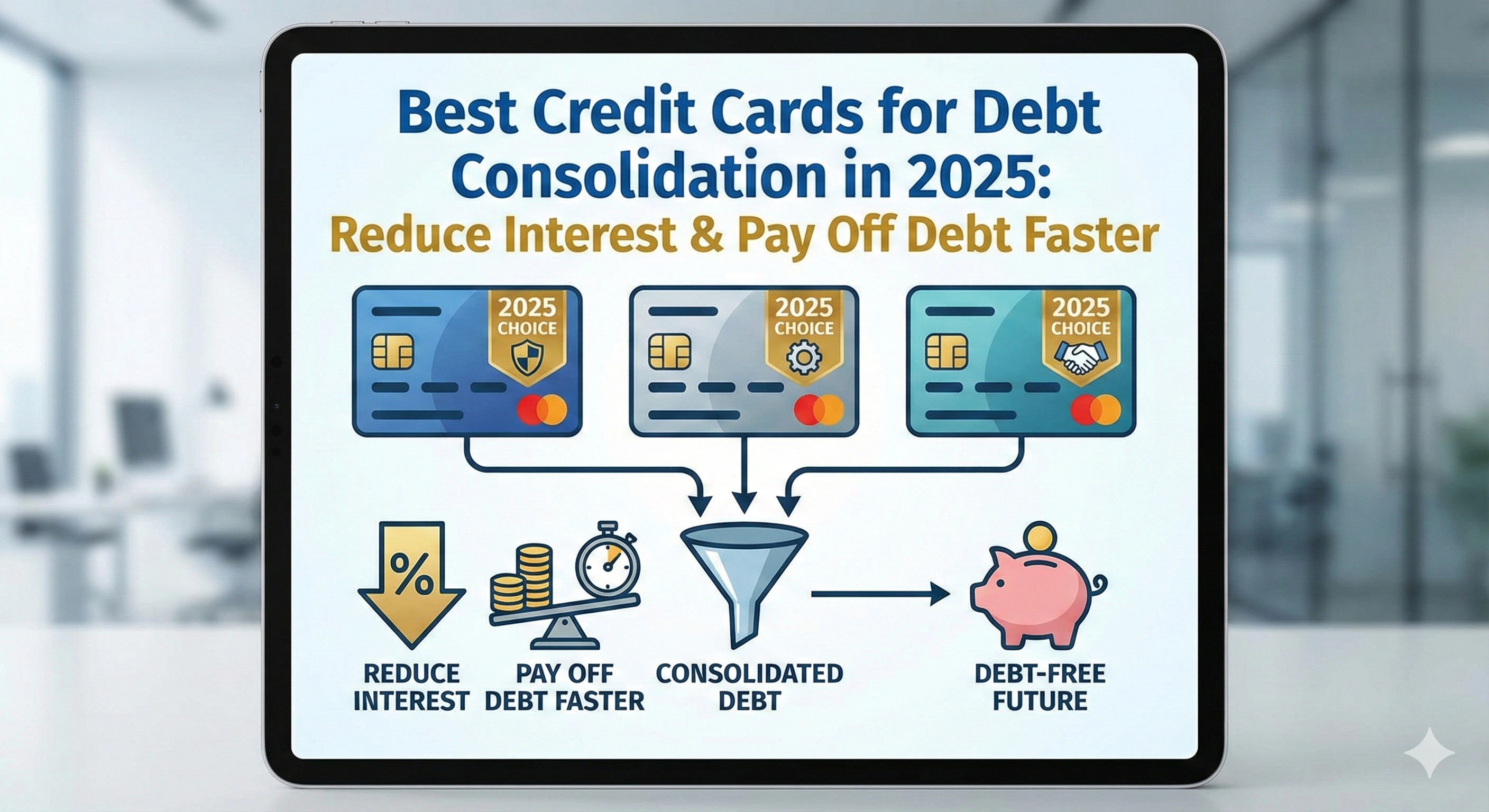

Best Credit Cards for Debt Consolidation in 2025: Reduce Interest & Pay Off Debt Faster

With rising inflation, increased cost of borrowing, and fluctuating credit card interest rates worldwide, consumers in 2025 are looking for smarter, safer, and more cost-efficient ways to pay off existing credit card debt. One of the most effective ways to do this is by using a debt consolidation credit card — especially those offering long 0% introductory APR periods for balance transfers.

This comprehensive guide breaks down the best credit cards for debt consolidation in 2025, explains how they work, compares interest-saving potential, and provides expert-level strategies to help you eliminate debt faster.

What Is a Debt Consolidation Credit Card?

A debt consolidation credit card is designed to help consumers combine or “consolidate” multiple credit card balances into one account — typically with a low or 0% introductory APR for a specific period. This reduces interest costs dramatically and helps accelerate repayment.

How It Works:

- You apply for a new consolidation credit card (usually with 0% APR offer).

- You transfer your existing high-interest card balances to the new card.

- You pay little to no interest during the promotional period.

- You aggressively pay off the principal during the intro period.

The main goal is to stop paying high interest and redirect your payments toward the actual debt.

