First-Time Home Buyer Programs: Global Guide to Grants, Loans & Incentives (2025)

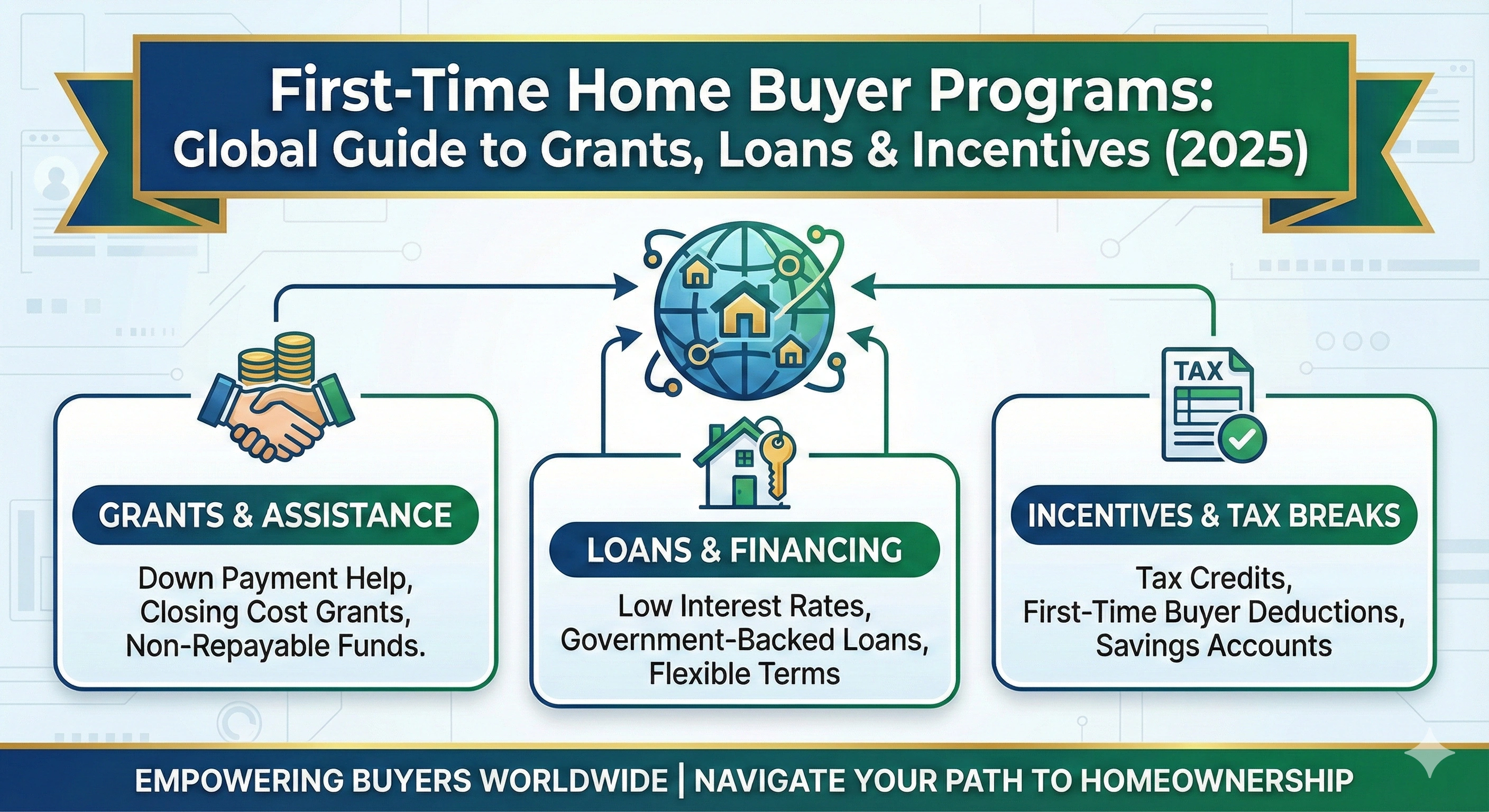

Buying your first home is one of the biggest financial decisions in life — and also one of the most expensive. Whether you live in North America, Europe, Asia, the Middle East, or any other region, governments and financial institutions across the world provide grants, subsidies, low-interest loans, tax benefits, and special incentives to make homeownership more accessible.

This comprehensive global guide covers the most powerful first-time home buyer programs available internationally in 2025. It examines how these programs work, eligibility criteria, financing limits, benefits, and smart strategies to get approved faster.

