The Ultimate Guide to Comparing Mortgage Rates: How to Secure the Lowest Home Loan Rate in 2025

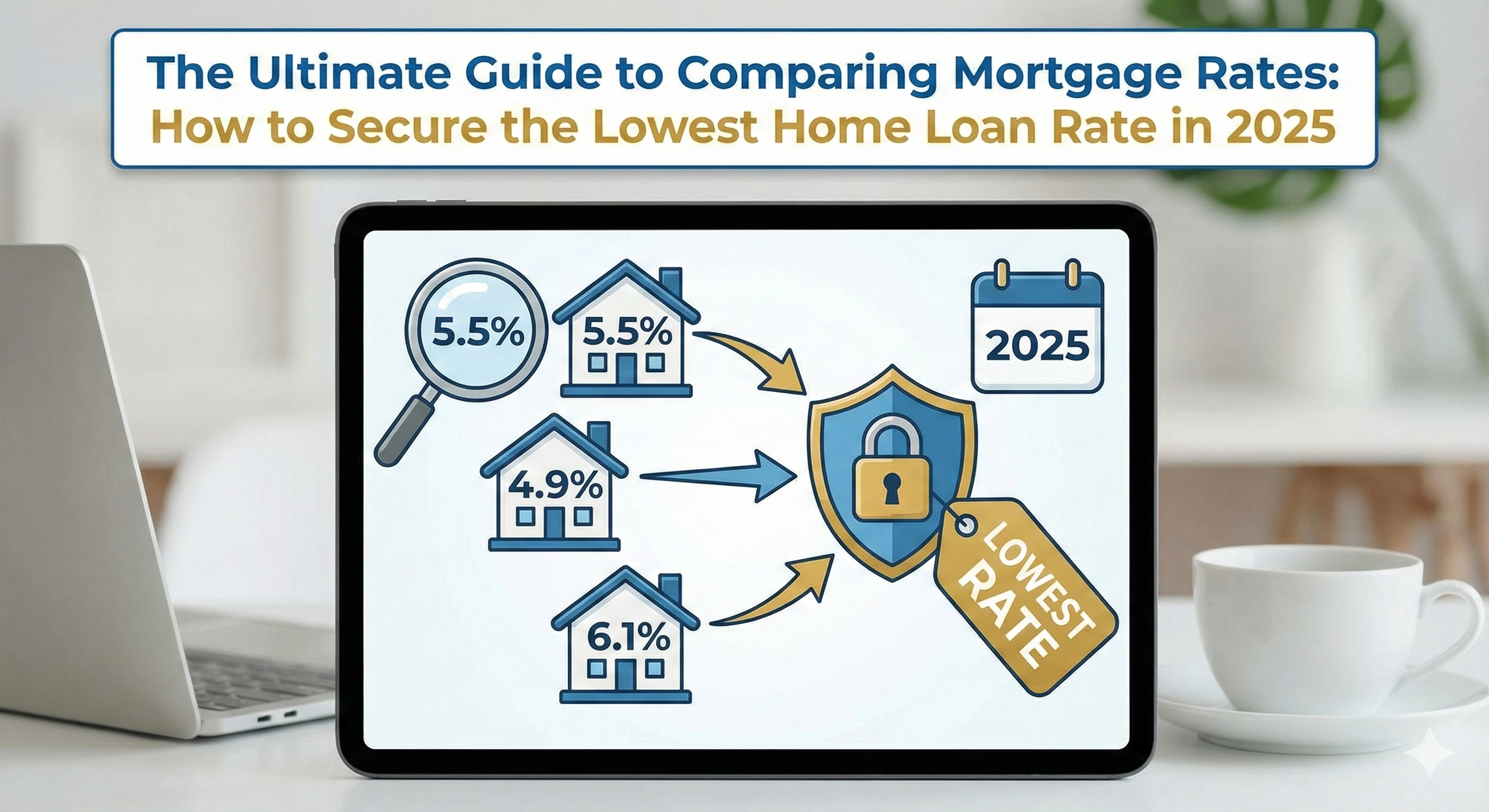

Buying a home is one of the biggest financial decisions in life, and comparing mortgage rates can save you tens of thousands of dollars over the loan term. Whether you're a first-time homebuyer, planning to refinance, or exploring home equity funding, understanding how mortgage rate comparison works is critical. This global guide explains how mortgage lenders set rates, how to compare offers, what affects your interest rate, and the smart strategies to secure the lowest possible loan rate in 2025.