Benefits of Using a Debt Consolidation Credit Card

Choosing the right card in 2025 can save you thousands of dollars. Here are major benefits:

- Zero or low-interest promo periods — your payments chip away at principal, not interest.

- Simplified payments — manage one account instead of many.

- Improved credit utilization — transferring balances reduces usage on old cards.

- No collateral required — unlike personal loans, no assets are needed.

- Potential credit score improvement — if handled properly.

Debt consolidation cards are particularly useful for individuals with multiple maxed-out cards or rising interest rates.

What to Look for in a Debt Consolidation Card in 2025

Not all balance transfer cards are ideal for debt consolidation. Here are the key criteria:

1. Length of the 0% APR Intro Period

Longer promotional periods (18–24 months or more) give you more time to pay off debt without interest.

2. Balance Transfer Fee

Most cards charge 3–5%. Some offer reduced fees for transfers within the first 60–90 days.

3. Post-Intro APR

If you fail to pay the balance within the promo period, the remaining debt may revert to a standard APR of 18–29%.

4. Credit Limit Offered

The higher the credit limit, the more debt you can consolidate.

5. Penalties & Fine Print

Late payments can instantly void 0% intro APR offers — be careful.

6. Whether New Purchases Also Get Intro APR

Some cards only give 0% APR on transfers, not purchases.

Top 7 Best Credit Cards for Debt Consolidation in 2025

Below are expert-selected consolidation cards offering the best combination of long intro APR, low fees, and strong repayment flexibility.

1. Reflect® 0% APR Debt Consolidation Card — Best Overall

- 0% APR for up to 21 months on balance transfers

- 3%–5% transfer fee

- No annual fee

- Generous credit limits available

If you need maximum time to pay off debt without interest, this is one of the most powerful options.

2. Citi Simplicity® Card — Best for No Penalties

- 0% APR for 18–21 months

- No late fees

- No penalty APR

Perfect for borrowers who want flexibility and forgiveness in repayment.

3. Discover it® Balance Transfer — Best for Rewards + Consolidation

- 0% APR for 18 months

- Cashback on purchases

- 3% intro transfer fee

Great if you want rewards on new spending without losing consolidation benefits.

4. Chase Slate Edge® — Best for Moderate Debt Levels

- 0% APR for 15 months

- Useful credit-building tools

- Good customer support

A solid choice for smaller balances and short-term consolidation needs.

5. BankAmericard® Credit Card — Best for Simple, Predictable Terms

- 0% APR for 18 months

- Low ongoing APR compared to competitors

6. Wells Fargo Reflect / Active Cash Variants — Best for High Limits

- High approval odds for large credit limits

- Strong customer service and mobile banking

7. Credit Union Balance Transfer Cards — Best Low-Fee Option

Many regional credit unions offer:

- Lower than average transfer fees

- Occasional 0% APR for 12–18 months

- Bigger approval odds for existing members

How Much Can a Debt Consolidation Card Save You?

Let’s calculate a typical scenario.

Scenario:

- Debt: $7,500

- Current APR: 22%

- Monthly payment: $250

With your existing card, you would pay:

- Total interest: ~$3,100+

- Payoff time: 42+ months

With a debt consolidation card offering:

- 0% APR for 21 months

- 3% transfer fee = $225

If you keep paying $250/month, payoff time becomes:

- ~31 months

- Total cost including fee: ~$7,725

You save roughly $2,800+ in interest.

This demonstrates why debt consolidation cards are extremely powerful tools — if used correctly.

Step-by-Step Guide: How to Consolidate Your Debt in 2025

1. Calculate Your Total Debt

List all balances, APRs, and minimum payments.

2. Choose the Right Consolidation Card

Ensure it offers enough credit limit and a long 0% APR period.

3. Apply and Get Approved

Applicants with higher credit scores (680+) get the best offers.

4. Transfer Balances Immediately

Do it within the promotional transfer window.

5. Stop Using Old Cards

This prevents accumulating new debt.

6. Create a Strict Repayment Plan

Calculate how much you need to pay monthly to finish before promo ends.

7. Set Up Autopay

Missing a payment may void 0% APR.

Common Mistakes to Avoid

- Using the new card for new purchases — ruins the purpose.

- Paying only the minimum due — you won’t finish before promo ends.

- Ignoring the balance transfer fee — calculate savings correctly.

- Not transferring all eligible debt — partial consolidation delays payoff.

- Reusing old cards — causes debt recycling.

Who Should Use a Debt Consolidation Credit Card?

These cards are ideal for:

- People with high-interest credit card debt

- Borrowers with 680+ credit scores

- Individuals committed to disciplined repayment

- People avoiding risky personal loans

If you are not disciplined, a personal loan with fixed payments may be better.

Final Verdict: Best Debt Consolidation Cards in 2025

With economic uncertainty and high variable APRs, 2025 is a crucial year to manage debt wisely. The best debt consolidation credit cards offer long 0% APR periods, reasonable transfer fees, and repayment flexibility.

Whether you choose a long-duration 21-month card or a no-fee credit union option, the key is simple:

Transfer your balances immediately, avoid new debt, and repay aggressively before the promo expires.

Used correctly, these cards can save you thousands of dollars and help you achieve debt-free stability faster than any other method.

Admin

Admin

Admin

Admin