What Is a HELOC? Complete Global Guide to Home Equity Lines of Credit

A Home Equity Line of Credit, widely known as a HELOC, is one of the most flexible ways homeowners around the world access funds using the equity they’ve built in their property. Whether you're considering renovations, investing, consolidating debt, or handling major expenses, HELOCs provide revolving credit based on your home’s value. This comprehensive global guide explains how HELOCs work, eligibility, interest rates, advantages, risks, and the smartest ways homeowners use them in 2025 and beyond.

What Exactly Is a HELOC?

A HELOC (Home Equity Line of Credit) is a revolving credit line secured by your home. Unlike traditional home loans or refinancing products, a HELOC works like a credit card—borrow, repay, borrow again—within a set limit. Because the loan is secured by your property, interest rates are typically much lower than personal loans or credit cards.

How HELOCs Work Globally

While HELOCs are extremely common in countries like the U.S., Canada, and Australia, similar home equity lending products exist worldwide:

- U.S.: Standard HELOCs with variable or fixed rates.

- Canada: Home Equity Lines integrated with mortgage accounts.

- UK: Called "Homeowner Loans" or "Equity Release" options.

- Australia & New Zealand: Line-of-credit home loans via major banks.

- Europe: Offered by select banks as property-backed revolving credit.

Despite different terminology, the principle remains the same—borrow against your home’s equity.

How Much Can You Borrow?

Most lenders allow homeowners to borrow:

- Up to 70%–90% of the home’s market value

The exact amount depends on:

- Your home’s value

- Your mortgage balance

- Your income and credit health

Understanding Equity

Your home equity is calculated as:

Home Value – Mortgage Balance = Usable Equity

Example:

- Home value: $600,000

- Remaining mortgage: $250,000

Equity = $350,000

If the lender allows borrowing up to 80%:

Borrowing limit = $600,000 × 80% – $250,000 = $230,000

How HELOC Draw and Repayment Periods Work

HELOCs usually have two major phases:

1. Draw Period (5–10 years globally)

- You can borrow anytime.

- You pay interest-only or interest + small principal.

2. Repayment Period (10–20 years)

- No more borrowing.

- You repay principal + interest monthly.

Fixed vs Variable Rates

Most countries offer variable-rate HELOCs linked to national benchmark rates. However, fixed-rate HELOCs are becoming more available globally as lenders compete for customers.

Advantages of a HELOC

- Revolving credit: Borrow only what you need.

- Lower interest rates: Because it’s backed by property.

- Flexible repayment: Especially during the draw period.

- Use funds for anything: From renovations to investments.

- Potential tax benefits: In some countries, interest is tax-deductible when used for home improvement.

Risks of a HELOC

- Your home is collateral — missed payments can risk foreclosure.

- Variable interest rates can increase monthly payments.

- Overspending temptation due to revolving access.

- Reduced home equity when selling or refinancing.

Who Should Consider a HELOC?

A HELOC may be ideal if you want:

- Low-interest borrowing

- Flexible access to cash

- To consolidate debt at cheaper rates

- To fund home renovations

- Emergency financial backup

Who Should Avoid a HELOC?

