Mortgage & Home Insurance Guide 2025: Complete Global Comparison for Homeowners & Buyers

Mortgage and home insurance are two essential pillars of property protection in 2025. Whether you're buying your first home, refinancing an existing mortgage, or investing in properties, understanding the right type of insurance can protect you from financial losses, natural disasters, theft, liability issues, and unexpected damage.

This comprehensive global guide explains everything you need to know about home insurance, mortgage insurance, lender requirements, worldwide coverage differences, premium reduction strategies, and how to choose the best policy for your property.

What Is Mortgage Insurance?

Mortgage insurance protects lenders—not homeowners—when a borrower fails to repay their loan. It is typically required when making a down payment of less than 20% or when the property risk is high.

Mortgage insurance helps:

- Homebuyers qualify for mortgages with smaller down payments

- Lenders reduce risk and loan defaults

- Real estate markets remain stable

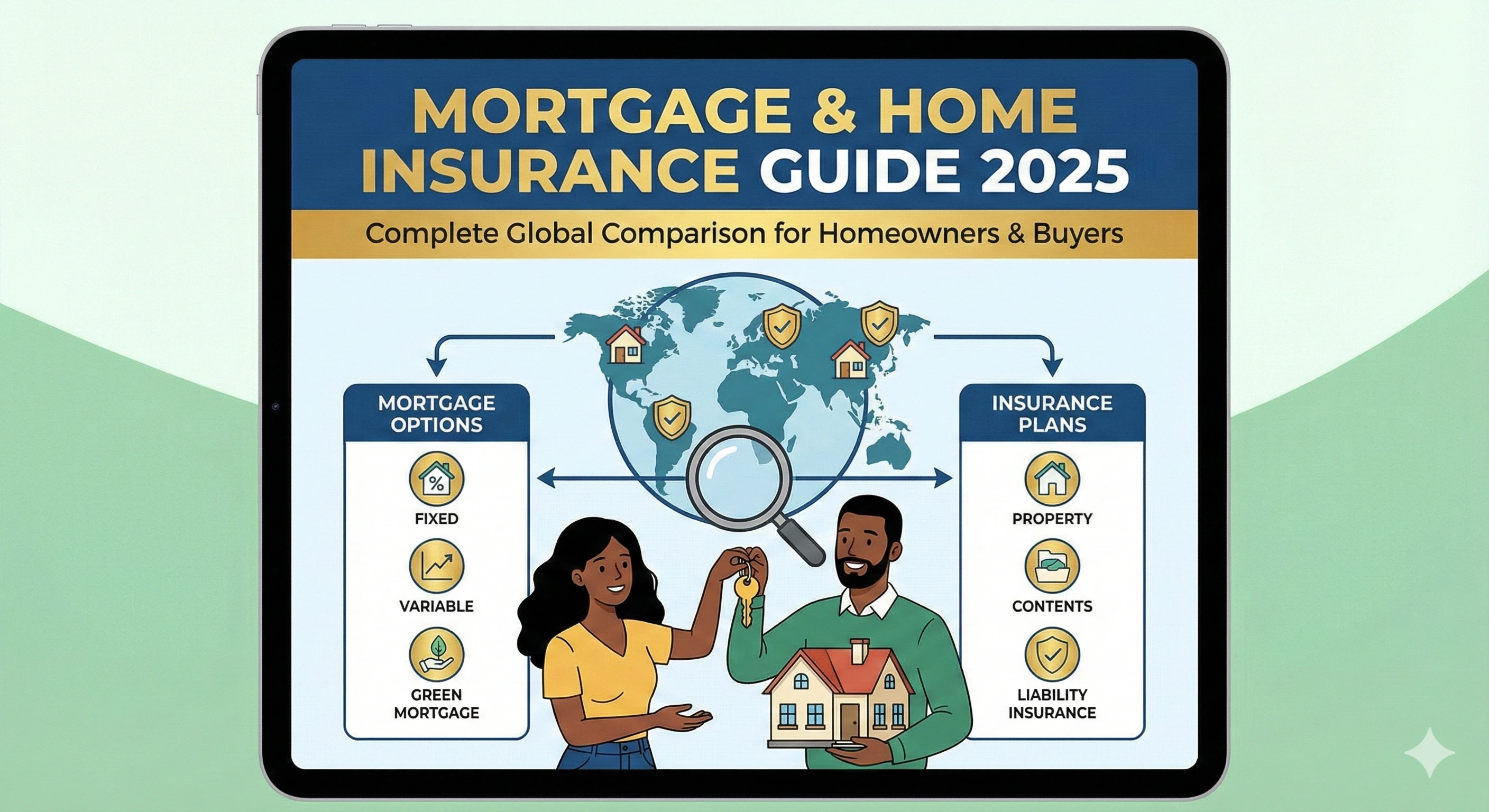

Types of Mortgage Insurance Globally

Mortgage insurance varies by country, but the most common types include:

1. Private Mortgage Insurance (PMI)

Common in the U.S., Canada, Australia, and parts of Europe. Required for high loan-to-value (LTV) mortgages.

2. Government-Backed Mortgage Insurance

Provided through FHA, VA, USDA, CMHC, or equivalent national agencies.

3. Lender’s Mortgage Insurance (LMI)

Common in Australia and New Zealand. Covers the lender but paid by the borrower.

4. Mortgage Protection Insurance (MPI)

Protects the borrower by covering mortgage payments if they become disabled, unemployed, or pass away.

What Is Home Insurance?

Home insurance protects the physical structure of a house and the belongings inside it. It can also include liability coverage if someone gets injured on your property.

Types of Home Insurance Coverage

1. Building/Structure Coverage

Protects walls, roof, electrical systems, plumbing, and permanent fixtures.

2. Contents/Personal Belongings Coverage

Covers furniture, electronics, clothing, art, appliances, and valuables.

3. Liability Protection

Covers legal fees and damages if someone gets injured on your property.

4. Natural Disaster (Catastrophe) Coverage

