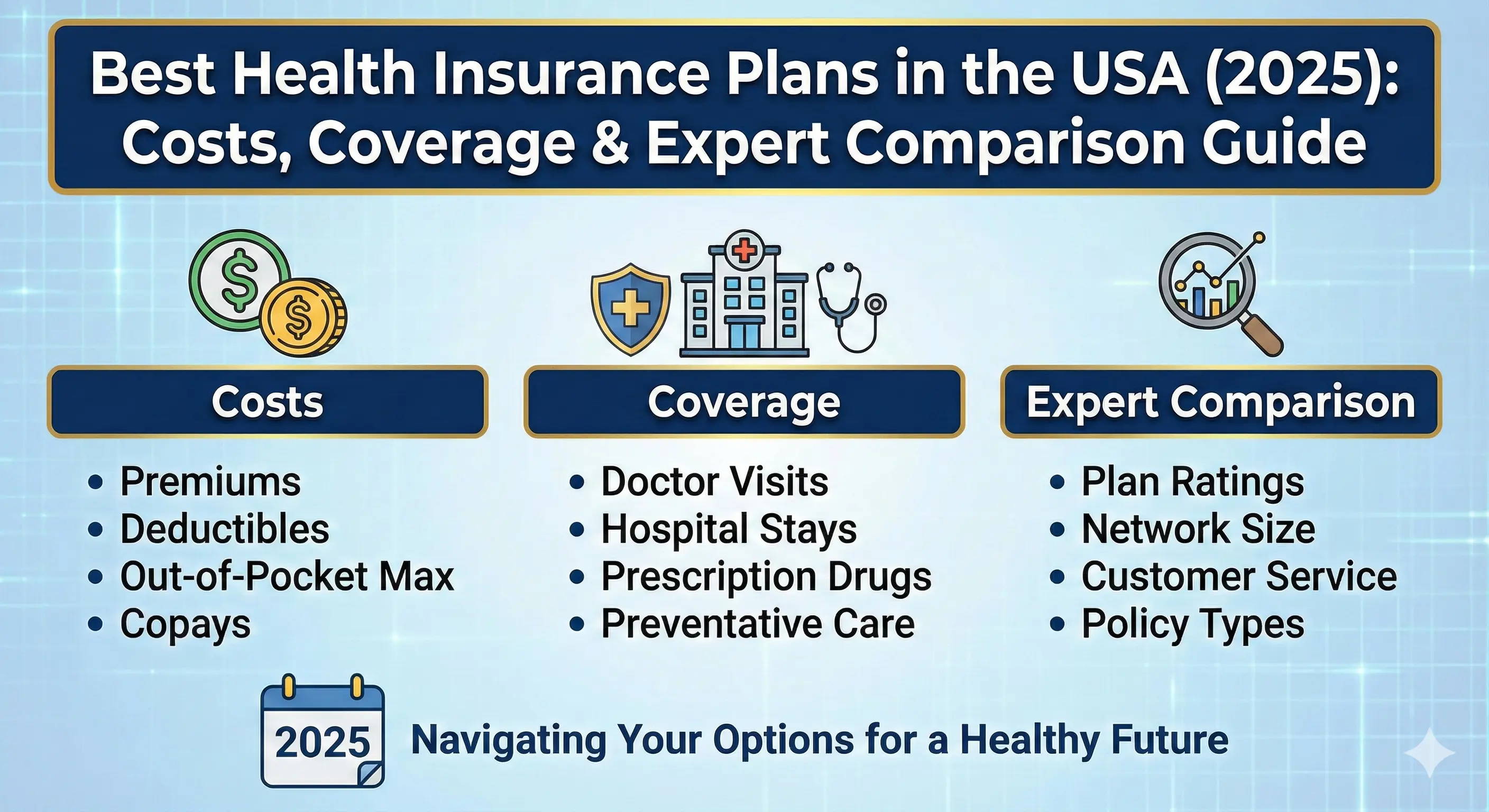

Best Health Insurance Plans in the USA (2025): Costs, Coverage & Expert Comparison Guide

Health insurance remains one of the biggest financial decisions for American families, individuals, and business owners. With rising healthcare costs, medical inflation, and unpredictable emergencies, selecting the right health insurance plan in 2025 is no longer optional—it’s essential.

This in-depth, 3000+ word guide covers everything you need to make an informed, financially smart choice. Whether you want the cheapest health insurance, the best PPO for nationwide coverage, a family plan with low deductibles, or a small business health insurance policy, you’ll find step-by-step clarity here.

