Life Insurance vs. Investment Plans: Which One Should You Choose for Long-Term Financial Security?

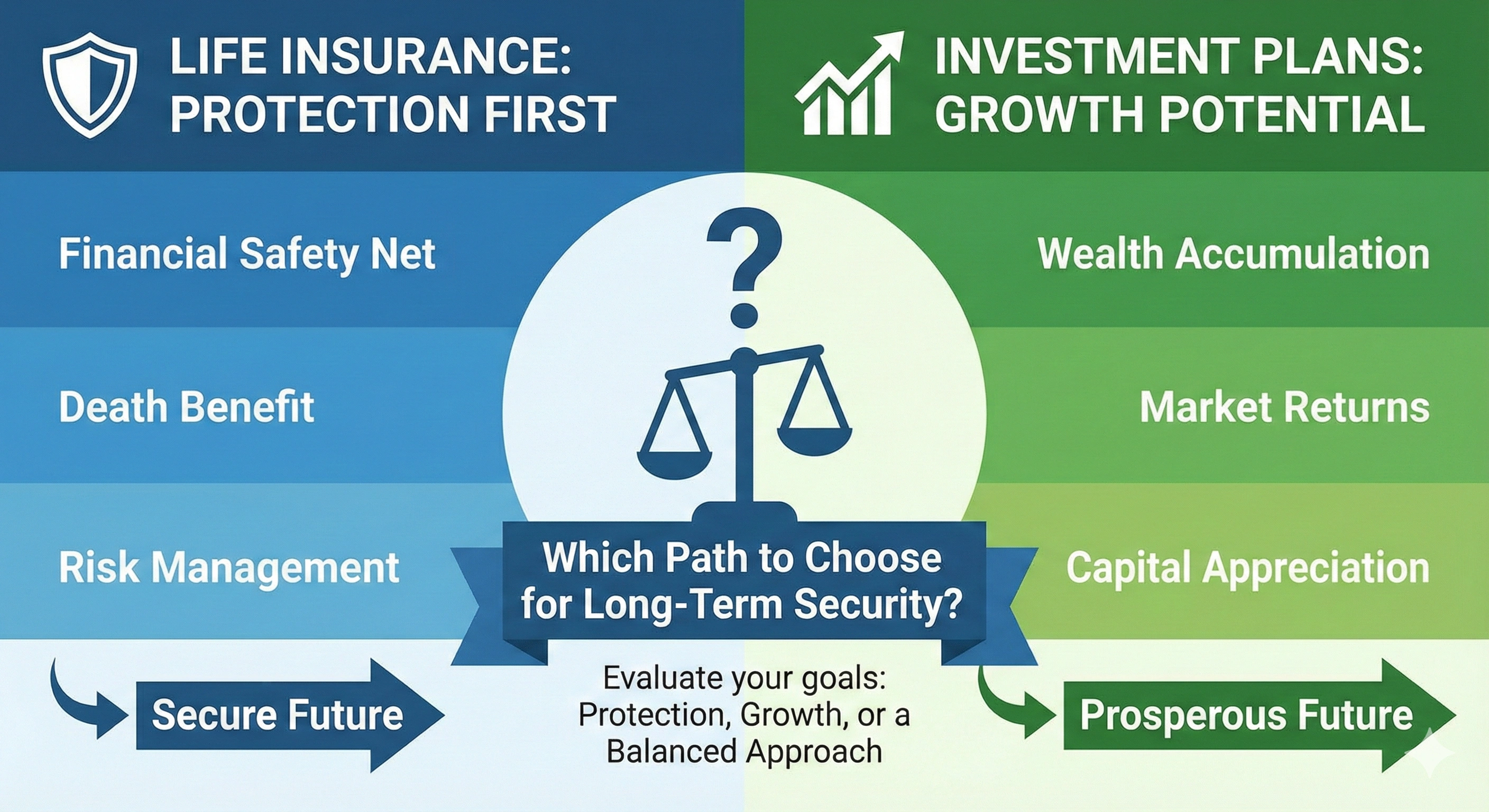

One of the most common financial questions people face is whether to prioritize life insurance or investment plans. Both are important, both contribute to long-term security, and both play essential roles in global financial planning. Yet they serve fundamentally different purposes—and choosing incorrectly can lead to financial losses, inadequate protection, or missed wealth-building opportunities.

