global guide explores how family protection life insurance works, policy options, benefits, costs, and how to choose the right plan for your loved ones.

What Are Family Protection Life Insurance Plans?

Family protection life insurance refers to policies designed to financially protect your dependents in case of your unexpected death. These plans ensure that your family can maintain their lifestyle, pay essential bills, and achieve long-term goals.

They are ideal for:

- Parents with minor children

- Families with one or two income earners

- People supporting elderly parents

- Couples planning long-term wealth distribution

Types of Family Protection Life Insurance

1. Term Life Insurance for Families

Term life is the simplest and most affordable option. It provides coverage for a fixed duration — usually 10, 20, or 30 years.

Best for: young families, new parents, and people needing high coverage at low cost.

2. Whole Life Insurance

Whole life provides lifelong protection with a cash-value component that grows over time.

Best for: families planning legacy creation or wealth transfer.

3. Family Income Benefit Policies

Instead of a lump sum payout, these plans provide monthly income to surviving family members.

Best for: families wanting predictable and stable financial support.

4. Joint Life Insurance

A single policy covering two people — usually spouses.

Best for: couples sharing financial responsibilities.

5. Child Life Insurance Add-Ons

Policies can include small coverage for children, which can lock in low premiums for life.

Why Families Need Life Insurance

- To replace lost income

- To protect children’s education

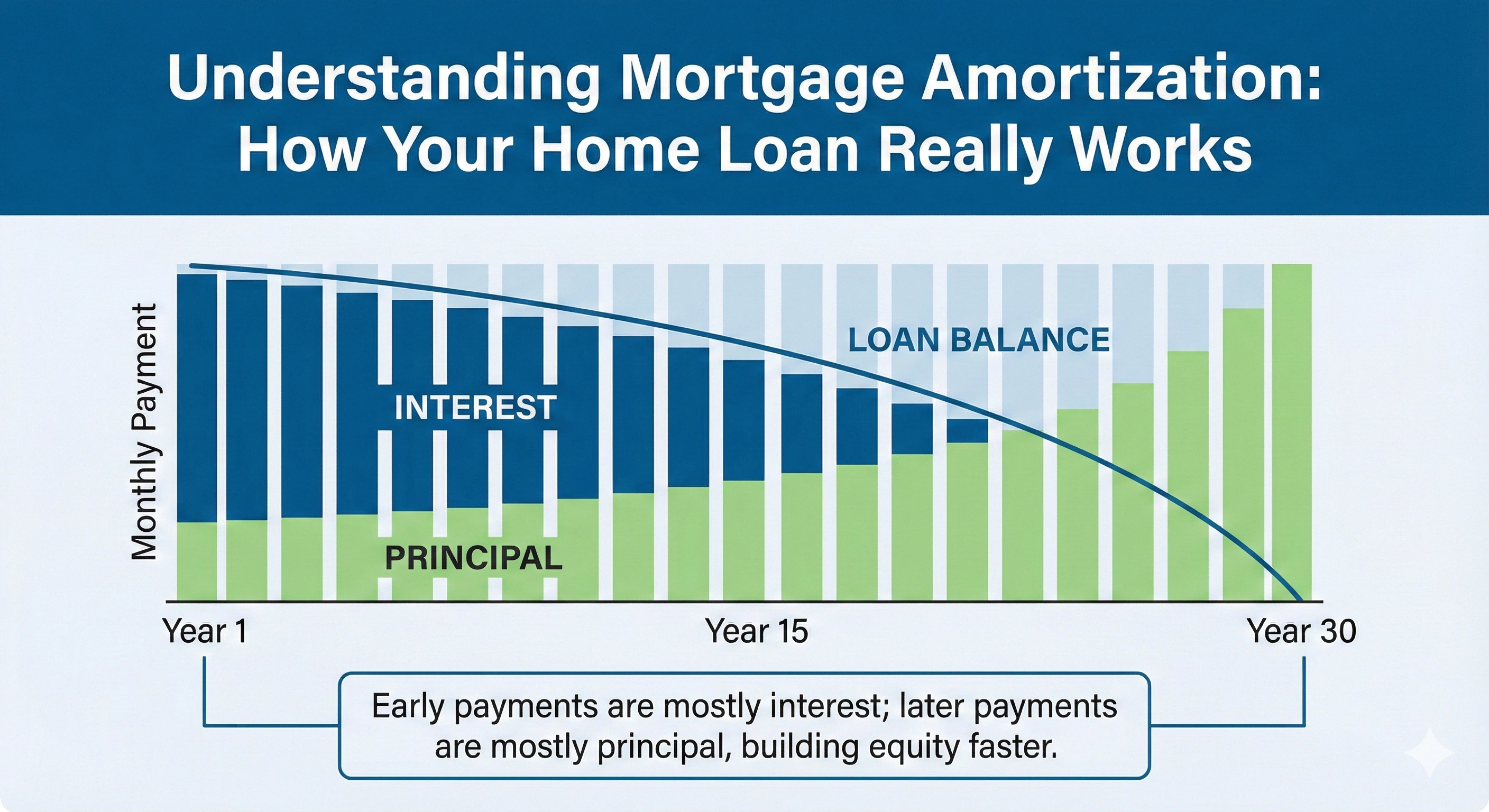

- To pay off home loans or debts

- To cover daily living expenses

- To fund long-term financial goals

Life insurance is especially critical for single parents, breadwinners, and families with dependent elders.

Global Premium Factors for Family Life Insurance

The cost of family protection insurance varies worldwide depending on:

- Age of the insured person

- Overall health conditions

- Lifestyle habits such as smoking

- Occupation risk level

- Coverage amount

- Policy duration

Younger and healthier individuals typically enjoy the lowest premiums.

Common Riders for Family Protection Plans

- Critical illness rider – lump-sum payout for major diseases