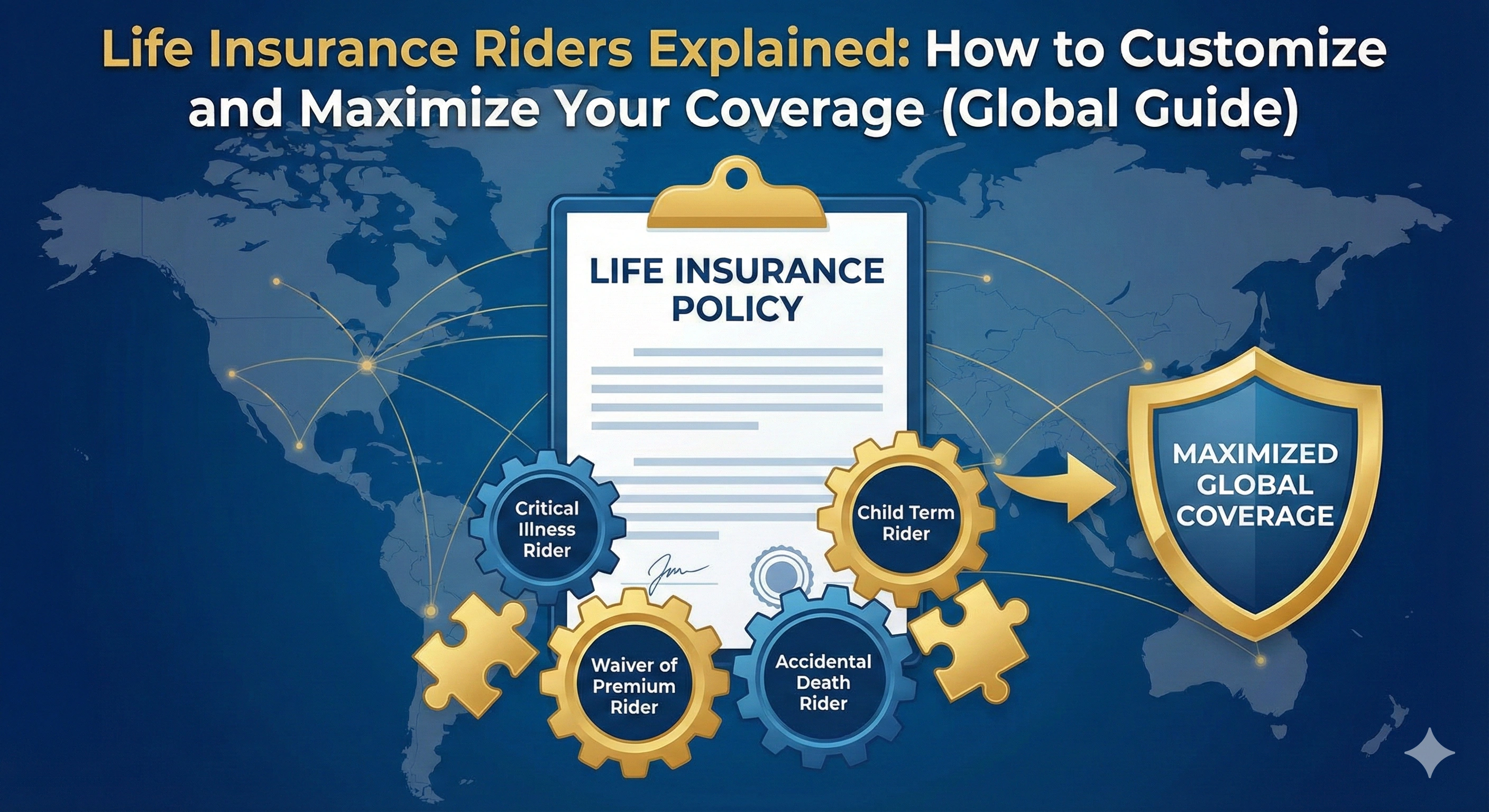

🌍 What Are First-Time Home Buyer Programs?

First-time home buyer programs are financial assistance initiatives offered by governments, banks, and housing authorities to help new buyers afford a home more easily. These programs typically support buyers by:

- Reducing the required down payment

- Lowering interest rates

- Offering tax credits or rebates

- Providing grants that do not need to be repaid

- Guaranteeing loans for easier approval

- Reducing closing costs

Since real estate prices continue rising globally in 2025, these programs are more important than ever — and they unlock opportunities even in high-cost cities.

🏠 Who Qualifies as a “First-Time Home Buyer” Globally?

Most countries follow a broad definition. You may be considered a first-time buyer if:

- You have never owned a home before

- You have not owned property in the past 3–5 years

- You only owned a property through inheritance (in some countries)

- You had ownership but did not live in the property

In many cases, even previous homeowners can qualify again after meeting a waiting period.

