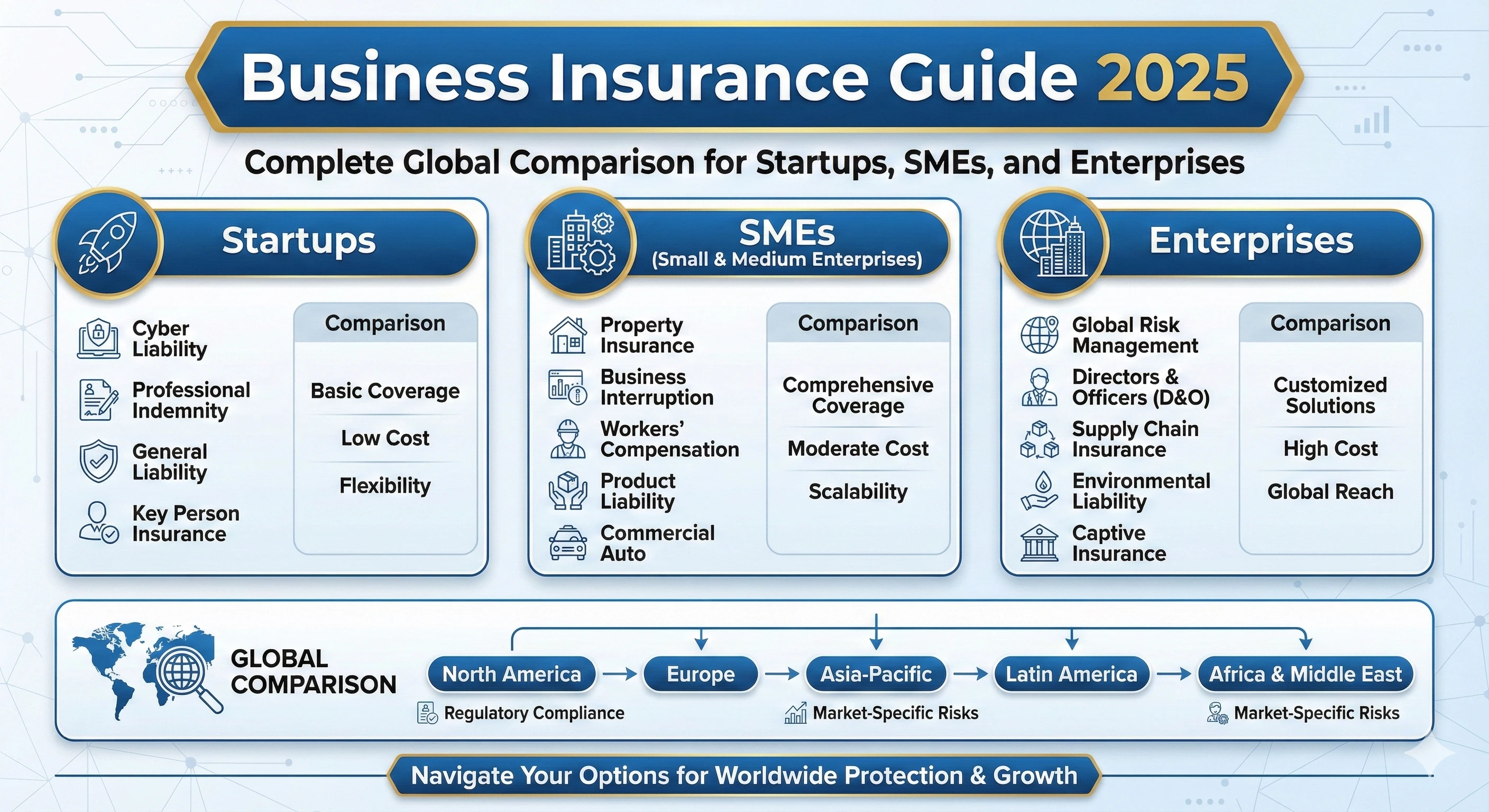

Best Business Credit Cards & Loans for Entrepreneurs in 2025 (High-Value B2B Guide)

The year 2025 is reshaping business finance across the globe. With digital transformation, AI-based credit scoring, fintech expansion, and increasing cross-border business activity, entrepreneurs now have more financing options than ever before. Whether you're a startup looking for your first business credit card or an established company seeking high-limit funding solutions, this guide covers the best business credit cards and loans for 2025.

Business credit products are among the highest CPC (cost-per-click) topics globally, because banks and lenders aggressively compete for quality business clients. These products carry high-value customers, higher borrowing potential, and long-term revenue — which makes them extremely lucrative for advertisers and publishers.