- Accidental death benefit – extra coverage for accidental death

- Child education rider – ensures future studies are funded

- Premium waiver rider – premiums waived after disability

- Income rider – provides monthly income instead of lump sum

How Much Coverage Does a Family Need?

The global standard recommendation is:

10–20× your annual income

This amount helps cover long-term financial needs such as:

- Daily expenses for 10+ years

- Children’s school and university costs

- Mortgage or rent

- Medical emergencies

Choosing the Right Family Protection Policy

1. Evaluate Your Family's Financial Goals

Understand income needs, debt levels, and future plans.

2. Decide Between Term and Whole Life

Term is cheaper; whole life builds wealth.

3. Check Claim Settlement Ratio

Choose insurers with high claim approval rates.

4. Compare Premiums Across Providers

Online comparison tools help find the best value for money.

5. Add Essential Riders

Riders add protection without purchasing multiple policies.

Benefits of Family Protection Life Insurance

- Ensures financial security

- Protects children’s future

- Safeguards long-term goals

- Provides peace of mind

- Offers tax benefits (varies by country)

Top Mistakes to Avoid When Buying Family Life Insurance

- Buying too little coverage

- Delaying purchase until later age

- Choosing the cheapest plan blindly

- Not updating beneficiaries

- Ignoring riders

Is Life Insurance Worth It for Young Families?

Yes — young families benefit the most due to lower premiums and long-term protection. Buying early locks in the lowest possible rates.

Who Are the Ideal Buyers?

- Young parents

- Dual-income families

- Families with home loans

- Single parents

- Business families with dependents

Conclusion

Family Protection Life Insurance Plans are essential for long-term security and peace of mind. Selecting the right policy ensures your loved ones can maintain financial stability even during life’s toughest moments. By comparing global insurers, tailoring coverage to your needs, and adding important riders, you can build a strong and future-proof financial shield for your family.

Investing in family life insurance today is one of the most responsible and powerful decisions you can make for your loved ones.

Admin

Admin

Admin

Admin