How to Qualify for a Low-Interest Mortgage in 2025

Mortgage rates may fluctuate, but with the right preparation, you can still qualify for a competitive low-interest home loan in 2025. Here’s a practical guide to improving your financial profile and securing a better mortgage rate.

1. Strengthen Your Credit Score

Your credit score is one of the biggest factors lenders use to determine your interest rate. A score above 740 generally unlocks the best rates.

- Pay down revolving credit

- Avoid new credit inquiries

- Maintain perfect on-time payments

2. Lower Your Debt-to-Income (DTI) Ratio

A DTI below 36% is ideal. Higher DTIs may lead to higher interest rates.

- Pay off personal loans or credit cards

- Increase income through side earnings or bonuses

- Avoid taking new loans during the application period

3. Save for a Larger Down Payment

Putting more money down (15–20%) reduces lender risk and qualifies you for a better rate, especially on conventional loans.

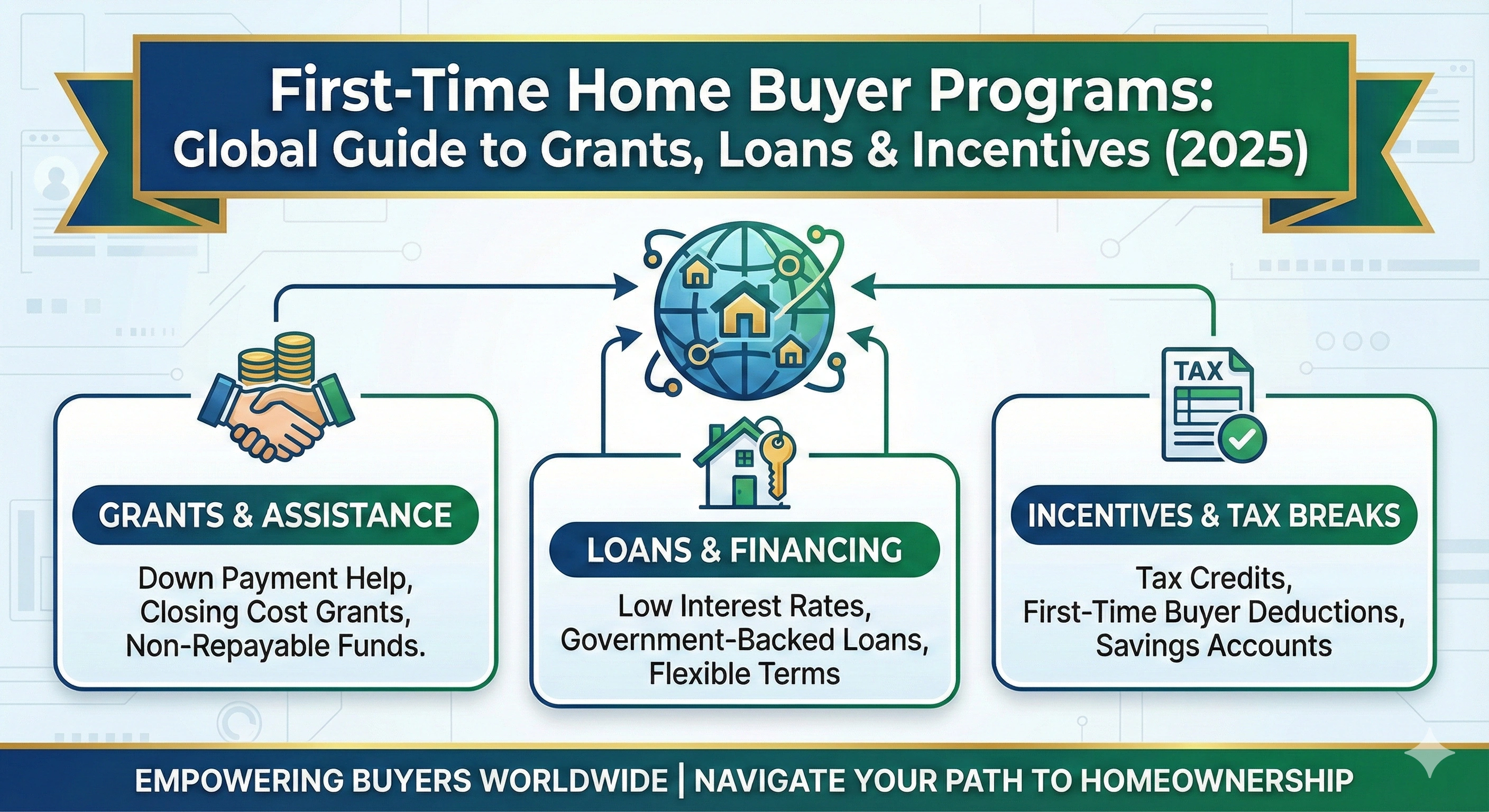

4. Consider Government-Backed Options

Programs like FHA, VA, and USDA loans offer competitive rates and are easier to qualify for.

5. Compare Lenders — Don’t Settle for One Quote

Mortgage rates can vary between lenders by 0.25% or more. Always compare:

- National banks

- Credit unions

- Online lenders

- Mortgage brokers

6. Lock Your Rate at the Right Time

Rate locks can secure your interest rate for 30–90 days, protecting you from market fluctuations.

Final Thoughts

With strong financial preparation and smart lender comparison, you can qualify for a low-interest mortgage in 2025 — even in a competitive housing market.

Admin

Admin

Admin

Admin