Why Choosing the Right Health Insurance Matters in 2025

Healthcare in the United States has seen significant cost increases year over year. According to multiple industry reports, an uninsured emergency room visit can cost between $1,500 and $15,000+. Even a short hospital stay can escalate to $30,000 to $80,000.

Health insurance helps protect you from:

- Unexpected medical bills

- Hospitalization costs

- Chronic illness treatment expenses

- Prescription medication fees

- Preventive care costs (checkups, screenings)

With the right plan, families can save thousands annually while gaining reliable access to top-quality healthcare.

Types of Health Insurance Available in the USA (2025)

There are several types of health insurance structures. Understanding these options will help you compare and choose the best policy suited to your lifestyle, medical needs, and financial situation.

1. PPO (Preferred Provider Organization)

Best for people who want maximum freedom in choosing doctors and hospitals.

- No referrals needed

- Large nationwide network

- Higher premiums, but more flexibility

2. HMO (Health Maintenance Organization)

Best for people who want low-cost coverage and don’t mind using network doctors.

- Requires referrals from a primary care physician

- Lower premiums

- No out-of-network coverage except emergency

3. EPO (Exclusive Provider Organization)

A balance between HMO and PPO—no referrals needed, but must stay in-network.

4. POS (Point of Service)

Hybrid plan allowing out-of-network care with referrals.

5. HDHP with HSA (High Deductible Health Plan + Health Savings Account)

Best for young, healthy individuals who want low monthly premiums and tax benefits.

- Low monthly cost

- High deductibles

- HSAs allow tax-free savings for medical expenses

6. ACA Marketplace Plans (Obamacare)

Available through Healthcare.gov with subsidies based on income.

Metal tiers:

- Bronze – lowest premiums, highest deductibles

- Silver – balanced coverage

- Gold – higher premiums, low deductibles

- Platinum – highest premiums, lowest medical costs

7. Private/Off-Market Plans

Offered directly by insurers outside the ACA marketplace.

8. Employer-Sponsored Health Insurance

The most common type of coverage in the U.S., often offering lower costs.

9. Medicare

For individuals 65+ and some younger people with disabilities.

10. Medicaid

For low-income families and individuals.

Top Health Insurance Providers in the USA (2025)

Here are the best, most trusted health insurance companies in 2025. These companies are known for strong coverage, extensive provider networks, excellent customer service, and competitive pricing.

1. Blue Cross Blue Shield (BCBS)

One of the most widely accepted insurers nationwide.

2. UnitedHealthcare (UHC)

Great for digital tools, telemedicine, and nationwide coverage.

3. Kaiser Permanente

Best for preventive care and in-network hospitals.

4. Cigna

Excellent international coverage and strong PPO plans.

5. Aetna

Strong employer plans and extensive pharmacy benefits.

6. Humana

Popular for Medicare Advantage plans.

Health Insurance Costs in 2025

Average monthly premiums for 2025:

| Plan Type | Average Monthly Premium | Deductible |

|---|---|---|

| PPO | $520–$850 | $1,000–$4,000 |

| HMO | $380–$650 | $800–$3,500 |

| HDHP | $290–$480 | $3,000–$7,000 |

| Employer Coverage | $120–$220 (employee contribution) | $500–$2,500 |

Tip: Premiums vary by age, state, income, and plan type.

