The 4 Most Important Insurance Policies Everyone Should Consider in 2025

Insurance is one of the most powerful financial tools available for protecting your life, assets, and long-term security. Whether you're safeguarding your family, your home, your car, or your business, choosing the right insurance policy can save you from unexpected financial risks.

Below is a globally relevant guide covering the four essential insurance categories people are actively researching and purchasing in 2025.

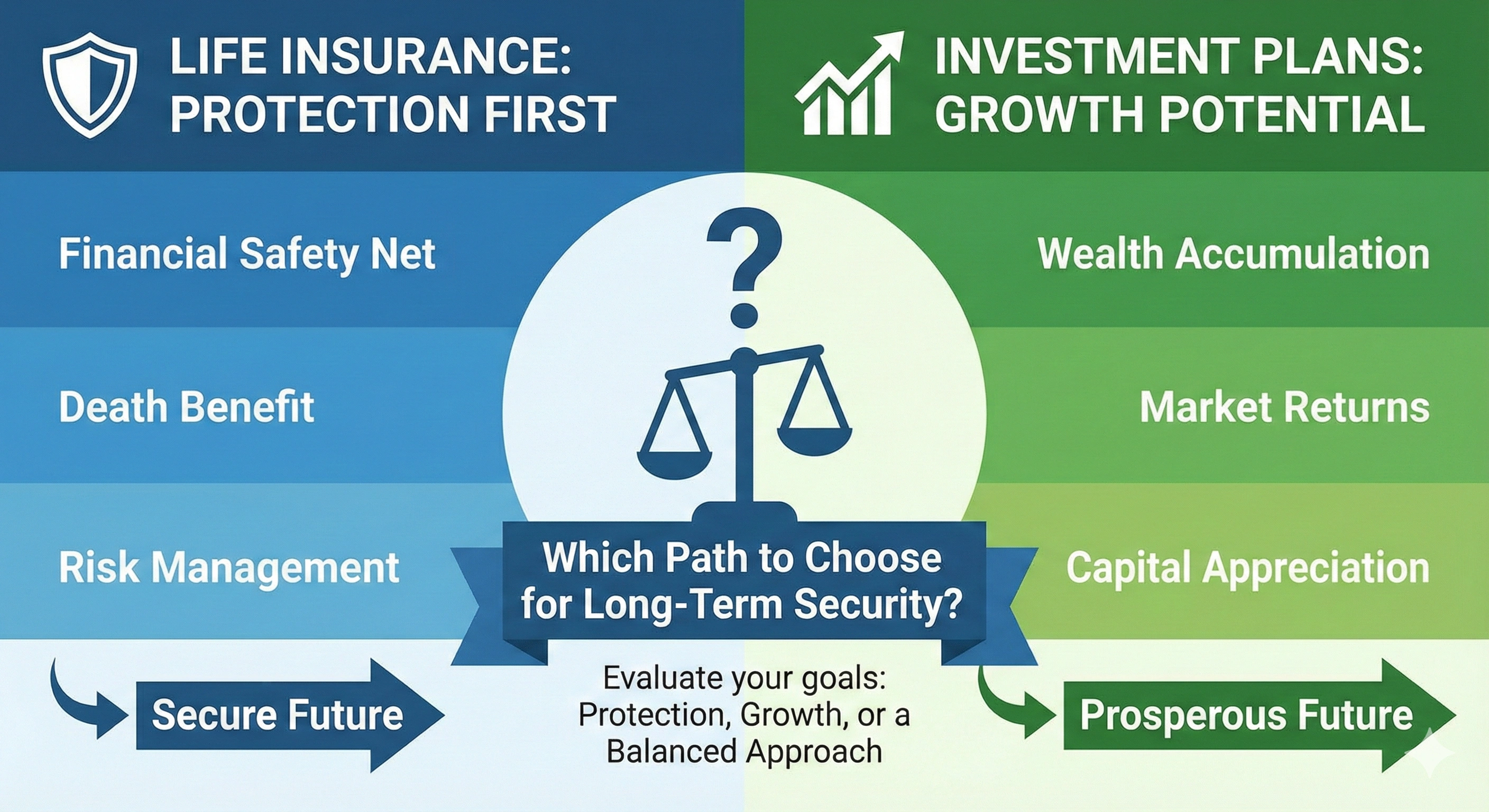

1. Life Insurance Planning

Life insurance is not just about replacing income—it’s about securing your family’s future. High-net-worth individuals often use life insurance for wealth protection, estate planning, business succession, and tax optimization.

Common Types of Life Insurance:

- Term Life Insurance – Affordable and ideal for income replacement.

- Whole Life Insurance – Lifetime coverage with guaranteed cash value.

- Universal Life – Flexible premiums and long-term investment benefits.

- Indexed Universal Life (IUL) – For individuals looking for higher growth potential.