This comprehensive 3000+ word global guide explains the differences between life insurance and investment plans, the advantages of each, who needs what, and how to build a balanced long-term strategy. Designed for individuals, families, and business owners, this guide helps you make smarter financial decisions.

What Is Life Insurance?

Life insurance is primarily a risk protection tool. Its main purpose is to financially protect dependents in case of the policyholder’s death. It provides a sum assured (a lump-sum payment) to the family or nominee, helping them maintain financial stability.

Life Insurance Benefits:

- Financial protection for dependents

- Low-cost coverage (especially term insurance)

- Peace of mind for families

- Ability to cover loans, debts, or mortgages

- Optional riders for critical illness, disability, or accidental death

Types of Life Insurance Globally:

- Term Life Insurance: Pure protection

- Whole Life Insurance: Coverage for life, with savings

- Universal Life Insurance: Flexible premiums + investment potential

- ULIPs (in many regions): Insurance + market-linked investments

- Endowment Plans: Insurance with guaranteed maturity benefit

What Are Investment Plans?

Investment plans are designed to help you grow wealth over time. They focus on returns, capital appreciation, financial goals, and long-term stability.

Common Global Investment Options:

- Mutual funds

- Stocks / equities

- Bonds & fixed income investments

- Real estate & REITs

- Index funds & ETFs

- Retirement plans (401k, superannuation, national pension schemes, etc.)

- Cryptocurrency (high risk)

Investment Plan Benefits:

- Long-term wealth growth

- Higher returns compared to insurance

- Flexibility and liquidity

- Suitable for retirement planning

- Can help beat inflation

Life Insurance vs Investment Plans: Purpose Comparison

| Feature | Life Insurance | Investment Plans |

|---|---|---|

| Primary Purpose | Protection | Wealth Growth |

| Risk Level | Low | Medium to High |

| Returns | Minimal or None (term) | Low to Very High |

| Best For | Families, breadwinners, people with dependents | Long-term wealth creators |

Why You Should NOT Mix Insurance & Investment

Many insurers offer plans that mix investment and insurance (such as ULIPs or endowment plans). While these products sound attractive, they often underperform compared to buying insurance and investment separately.

Reasons to Avoid Mixing:

- Higher charges compared to mutual funds

- Poor liquidity

- Confusing structures

- Lower returns

- Lock-in periods

Globally, financial advisors recommend: “Buy Term Insurance, Invest the Rest.”

Term Life Insurance: The Most Cost-Effective Insurance Plan

Term insurance provides the highest life cover at the lowest cost. It is ideal for individuals who need strong protection without mixing investments.

Benefits:

- Very affordable

- High sum assured options

- Best value for families

- Add-on riders for more coverage

Investment Plans: Building Long-Term Wealth

When to Choose Investment Plans:

- You want to build wealth over time

- You are saving for retirement, a home, or future expenses

- You want flexibility and liquidity

- You want returns higher than inflation

Life Insurance + Investment Plan: A Balanced Global Strategy

Instead of choosing one over the other, smart financial planning combines both:

- Buy a high-coverage term insurance policy to protect dependents

- Invest separately in diversified investment options for long-term financial growth

This strategy ensures security + wealth building, without compromising returns or protection.

Which One Should You Choose Based on Your Profile?

✔ Single individuals

- Small term insurance (if parents depend on income)

- Focus heavily on investments

✔ Married couples with children

- High term insurance coverage

- Critical illness & disability riders

- Balanced investment strategy

✔ Business owners

- Large life cover

- Key-person insurance

- Buy-sell agreement insurance

- Heavy investments for cash reserves

✔ High-net-worth individuals (HNIs)

- Life insurance for estate planning

- Advanced investment portfolios

Final Verdict: Which Is Better?

The short answer: Both are important—but for different reasons.

- Life Insurance = Protection

- Investment Plans = Wealth Creation

The right approach is to combine both strategically. Buy a cost-effective term insurance plan for protection, and build long-term wealth through diversified investment options.

When used together, these tools create a complete financial shield for you and your family—globally, across any economic environment.

Admin

Admin

Admin

Admin