- People with unstable income

- Anyone planning to sell soon

- Homeowners already stretched with debt

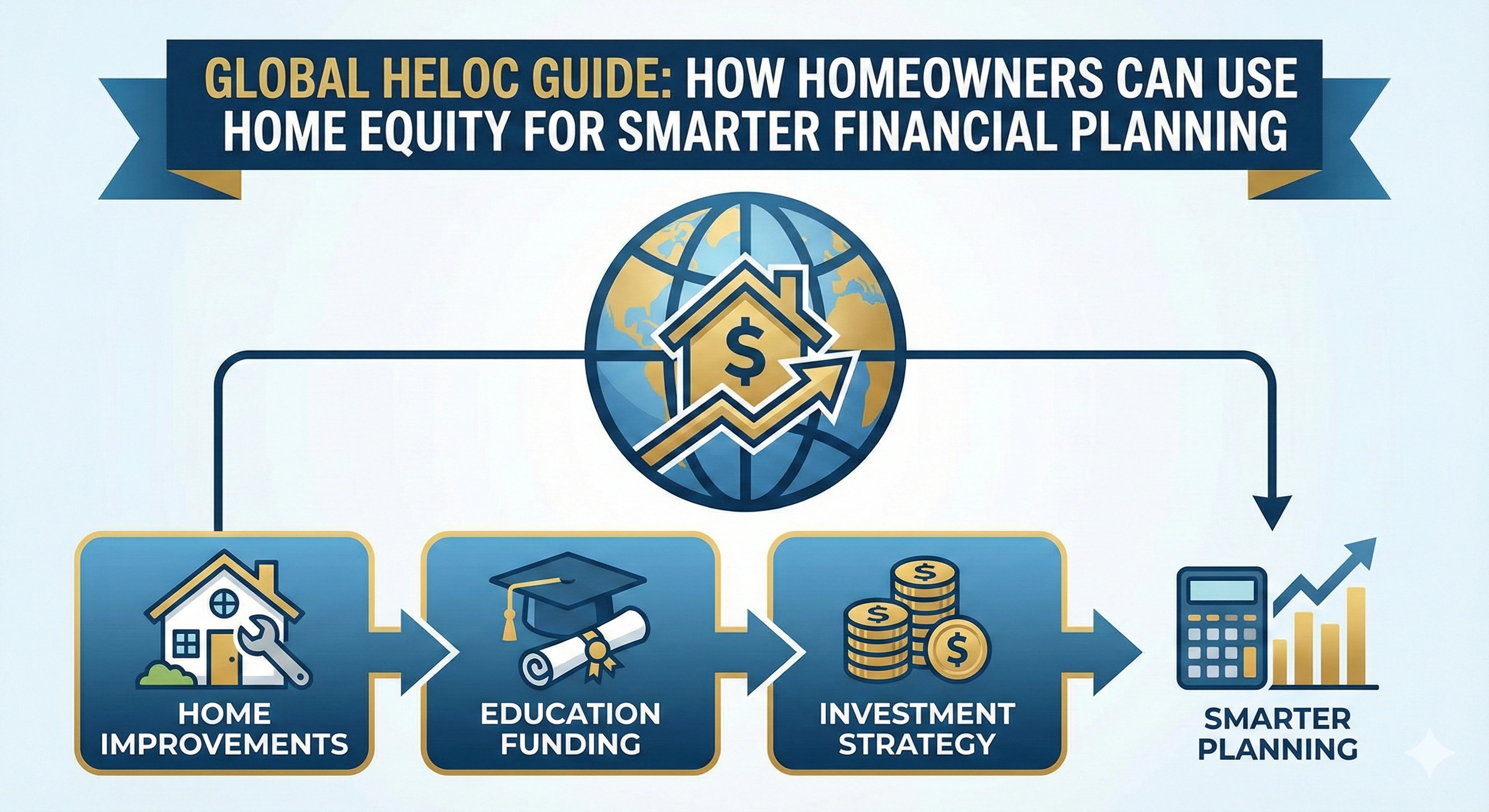

Best Uses of HELOC Funds

Globally, the smartest homeowners use HELOCs for:

1. Home Renovations

This is the most common and financially sound use since improvements often increase property value.

2. Debt Consolidation

Replacing high-interest credit cards with a lower-rate HELOC can save thousands.

3. Education Costs

Many families use HELOCs for tuition or overseas education.

4. Emergency Funds

A HELOC acts as a safety net without monthly payments unless used.

5. Investment Opportunities

Some homeowners use HELOC funds for:

- Real estate investments

- Stock markets

- Business expansion

Global HELOC Eligibility Requirements

While each lender differs, typical eligibility criteria include:

- At least 20% home equity

- Stable income for 1–2 years

- Good credit score

- Low debt-to-income ratio (DTI)

- Reliable employment history

- Clean repayment history

Documents Required

- ID proof

- Property documents

- Income papers (salary slips, tax returns)

- Bank statements

- Credit reports

How Interest Is Calculated

Most lenders use a benchmark rate plus a lender margin. For example:

HELOC Rate = Benchmark Rate + 1% to 3%

How to Increase HELOC Approval Chances

- Boost your credit score.

- Pay down existing debt.

- Increase your income stability.

- Choose a lower borrowing limit.

- Improve your home's documented value.

HELOC vs Home Equity Loan vs Cash-Out Refinance

| Feature | HELOC | Home Equity Loan | Cash-Out Refinance |

|---|---|---|---|

| Type | Revolving credit | Lump-sum loan | New mortgage |

| Rate | Mainly variable | Mainly fixed | Fixed or variable |

| Flexibility | Highest | Medium | Lowest |

| Best For | Ongoing expenses | One-time needs | Lowering mortgage rate + cash |

Is a HELOC Right for You?

A HELOC is excellent for homeowners needing flexible, affordable borrowing, especially for renovations or debt consolidation. However, because your home is the collateral, borrowers should use it responsibly and ensure repayment ability.

Final Thoughts

A HELOC is one of the most powerful financial tools for homeowners, offering flexibility, low interest, and high borrowing potential. Whether used for home improvements, education, investments, or financial emergencies, understanding how a HELOC works can help you make smarter decisions and maximize your property’s equity. As lending markets evolve globally, HELOCs continue to remain a top choice for homeowners looking to unlock financial freedom while leveraging their real estate.

Admin

Admin

Admin

Admin