Why Business Credit Cards & Business Loans Matter in 2025

The modern business environment requires more financial flexibility than ever. Businesses across the world — small, medium, and enterprise — rely on credit for:

- Working capital management

- Cash-flow stability

- Purchasing inventory or equipment

- Marketing and growth campaigns

- Technology upgrades and SaaS tools

- Hiring and expansion

- Emergency or seasonal expenses

A proper business credit card or loan can help a company reduce operational strain, access high-value rewards, and stay financially agile throughout the year.

How We Ranked The Best Business Financial Products

This 2025 guide evaluates products on the basis of:

- Approval Difficulty & Eligibility

- Credit Limits & Loan Amount

- Rewards Structure & Cashback Categories

- Interest Rates (APR)

- Annual Fees & Hidden Charges

- Digital Banking Features

- Business Insurance & Extra Perks

- User Reviews & Global Availability

With these factors, we selected the Top Business Credit Cards & Loans of 2025 for entrepreneurs and global business owners.

1. Global Business Platinum Credit Card

The Global Business Platinum Card leads the market as one of the most premium B2B credit cards worldwide, ideal for medium and large businesses.

Key Features

- High credit limit: Up to USD 250,000

- 5% cashback on advertising (Google Ads, Meta Ads, LinkedIn Ads)

- Exclusive airport lounge access for business travel

- Travel insurance for employees

- AI-powered fraud protection

- Free employee cards with spending controls

Who Should Apply?

Startups running ads, digital agencies, and global teams that frequently travel.

2. Business Growth Mastercard (Zero Foreign Fees)

This card is extremely popular among cross-border businesses and remote-first companies.

Features

- 0% foreign transaction fees

- Rewards on international purchases

- High acceptance rate globally

- Integrated expense management system

- Perfect for import–export businesses

3. Startup Accelerator Credit Card

This card is targeted at new startups, freelancers, and small businesses with limited financial history.

Benefits

- Approval even with limited credit history

- Cashback on SaaS tools (AWS, Google Cloud, Notion, Slack, HubSpot)

- Low annual fee

- Free credit score monitoring

4. Corporate Executive Credit Card (High-End Category)

One of the most luxurious cards for corporate leaders and entrepreneurs handling large financial decisions.

Premium Features

- Unlimited lounge access

- Dedicated relationship manager

- Priority customer support

- Concierge services

- Business trip insurance

- Up to 4% cashback on flight and hotel bookings

5. E-Commerce Business Rewards Card

Designed specifically for dropshippers, online brands, e-commerce sellers, and marketplace vendors.

Top Perks

- Exclusive rewards on advertising spend

- Cashback on shipping providers

- Cashback on software tools

- Inventory financing options

Best Business Loans of 2025

Now let’s explore the top business loan options that companies globally are using to expand and scale operations in 2025.

6. Business Expansion Term Loan (Global Banks)

These loans are suitable for businesses planning long-term investment in machinery, equipment, production, or new branches.

Key Features

- Loan amounts up to $5 million

- Flexible repayment terms: 3–10 years

- Competitive interest rates

- Useful for stable, established SMEs

7. Working Capital Flexi-Loan

A flexible credit line for managing short-term expenses, seasonal cash flow shortages, or operational requirements.

Benefits

- Borrow only when needed

- Interest charged only on used amount

- Fast approval — often within 24 hours

8. Invoice Financing Loan

Invoice financing helps businesses that have large unpaid invoices and need cash flow immediately.

Advantages

- Up to 90% of invoice value financed

- No need for traditional collateral

- Ideal for B2B service companies

9. Equipment Financing Loan

Best for manufacturing, construction, logistics, and industrial companies requiring heavy machinery or high-cost tools.

Key Features

- Loan is secured by equipment itself

- Lower interest rates

- Fast processing

10. Startup Funding Loan (No Collateral)

These loans are designed for startups with little or no revenue history.

Top Highlights

- No collateral required

- Suitable for early-stage founders

- Relatively quick approval

- Loan amounts up to $250,000

How to Choose the Best Business Credit Product

Consider the following factors when selecting a business financial product:

- How much credit or loan amount do you need?

- Do you want cashback or travel rewards?

- Do you need international flexibility?

- Are you a startup or established company?

- Are you financing advertising, operations, or capital investment?

Choose a card/loan that aligns with your business model, monthly spending, and financial goals.

Final Thoughts

The business credit environment in 2025 is incredibly dynamic. With global fintech advancements, AI-driven credit approvals, and competitive bank offerings, entrepreneurs have more financing power than ever before. Whether you need a high-limit credit card, startup-friendly loan, or rewards-focused business solution — the options in this guide will help you unlock growth, stability, and long-term profitability.

Admin

Admin

Admin

Admin