Why Mortgage Rate Comparison Matters More Than Ever in 2025

Across the world—whether you're in the U.S., Canada, UK, Australia, Europe, or Asia—home loan interest rates are fluctuating with inflation, banking policies, and global economic uncertainty. One lender’s rate may differ drastically from another, and even a small percentage difference (0.5% or 1%) can translate into huge savings.

For example, a 1% difference on a $350,000 mortgage over 30 years can save you more than $60,000.

Because of this, mortgage rate comparison tools, brokers, and online marketplaces have become essential for borrowers worldwide.

How Mortgage Rates Are Determined Globally

Lenders do not randomly assign mortgage rates. They consider several factors, including:

- Central bank interest rates

- Global economic conditions

- Bank lending policies

- Borrower credit score

- Loan type and location

- Income and employment stability

- Debt-to-income ratio (DTI)

- Loan-to-value ratio (LTV)

- Property type (residential, condo, multi-unit)

Fixed vs. Adjustable Mortgage Rates

Before comparing lenders, it’s important to understand rate types:

1. Fixed-Rate Mortgages

- Rate stays the same for the entire loan term.

- Ideal for long-term stability.

- Popular in the U.S., UK, Canada, and Europe.

2. Adjustable/Variable-Rate Mortgages (ARM/VRM)

- Rate changes with market conditions.

- Lower initial rate, higher risk later.

- Common in Australia, India, Singapore, Hong Kong.

How to Compare Mortgage Rates the Right Way

Many people make mistakes by comparing only the interest rate. True cost involves other factors such as lender fees, PMI, insurance, and loan structure.

1. Compare the APR (Annual Percentage Rate)

APR includes interest rate + lender fees.

2. Compare the Loan Term

- Shorter terms = higher monthly payments, lower total interest

- Longer terms = lower monthly payments, higher total interest

3. Compare Lender Fees

Some lenders offer low-interest loans but high hidden charges:

- Origination fee

- Processing fee

- Underwriting fee

- Rate lock fee

- Administrative fee

4. Compare Mortgage Insurance (PMI)

If your down payment is below 20%, PMI adds cost. Rates vary by lender.

5. Compare Discounts, Benefits & Cashback Offers

Many lenders offer:

- Rate discounts for auto-pay

- Bundled banking bonuses

- Relationship-based pricing

- First-time buyer incentives

Mortgage Comparison Tools & Marketplaces (Global)

Across different countries, these platforms help users compare rates instantly:

United States

- Bankrate

- NerdWallet

- LendingTree

- Zillow Home Loans

Canada

- Ratehub

- Lowestrates.ca

United Kingdom

- MoneySuperMarket

- Confused.com

Australia

- Canstar

- Mozo

India

- BankBazaar

- PaisaBazaar

Europe

- ING

- HSBC

- UniCredit

Tips to Get the Lowest Mortgage Rate in 2025

1. Improve Your Credit Score

Global lenders heavily prioritize your credit rating. Higher score = lower rate.

2. Lower Your Debt-to-Income Ratio

Maintain a DTI below 36% for best rates.

3. Increase Your Down Payment

A 20% down payment helps you avoid mortgage insurance and secure lower rates.

4. Shop at Least 3–5 Lenders

Borrowers who compare lenders save an average of $1,500–$5,000 per year globally.

5. Choose the Right Loan Type

Government-backed loans often have lower interest rates.

Different Types of Mortgage Loans to Compare

Globally, these loans are common:

Conventional Loans

Offered by private lenders, ideal for strong-credit borrowers.

Government-Backed Loans

- FHA (USA)

- VA Loans (Military)

- USDA Loans

- Canada CMHC-backed loans

- UK Help-to-Buy schemes

- Australia First Home Guarantee

Refinancing Loans

For lowering current mortgage payments.