Best Health Insurance Plans by Category

Best for Families

- Blue Cross Blue Shield Gold PPO

- Cigna Family Silver Plan

Best for Individuals

- UnitedHealthcare Bronze HDHP

- KP HMO Silver Plan

Best for Small Business Owners

- Aetna Business PPO

- UHC Level-Funded Plans

Best for Seniors

- Humana Medicare Advantage

- Kaiser Senior Advantage

Best for Nationwide Coverage

- Cigna PPO

- BCBS PPO

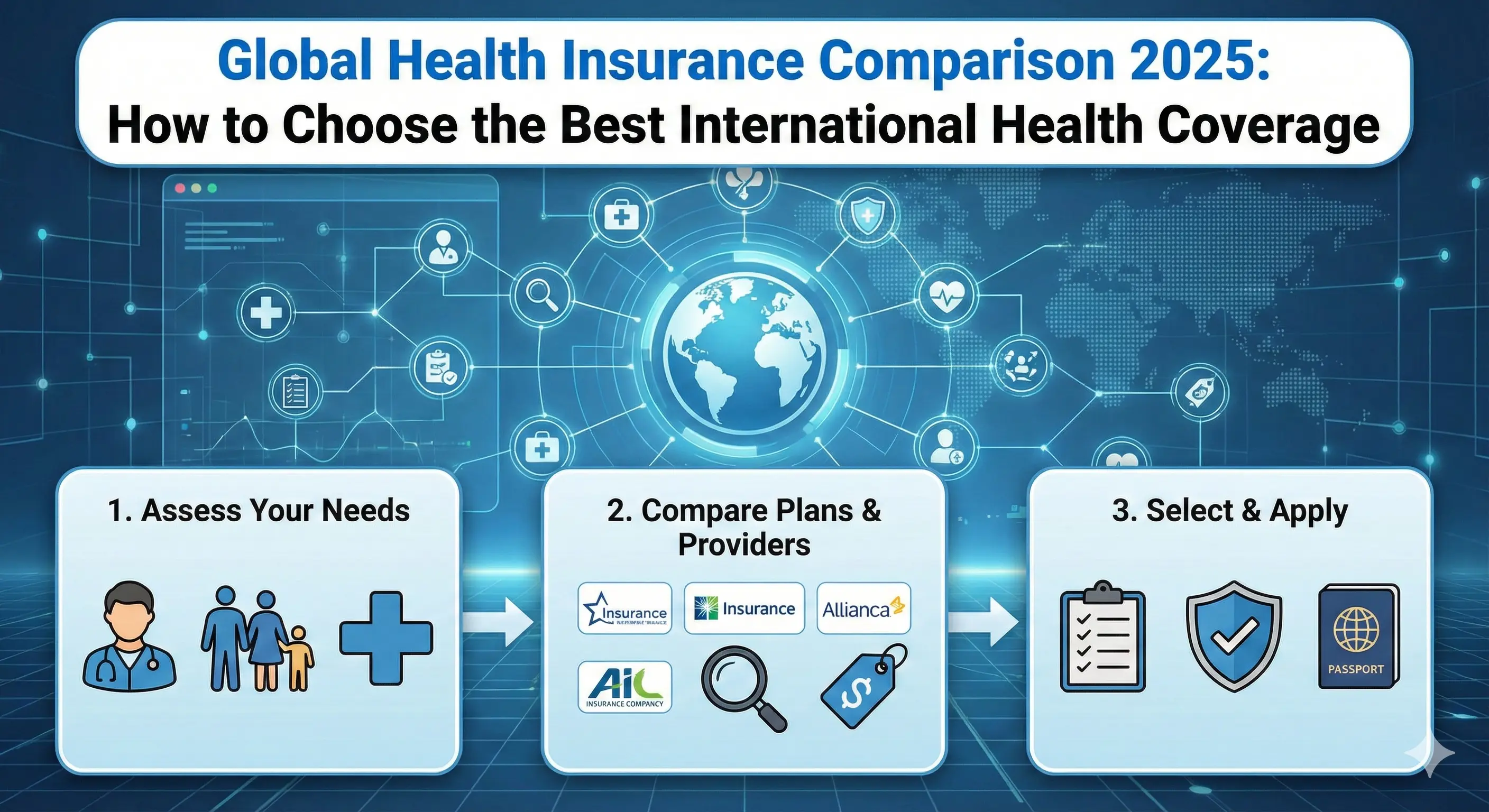

How to Choose the Best Health Insurance Plan in 2025

You should compare these critical factors before selecting any health insurance plan:

- Premiums – Monthly cost of the plan

- Deductibles – What you must pay before insurance starts

- Out-of-pocket maximum – After this, insurance covers 100%

- Provider network – Are your doctors included?

- Prescription drug coverage

- Emergency care & hospital coverage

- Preventive care benefits

For Families

Look for low deductibles and strong pediatric services.

For Freelancers

HDHP + HSA plans are highly cost-effective.

For Small Businesses

Employer group plans offer tax advantages and better savings.

Frequently Asked Questions (FAQ)

1. What is the cheapest health insurance plan in the USA?

ACA Bronze plans and HDHP plans usually offer the lowest monthly premiums.

2. What is the best health insurance company overall?

BCBS and UnitedHealthcare consistently rank highest for affordability and coverage.

3. Do I need health insurance if I’m young and healthy?

Yes—medical emergencies can cost tens of thousands of dollars without coverage.

4. What is the best health insurance for self-employed individuals?

High-deductible plans paired with HSAs provide the best tax benefits and flexibility.

Final Verdict: The Best Health Insurance Plan for 2025

The best health insurance plan for you will depend on income, location, age, family size, pre-existing conditions, and your preferred doctors. If you want nationwide flexibility, choose a PPO. If affordability is the priority, go with an HMO or HDHP. Families benefit most from Gold-tier plans, while seniors should consider Medicare Advantage.

Health insurance is not just a financial investment—it is long-term protection for your family’s well-being.

Admin

Admin

Admin

Admin