How to Compare Mortgage Lenders: A Complete Global Guide

Choosing the right mortgage lender is one of the most important financial decisions you will make during your home-buying journey. Whether you are buying your first home, refinancing an existing property, or exploring government-backed loan options, comparing lenders correctly can save you thousands of dollars over the lifetime of your loan.

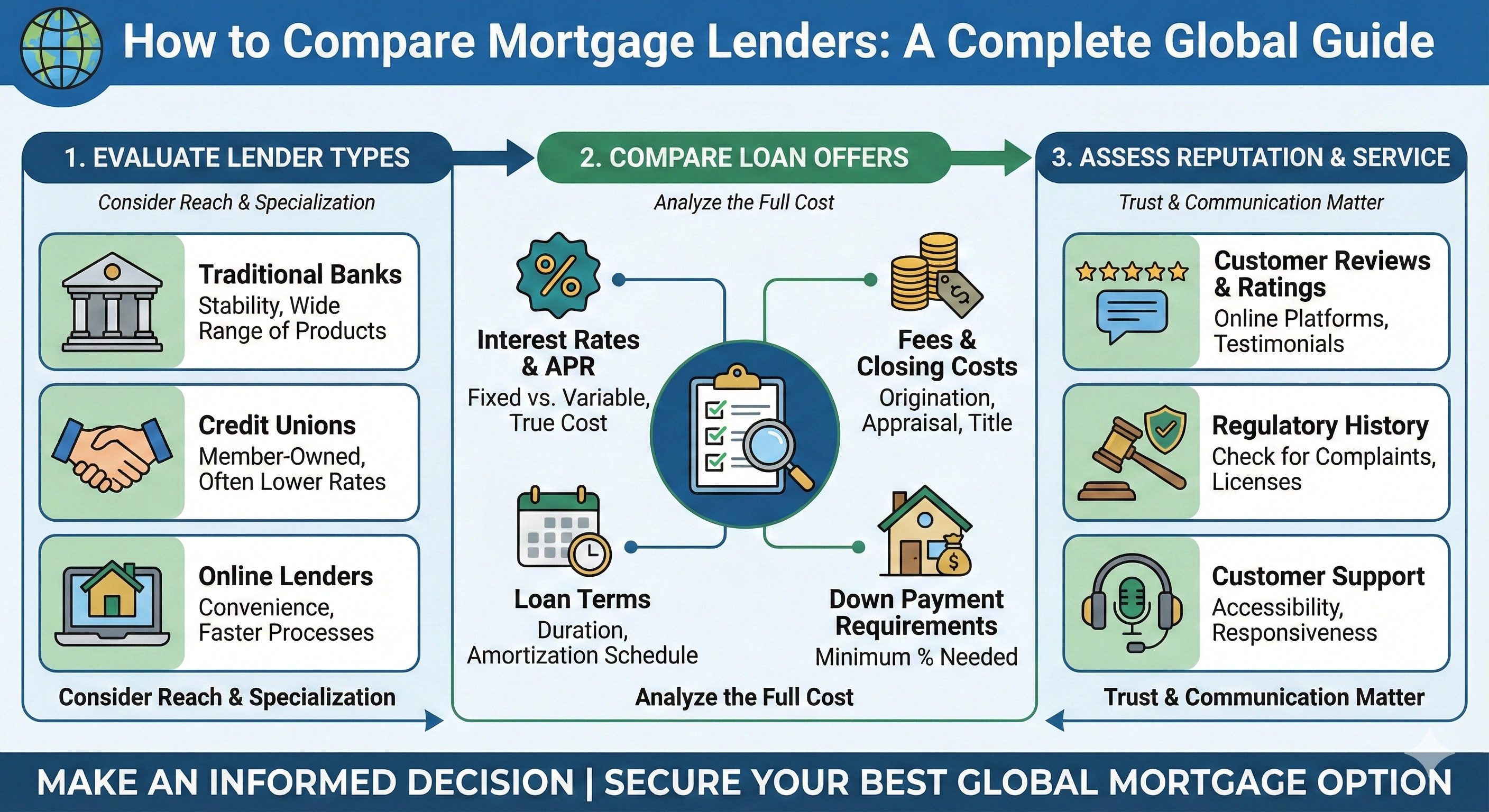

1. Understand The Types of Mortgage Lenders

Globally, home borrowers can choose from multiple types of lenders, including:

- Banks: Traditional, stable lenders offering multiple loan products.

- Credit Unions: Member-based institutions with competitive interest rates.

- Mortgage Brokers: Professionals who compare lenders on your behalf.

- Online Mortgage Lenders: Fast processing times and digital documentation.

- Government-Backed Loan Providers: Such as FHA, VA, or local housing authorities in different countries.

2. Compare Interest Rates

Interest rate comparison is the most critical step. Even a 0.25% difference can translate to significant savings. Evaluate:

- Fixed-rate vs. floating-rate mortgages

- Annual Percentage Rate (APR) instead of just the base interest rate

- Any rate lock options

- Special offers for first-time buyers or refinancing

3. Analyze Loan Fees

Fees vary widely across lenders. Important charges to review:

- Origination fees

- Application fees

- Processing charges

- Legal or documentation fees

- Early repayment penalties

4. Understand Loan Terms

A lower monthly payment does not always mean a better loan. Compare:

- Loan repayment period (15, 20, or 30 years)

- Prepayment flexibility

- Eligibility for refinancing later

- Principal + interest structure

5. Check Customer Reviews and Service Quality

- Communication clarity

- Transparency in fees

- Loan approval speed

- Customer satisfaction in long-term service

6. Evaluate Lender’s Pre-Approval Strength

A strong pre-approval helps you negotiate better with property sellers. Compare lenders based on:

- Pre-approval turnaround time

- Accuracy of quoted terms

- Depth of verification

7. Use Global Mortgage Comparison Tools

Many online platforms allow you to compare multiple lenders simultaneously based on region, loan amount, and credit score. These tools help you quickly shortlist top-performing lenders.

8. Factors That Influence Your Mortgage Offers

- Credit score or creditworthiness

- Income stability

- Down payment amount

- Employment history

- Property type and location

9. When Should You Refinance?

Consider refinancing when:

- Interest rates drop significantly

- You want to switch from a variable rate to a fixed rate

- You want better loan terms

- You want to access home equity

10. Key Questions to Ask Your Lender

- What is the total cost of the loan?

- Are there hidden fees?

- What is the minimum down payment?

- How long will approval take?

- Is there a penalty for early repayment?

Conclusion

Selecting the right mortgage lender requires careful comparison of rates, fees, terms, and services. A well-researched lender choice can reduce financial stress, lower overall loan costs, and help you secure your dream home without unnecessary risk.

Admin

Admin

Admin

Admin