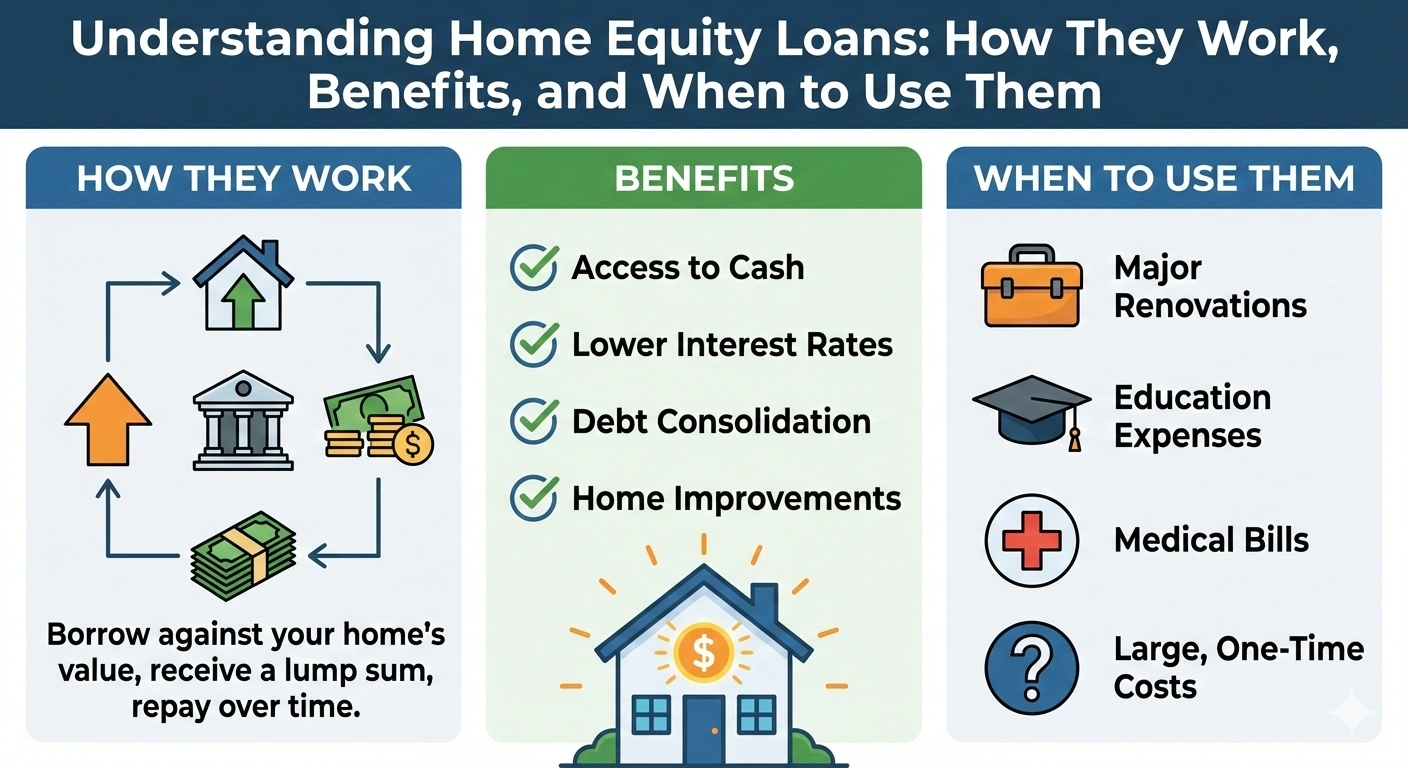

HELOC & Home Equity Loans

Uses home equity as collateral.

Common Mistakes People Make When Comparing Mortgage Rates

- Focusing only on the advertised rate

- Ignoring fees & hidden charges

- Not checking prepayment penalties

- Failing to lock the rate at the right time

- Choosing the wrong loan term

Should You Use a Mortgage Broker?

A broker can be extremely useful:

- They compare lenders for you

- They often get exclusive discounted rates

- They negotiate better deals

When to Lock Your Mortgage Rate

Mortgage rates change daily. Lock when:

- Central banks hint at rate increases

- Your credit is strong

- You’ve received multiple quotes

Frequently Asked Questions

What is a good mortgage rate in 2025?

This depends on country and loan type, but globally a competitive rate is 4%–6% for fixed loans and 3%–5% for variable loans.

How many lenders should I compare?

Minimum of 3; best is 5–7.

Does comparing rates hurt my credit?

Multiple inquiries within 14–45 days are treated as one soft pull in many countries.

Conclusion

Comparing mortgage rates is the key to saving money, reducing stress, and making smarter financial decisions. With global housing markets becoming more competitive, borrowers must use rate comparison tools, improve financial health, and negotiate with lenders. This guide ensures that you secure the lowest mortgage rate in 2025, regardless of where you live in the world.

Admin

Admin

Admin

Admin