Global Guide to Home Refinancing & HELOC: How to Access Affordable Home Equity in 2025

Refinancing and Home Equity Lines of Credit (HELOCs) are among the most powerful financial tools available to homeowners globally. Whether someone wants to lower their monthly mortgage payments, tap into home equity for major expenses, consolidate debt, or improve long-term financial stability—refinancing and HELOCs provide strategic, high-value solutions.

This guide covers refinancing and HELOCs from a global perspective, making it suitable for audiences in the US, UK, Canada, Australia, Europe, Asia, and emerging markets where home equity lending is expanding.

What is Home Refinancing?

Home refinancing means replacing an existing mortgage with a new one—ideally with better terms. Homeowners typically refinance to secure lower interest rates, reduce loan tenure, or shift from adjustable-rate mortgages to fixed-rate plans for stability.

Why People Refinance:

- To lower monthly mortgage payments.

- To secure a lower interest rate.

- To switch from variable to fixed interest rates.

- To shorten/extend the loan term.

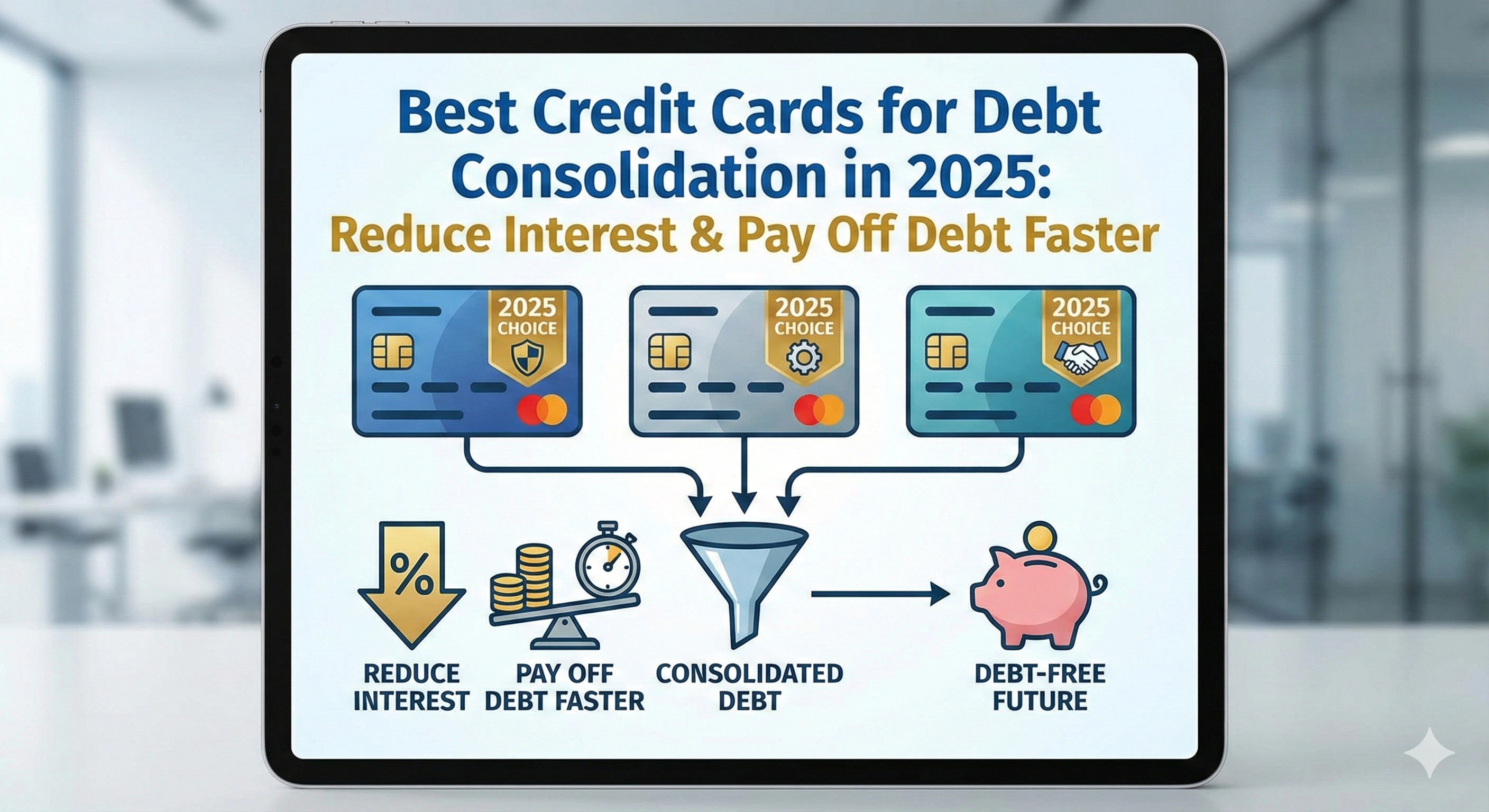

- To consolidate debt using home equity.

- To remove private mortgage insurance (PMI).

- To access cash through “cash-out refinancing”.

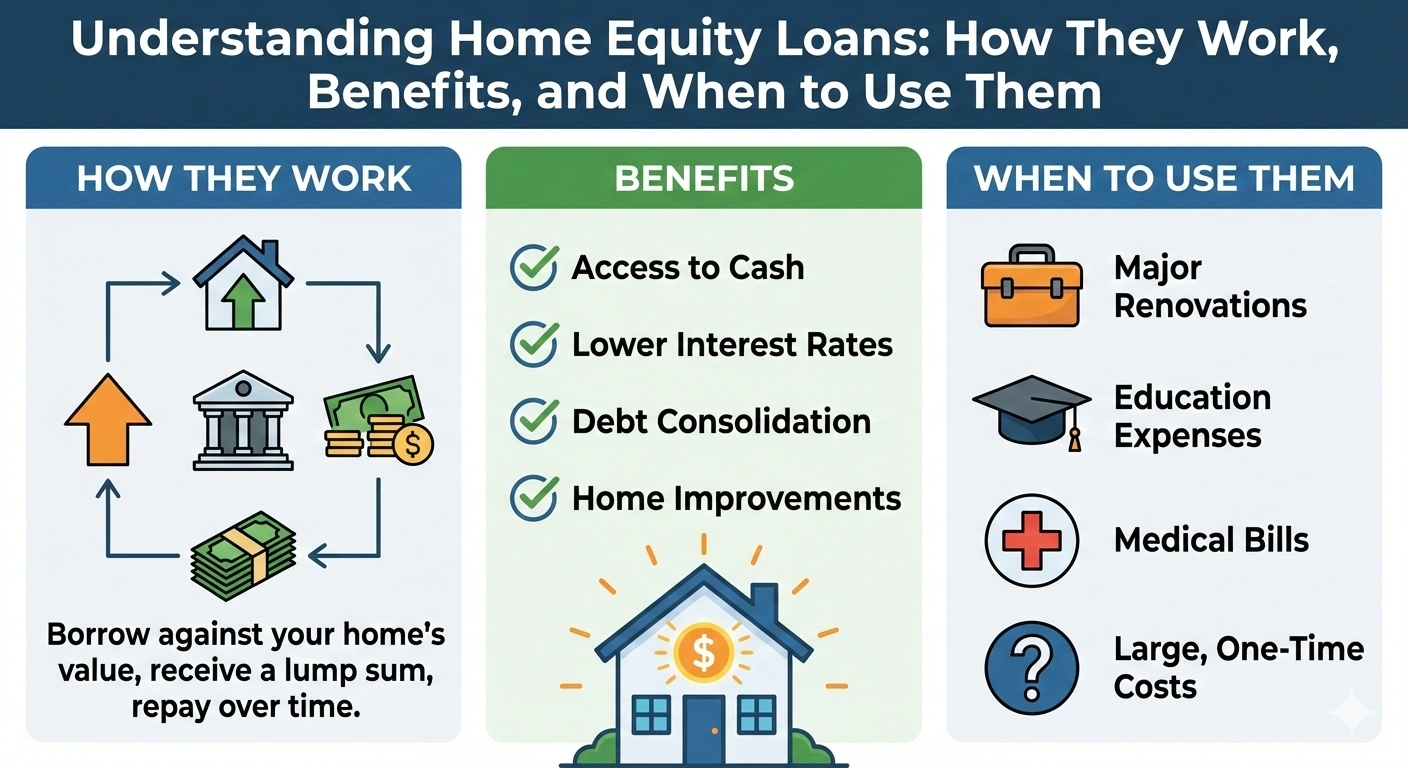

What is a HELOC?