Who needs it most? Families, business owners, high-net-worth individuals, and anyone with dependents or debt obligations.

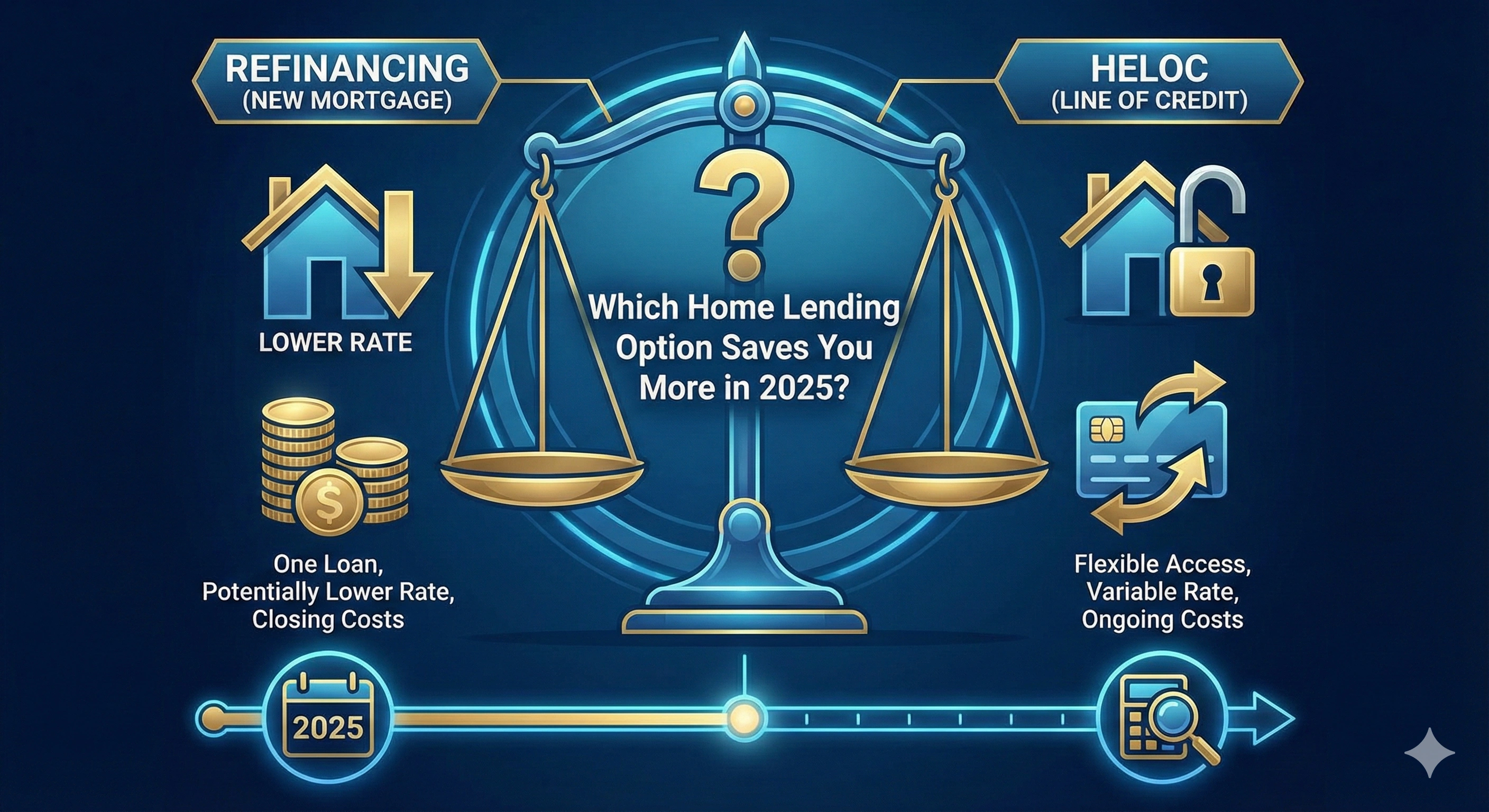

2. Mortgage & Home Insurance

Your home is one of your most valuable assets, and protecting it is essential. Mortgage lenders often require insurance, but even for fully paid homes, coverage is critical.

Key protections include:

- Property damage (fire, storms, theft, vandalism)

- Liability coverage

- Natural disaster add-ons (floods, earthquakes depending on region)

- Mortgage protection insurance for unexpected income loss

Homeowners worldwide invest in insurance as housing prices rise and extreme weather risks increase.

