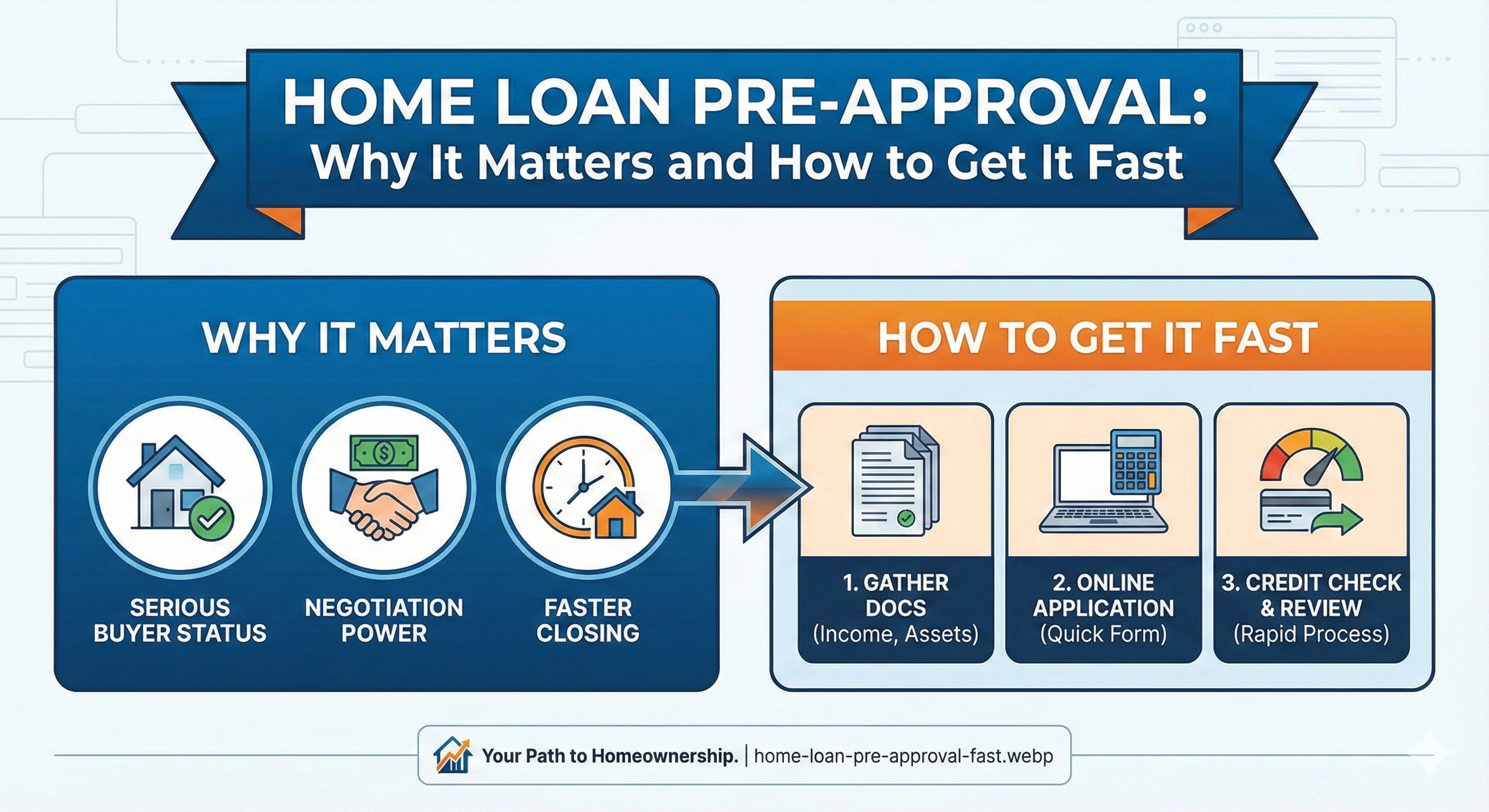

Home Loan Pre-Approval: Why It Matters and How to Get It Fast

Whether you're a first-time homebuyer or upgrading to a new property, getting pre-approved for a home loan is one of the most important steps in the home-buying journey. It not only strengthens your negotiation power but also helps you understand exactly how much you can borrow. In this comprehensive global guide, we break down what pre-approval means, why it matters, how lenders evaluate applicants, and what you can do to get approved faster.

What Is Home Loan Pre-Approval?

A mortgage pre-approval is a lender’s written commitment that states how much they are willing to lend you based on your financial health. This is different from pre-qualification, which is only an informal estimate. Pre-approval involves verified documents and credit checks, making it a stronger indicator of your borrowing ability.

Why Pre-Approval Matters

- Strengthens your offer when negotiating with sellers.

- Helps you determine your real budget and avoid over-shopping.

- Speeds up closing because financial checks are already completed.

- Makes you a serious buyer in competitive markets.

- Helps identify loan issues early so you can fix them before applying.

How Pre-Approval Works Globally

Across countries, the pre-approval process shares common components even though lending laws differ. Whether you’re in the U.S., U.K., Canada, Australia, Singapore, Europe, or Asia, lenders want to evaluate your financial stability and repayment capability before approving a loan.

What Lenders Check During Pre-Approval

- Income stability — salary, business income, rental income.

- Credit score/credit history — global standards vary, but higher is always better.

- Debt-to-income ratio (DTI) — lower ratios mean better approval odds.

- Employment history — stable jobs are preferred.

- Assets and savings — including down payment capability.

- Existing debts — loans, credit cards, business liabilities.

Documents Required for Pre-Approval

Although requirements differ slightly by country, the following documents are widely required:

- Identification (passport, ID card, residency documents)

- Income proof — salary slips, bank statements, tax returns

- Employment verification

- Credit reports

- Proof of assets — savings, investments, property

- Liability reports — existing loans, credit card debt

How Long Does Pre-Approval Take?

Typically, global lenders issue pre-approval within:

- 24–72 hours for salaried individuals

- 3–10 days for self-employed or business owners

The duration depends on the lender, the country’s regulations, and the complexity of your financial background.

How Long Pre-Approval Remains Valid

Most mortgage pre-approvals remain valid for:

- 60–90 days (globally standard)

You may need a renewal if your house-hunting extends beyond this period.

Common Reasons for Pre-Approval Denial

- Low or inconsistent income

- High debt-to-income ratio

- Poor credit history

- Unstable employment

- Insufficient down payment

- Missing or unverifiable documents

How to Improve Your Pre-Approval Chances

- Reduce existing debts before applying.

- Improve your credit score by paying bills on time.

- Increase your down payment amount.

- Maintain stable employment for at least 6–12 months.

- Avoid major purchases before applying.

Pre-Approval vs. Pre-Qualification

Pre-qualification is a quick, non-binding estimate based on self-reported financial info. Pre-approval is verified and backed by documentation, making it more trustworthy for both sellers and lenders.

Does Pre-Approval Guarantee a Mortgage?

No. Final approval occurs only after a formal loan application and property appraisal. However, pre-approval significantly increases your chances and accelerates the loan process.

Final Thoughts

Home loan pre-approval is one of the smartest steps you can take before beginning your property search. It provides clarity, boosts confidence, and helps you negotiate better. By understanding how the process works and preparing your documents, you can get pre-approved faster and move closer to owning your dream home.

Admin

Admin

Admin

Admin