A Home Equity Line of Credit (HELOC) is a revolving credit line secured against your home. Unlike a lump-sum home loan, a HELOC works like a credit card with a large limit—for example, homeowners can borrow $20,000 and repay only the amount they use, plus interest.

Key Benefits of HELOC:

- Borrow only what you need.

- Lower interest rates compared to personal loans.

- Flexible repayment schedules.

- Ideal for recurring expenses like renovations or education.

- Interest may be tax-deductible depending on the country.

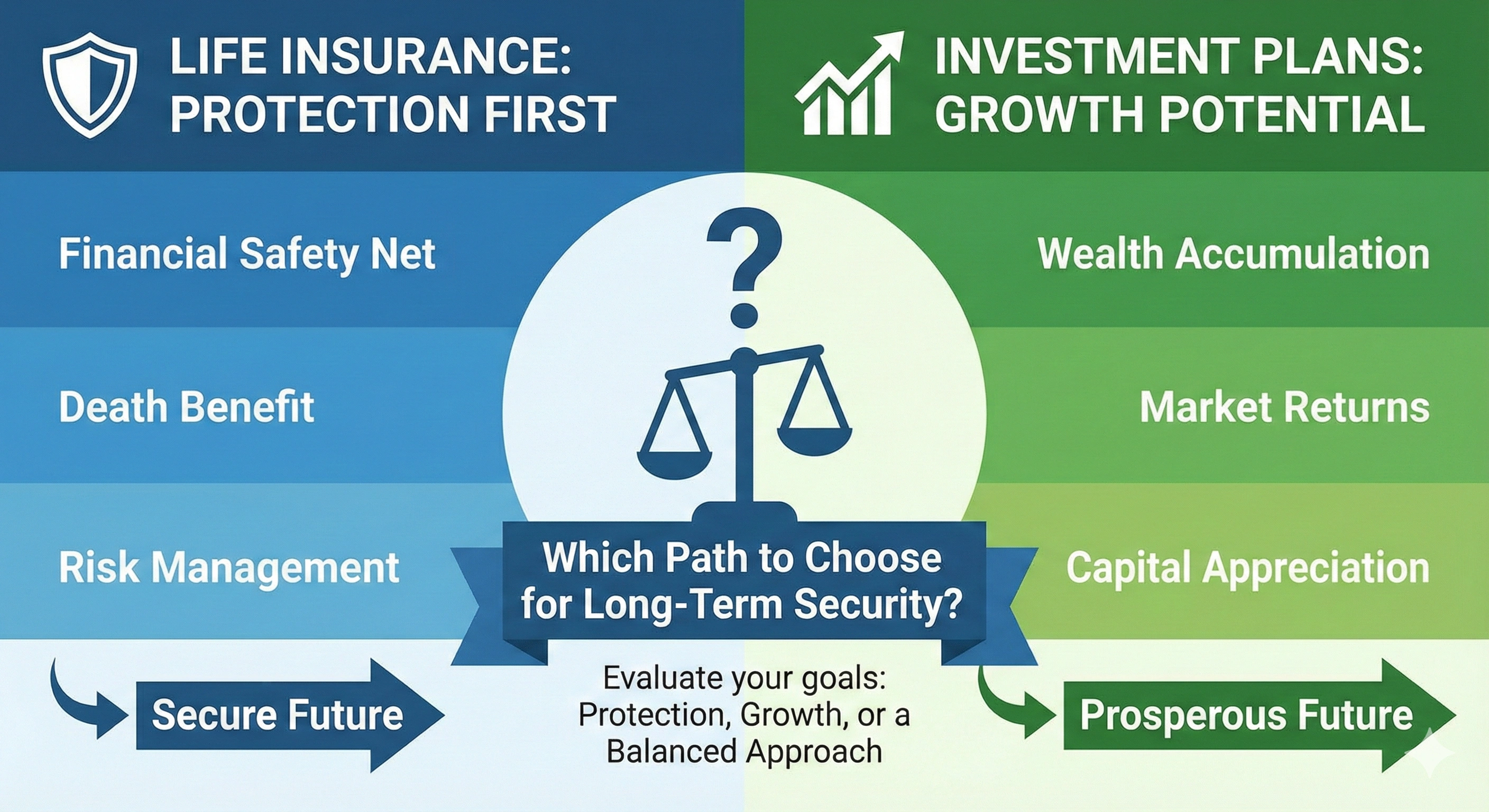

Refinancing vs HELOC: What’s the Difference?