🌏 Global Overview: First-Time Home Buyer Programs by Region

1. North America

Countries like the United States and Canada offer some of the most extensive structured programs globally, including tax credits, down payment assistance, and government-backed loans.

- Low down payment loans (as low as 3%)

- Government-backed mortgage insurance programs

- Tax-free savings accounts for home purchases

- Local grants for lower-income households

2. Europe

European countries focus heavily on subsidies, tax deductions, renovation grants, and zero-interest loans.

3. Asia

Asian markets (India, Singapore, Malaysia, Japan, China) offer combined government and banking incentives ranging from subsidies to affordable housing schemes.

4. Middle East

Countries like UAE, Saudi Arabia, and Qatar provide housing support programs aligned with national vision frameworks, especially for citizens.

5. Australia & New Zealand

Widely known for robust grant systems and reduced stamp duty programs.

6. Africa

Fast-growing real estate markets offer low-cost financing, government-backed mortgages, and housing subsidy programs.

🌍 Top First-Time Home Buyer Programs Around the World (Detailed Breakdown)

1. Down Payment Assistance (Global)

Many governments help buyers with partial or full down payment support. This is typically offered as:

- Grants (no repayment)

- Forgivable loans (waived after a set period)

- Shared-equity loans (government becomes partial owner)

- Zero-interest loans (repay later)

Benefits:

- Allows buyers with limited savings to purchase property

- Reduces upfront financial burden

- Increases mortgage approval chances

2. Reduced Interest Rate Home Loans

Many regions offer subsidized interest rate loans, reducing lifetime mortgage costs by 10–40%.

How it helps:

- Lower monthly payments

- Lower overall loan cost

- Easier qualification for higher property values

3. Government Mortgage Guarantees

Several countries provide mortgage guarantees so buyers can qualify even with lower income or credit history.

This means the government acts as the guarantor, reducing the lender’s risk and allowing:

- Lower down payments

- Easier loan approval

- Lower credit score requirements

4. Tax Credits & Rebates

Tax benefits are major incentives worldwide.

Examples:

- Tax deductions on mortgage interest

- Tax rebates for first-time buyers

- Land tax or stamp duty exemptions

- Rebates on property transfer taxes

5. Affordable Housing Programs

Many countries run subsidized housing schemes offering below-market-price homes. These are targeted toward:

- Low-income families

- Middle-income groups

- Youth & professionals

- Government employees

🌐 Country-by-Country Global Examples (2025)

🇬🇧 United Kingdom – First Home Scheme

Offers properties at 30–50% discount for qualifying first-time buyers.

🇦🇺 Australia – First Home Owner Grant (FHOG)

Cash grants + stamp duty exemptions for new home buyers.

🇨🇦 Canada – First Home Savings Account (FHSA)

A tax-free savings account dedicated to home purchases.

🇸🇬 Singapore – HDB Grants

One of the world's largest housing support systems with up to multiple grants for new and resale flats.

🇮🇳 India – PMAY

Offers subsidies on interest rates and affordable housing units.

🇦🇪 UAE – Housing Programs

Emirati families get government-backed affordable loans and grants.

🎯 Eligibility Criteria (Global Summary)

While requirements vary, most programs require:

- Being a first-time home buyer under the local definition

- Meeting income thresholds

- Using the home as a primary residence

- Stable employment or income

- Basic creditworthiness

Some programs also require homeowner education courses.

📘 Step-by-Step Guide to Applying

- Check local, national, and bank-supported programs in your region

- Evaluate your eligibility based on income and credit

- Gather financial documents (bank statements, salary slips, tax returns)

- Get pre-approved by a lender

- Apply for grants or housing authority programs

- Select properties eligible under your program

- Submit your final loan application

- Complete property inspections and closing formalities

💡 Tips for First-Time Home Buyers in 2025

- Improve your credit score before applying

- Use multiple assistance programs together

- Compare mortgage rates from several lenders

- Plan for hidden costs like insurance and taxes

- Buy during seasonal price dips

- Use AI-powered real estate tools to analyze price forecasts

🏁 Final Thoughts

First-time home buyer programs are becoming increasingly essential globally as property prices rise. Whether you’re looking for grants, interest-rate subsidies, down payment help, or government-backed loans, 2025 offers more opportunities than ever for new buyers.

With the right programs, even buyers with limited savings or moderate income can achieve homeownership successfully.

Use this guide as your starting point to explore the best global options tailored to your location, budget, and financial goals.

Admin

Admin

Admin

Admin