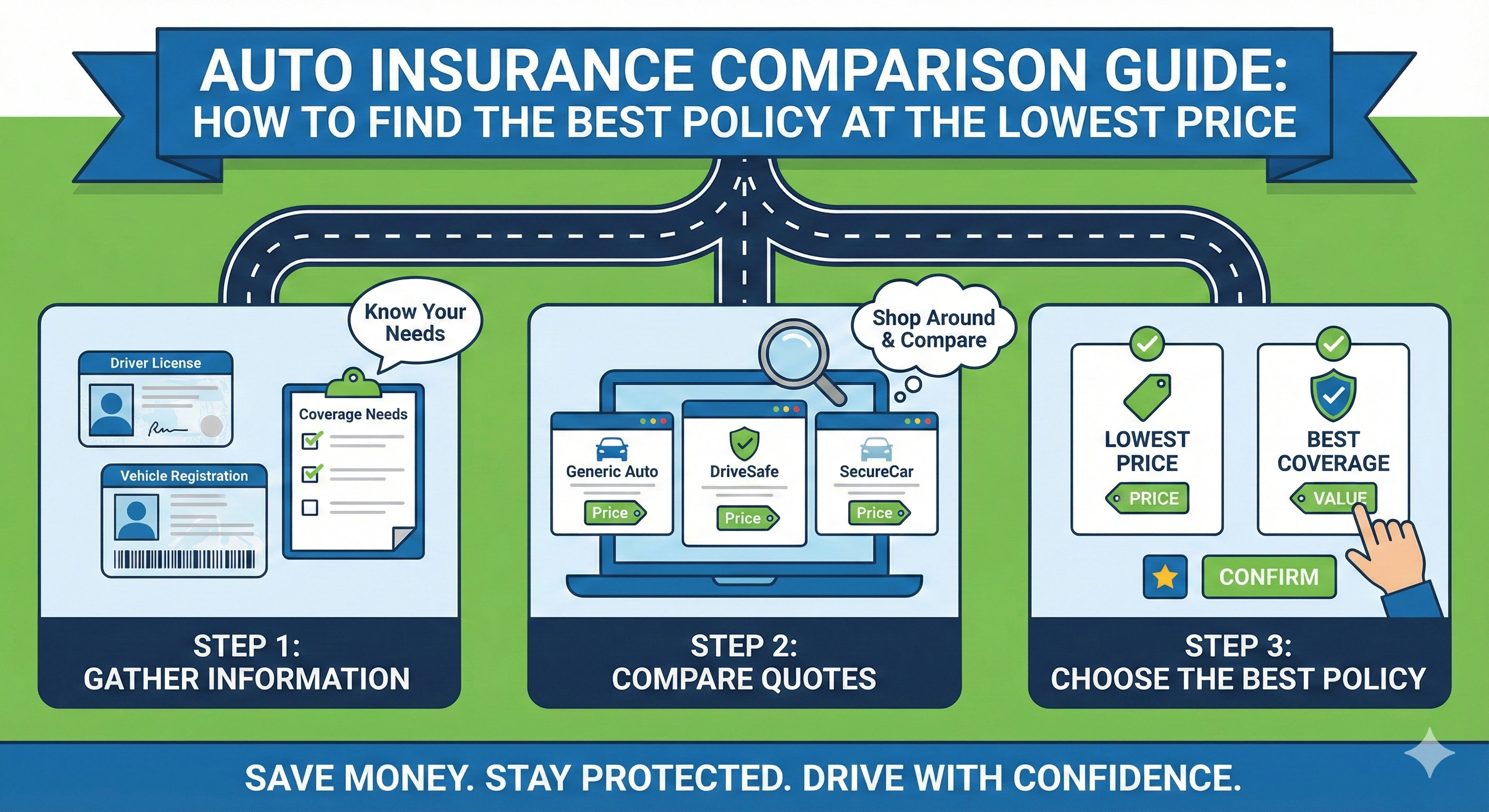

3. Auto Insurance Comparison

Auto insurance is one of the most competitive insurance markets globally—making comparison essential before buying a policy.

Important coverage types:

- Collision & Comprehensive Protection

- Personal Injury Protection

- Liability Insurance (mandatory in most regions)

- Uninsured/Underinsured Motorist Protection

Comparing auto insurance plans can help drivers save significantly while improving their protection.

4. Business & Commercial Insurance

Whether you're running a small business or managing a large enterprise, commercial insurance is essential to safeguard operations from financial disruption.

Most common business insurance types:

- General Liability Insurance

- Professional Indemnity (Errors & Omissions)

- Commercial Property Coverage

- Workers’ Compensation

- Cybersecurity Insurance

- Business Interruption Insurance

High-ticket clients and businesses actively search for these policies because the financial stakes are high.

Final Thoughts

Buying the right insurance policy today ensures long-term peace of mind and strong financial protection. Whether it’s life insurance for your family, home insurance for your property, auto protection, or commercial coverage for your business—investing wisely can completely safeguard your future.

Before purchasing any policy, always compare multiple plans and choose what aligns best with your financial goals.

Admin

Admin

Admin

Admin