- Refinancing: Replaces your whole mortgage with a new one.

- HELOC: Allows you to borrow extra funds using existing home equity.

- Cash-out refinance: Offers a lump sum by tapping into home equity.

When Should You Consider Refinancing?

Globally, refinancing makes financial sense when:

- Interest rates have dropped 0.5%–2% since the original mortgage.

- Your income has stabilized or increased.

- Your credit score has improved.

- You want predictable payments via a fixed-rate mortgage.

- You want to remove a co-borrower or restructure your loan.

When is a HELOC Better?

A HELOC makes more sense when you don't want to replace your mortgage but need flexible borrowing for:

- home renovations,

- medical expenses,

- business investment,

- paying for education,

- emergencies or personal cash flow.

Global HELOC Availability

HELOCs are widely available in:

- United States

- Canada

- United Kingdom (called “Homeowner Loans” or “Equity Release”)

- Australia & New Zealand

- Singapore & Hong Kong

- UAE

In some countries, HELOCs are still emerging or limited to banks offering secured credit lines.

How Much Equity Do You Need?

Most lenders globally allow borrowing up to:

- 75–90% of the home's value (Loan-to-Value / LTV ratio)

- Higher limits for strong credit scores

- Lower limits for investment or rental properties

Global Qualification Requirements

To qualify for refinancing or a HELOC, lenders usually evaluate:

- Credit score / credit rating

- Income stability

- Debt-to-income ratio (DTI)

- Loan-to-value ratio (LTV)

- Employment history

- Home appraisal value

Benefits of Refinancing

- Lower interest rates

- Lower monthly payments

- Ability to access cash from home equity (cash-out refinancing)

- Faster loan payoff with shorter-term refinance

- Switching loan type for more stability

- Debt consolidation at lower rates

Benefits of HELOC

- Access funds without refinancing your whole home loan

- Flexible borrowing and repayment

- Interest-only draw periods in some countries

- Low variable interest rates

Risks to Understand

No refinancing or HELOC guide is complete without understanding risks:

Risks of Refinancing

- Closing costs can be high

- High penalty fees for breaking a fixed-rate mortgage

- Can extend your loan term and increase interest over time

- Cash-out refinance increases your debt

Risks of HELOC

- Variable interest rates can increase

- Risk of overspending due to flexible access to funds

- May reduce equity and affect future borrowing

- Your home is used as collateral

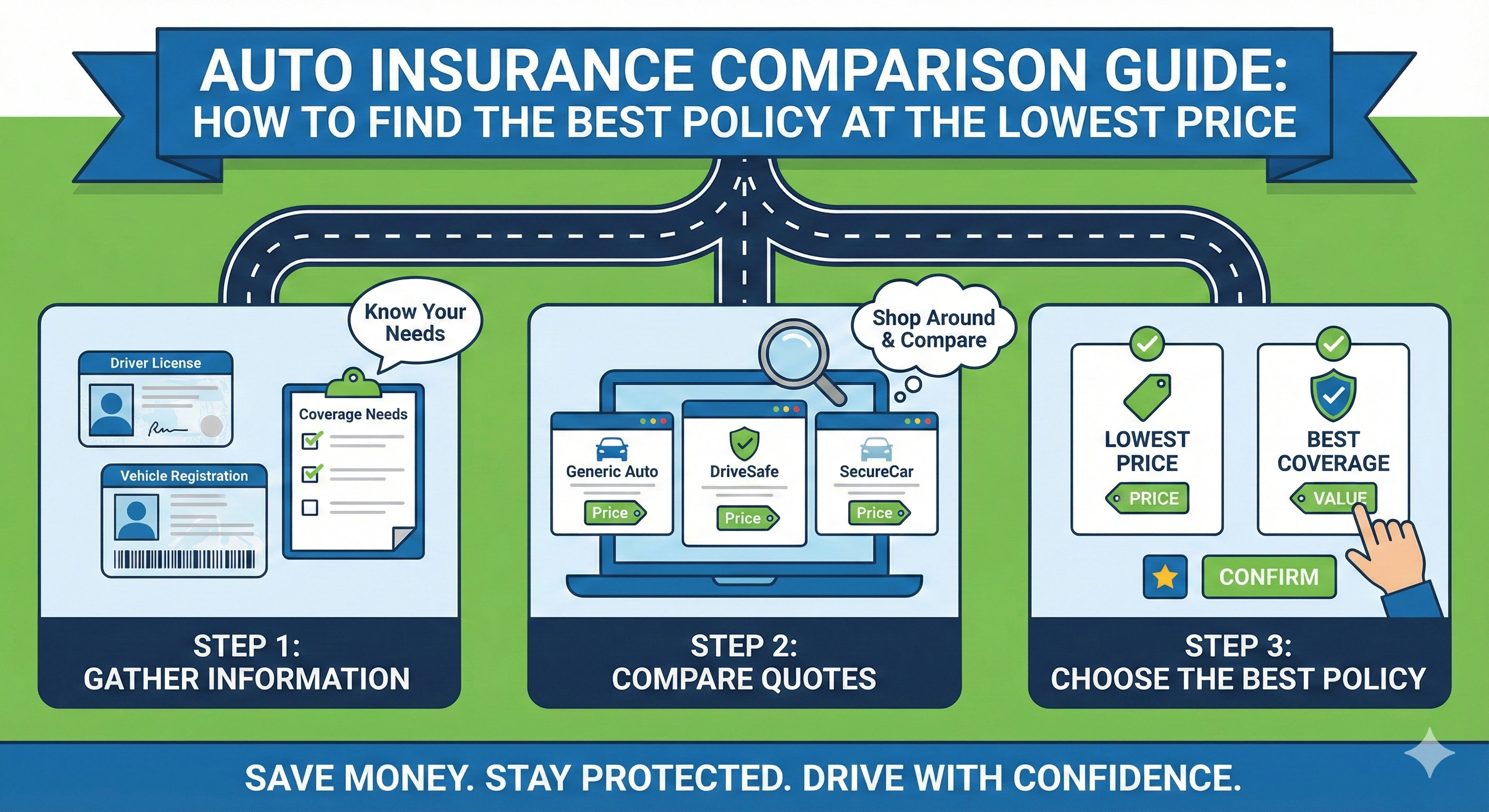

How to Compare Refinancing & HELOC Lenders Globally

To get the best deal, compare lenders on these factors:

- Interest rates

- Loan terms

- Fees and closing costs

- Fixed vs variable rate options

- Prepayment penalties

- Customer support

- Eligibility criteria

- Processing time

Best Use Cases for Refinancing

- Reducing interest rate during declining rate cycles

- Switching from adjustable to fixed-rate mortgage

- Shortening loan term to save on interest

- Removing PMI insurance

Best Use Cases for HELOC

- Home improvements that increase property value

- Funding education

- Starting or expanding a business

- Debt consolidation

- Large purchases with long repayment flexibility

Global Trends in Refinancing & HELOC (2024–2026)

- Increasing digital mortgage solutions

- Faster online approvals

- AI-powered underwriting

- More lenders offering flexible repayment plans

- Growing HELOC popularity in Asia & Europe

How to Maximize Approval Chances

- Improve your credit score

- Reduce existing debts

- Increase your income or add a co-borrower

- Prepare all financial documents

- Compare multiple lenders before deciding

Conclusion

Home refinancing and HELOCs offer powerful financial advantages when used wisely. Whether you're looking to lower your mortgage cost, access home equity, or restructure your debt, understanding your global options gives you the upper hand.

With proper planning, comparison, and financial discipline, refinancing or a HELOC can significantly improve your long-term financial stability and help you unlock the value of your home.

Admin

Admin

Admin

Admin