Why Auto Insurance Comparison Matters

Auto insurance premiums vary significantly between providers. Comparing policies helps drivers save money, get better coverage, and avoid overpaying for unnecessary add-ons.

Key Types of Auto Insurance Coverage

- Liability Insurance: Covers damage or injuries you cause to others.

- Collision Insurance: Covers damage to your vehicle from accidents.

- Comprehensive Insurance: Covers theft, vandalism, natural disasters, and non-collision damage.

- Personal Injury Protection (PIP): Covers medical bills regardless of fault.

- Uninsured/Underinsured Motorist: Protects you if the other driver lacks insurance.

How Auto Insurance Premiums Are Calculated

Insurance providers calculate premiums using several risk factors:

- Driving record and past claims

- Age, location, and vehicle type

- Mileage and usage patterns

- Credit score (in some regions)

- Coverage limits and deductibles

Why Prices Vary Between Companies

Each insurer uses its own risk models, algorithms, and underwriting rules. This difference can lead to price variations of up to 50% for the same driver and vehicle.

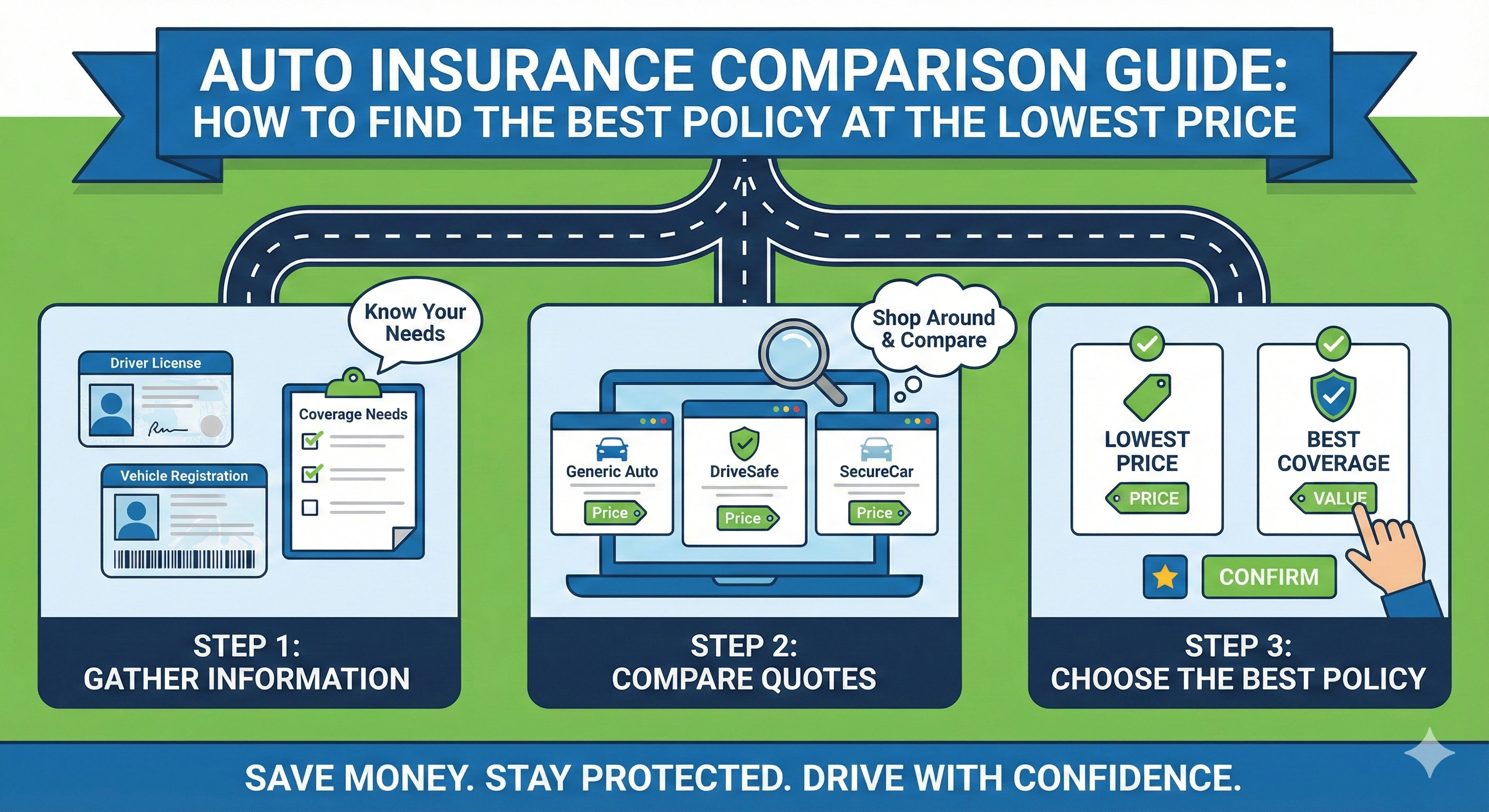

How to Compare Auto Insurance Policies Effectively

- Get at least 3–5 quotes from top insurers.

- Compare coverage limits and deductibles—not just price.

- Check customer reviews and claim handling reputation.

- Look for discounts: safe driver, multi-policy, anti-theft devices.

- Review optional add-ons carefully (roadside assistance, rental coverage, etc.).

Most Important Add-Ons to Consider

- Zero depreciation cover

- Roadside assistance

- Engine protection

- Return-to-invoice coverage

- Personal accident cover

Common Mistakes to Avoid

- Choosing the cheapest policy without checking coverage.

- Not updating annual mileage or home address.

- Failing to compare deductibles.

- Ignoring claim settlement ratios.

When Should You Switch Auto Insurance Providers?

You should consider switching insurers when premiums rise, coverage becomes insufficient, you buy a new car, or find a better deal elsewhere.

Final Thoughts

Auto insurance comparison is essential for saving money and improving coverage. By evaluating multiple providers, understanding coverage types, and identifying discounts, you can choose the best policy for your safety and budget.

Admin

Admin

Admin

Admin