What Is a HELOC? A Complete Guide for Homeowners

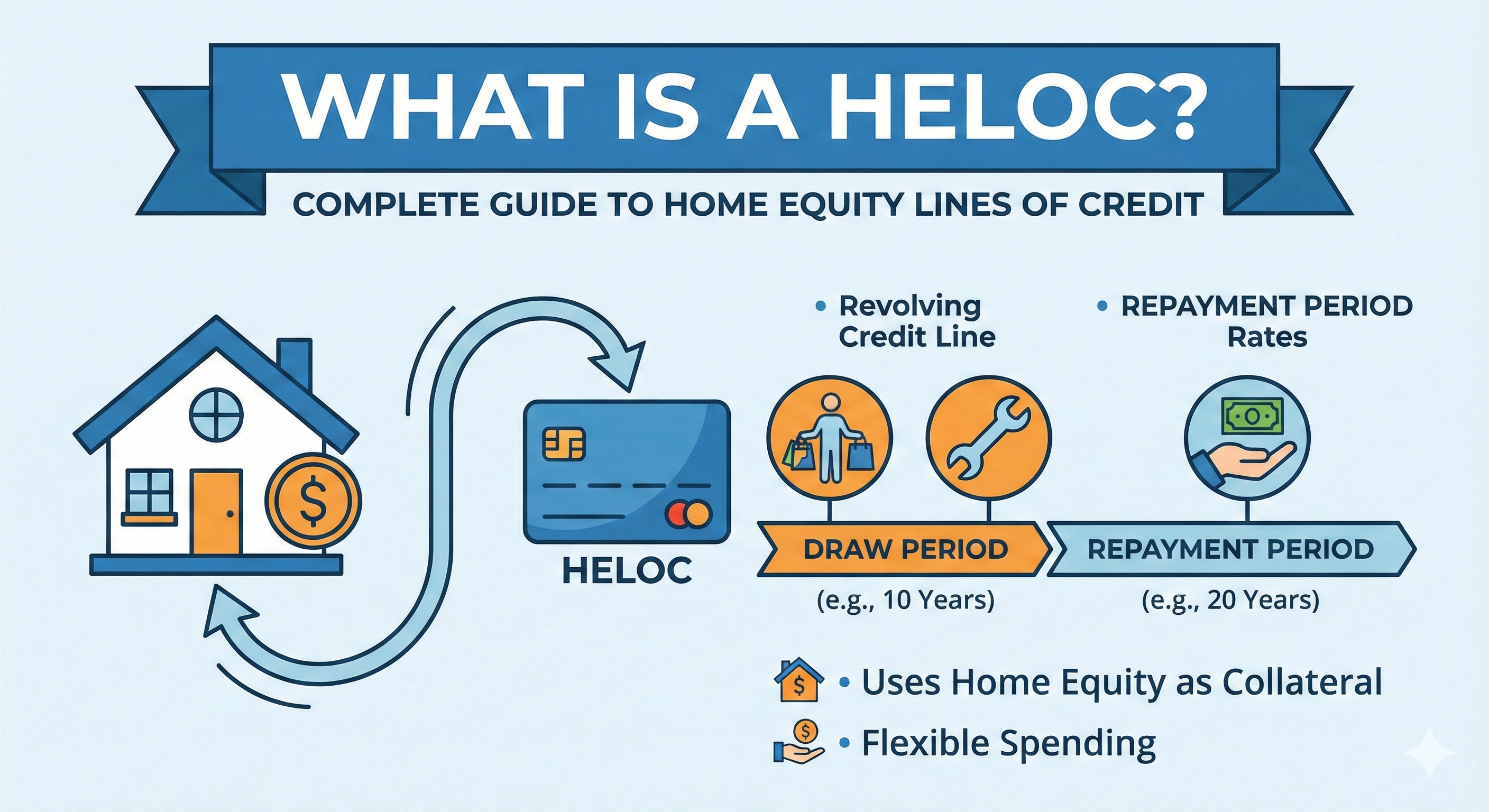

A Home Equity Line of Credit (HELOC) is one of the most flexible borrowing tools available to homeowners. It allows you to borrow against the equity in your home — similar to using a credit card backed by your property. Here’s everything you need to know before applying.

1. How a HELOC Works

A HELOC provides a revolving credit line that you can draw from as needed. You only pay interest on the amount you borrow, not the full credit limit.

- Typical draw period: 5–10 years

- Repayment period: 10–20 years

- Variable or fixed interest rates

2. HELOC vs Home Equity Loan

A HELOC is flexible, while a home equity loan offers a lump sum. Here’s the difference:

- HELOC: Revolving line of credit, variable rates

- Home Equity Loan: One-time amount, fixed rates

3. What Can You Use a HELOC For?

Homeowners commonly use HELOC funds for:

- Home renovations

- Debt consolidation

- Emergency expenses

- Education costs

- Investments or business funding

4. Requirements to Qualify

Most lenders require:

- At least 15–20% home equity

- Good credit score (680+ preferred)

- Stable income

- Low debt-to-income ratio

5. Pros and Cons of a HELOC

Pros

- Flexible borrowing

- Lower interest than credit cards

- Only pay interest on what you use

Cons

- Rates may fluctuate

- Risk of foreclosure if you fail to repay

- Over-borrowing temptation

6. Is a HELOC Right for You?

If you need ongoing access to funds and have strong home equity, a HELOC can be a powerful financial tool. However, always compare lenders and read the fine print.

Final Thoughts

HELOCs offer flexibility and affordability, making them ideal for renovation projects, debt consolidation, and strategic financial planning.

Admin

Admin

Admin

Admin