Protects against earthquakes, floods, storms, cyclones, and more.

5. Fire & Theft Coverage

Protects your home from fire, burglary, vandalism, and malicious damage.

6. Home Warranty Add-Ons

Covers appliances and major home system failures.

Why Homeowners Need Insurance in 2025

With rising construction costs, climate-related risks, and increasing home values, home insurance is no longer optional—it’s essential for financial safety.

Global risk factors increasing home insurance demand:

- Climate change increasing storms, floods, wildfires, and hurricanes

- Higher property values worldwide

- Increased home burglary rates in urban regions

- Rising construction and repair costs

- More remote work increasing home equipment needs

Global Comparison: Home Insurance Coverage by Region

North America

- Comprehensive multi-risk home insurance packages

- High wildfire, hurricane, and flood risk zones

- Special add-ons like identity theft coverage

Europe

- Strong regulatory framework

- Mandatory natural disaster coverage in some countries

- High building insurance standards

Asia-Pacific

- Rapid real estate growth

- High risk of typhoons, earthquakes, and floods

Middle East

- Rising demand for expat property insurance

- Specialized coverage for desert climate risks

Top Global Home Insurance Providers in 2025

- Allianz

- AXA

- Zurich Insurance

- State Farm

- Chubb

- Liberty Mutual

- Direct Line

- Aviva

- Tokyo Marine

- Ping An Insurance

How Much Does Home Insurance Cost in 2025?

Premiums depend on location, property value, construction type, and local risk exposure.

Factors affecting home insurance premiums globally:

- Geographical risk (flood zones, wildfire zones, cyclone regions)

- Age and materials of the building

- Home security systems installed

- Property size and interior upgrades

- Local construction cost trends

How to Reduce Home Insurance Premiums

- Install smart home security systems

- Bundle home + auto + life insurance

- Increase policy deductibles

- Reinforce the roof and structural elements

- Install fire alarms and sprinklers

- Perform regular inspections

Home Insurance vs. Mortgage Insurance: Key Differences

- Home Insurance: Protects your property and belongings.

- Mortgage Insurance: Protects the lender from borrower default.

Both are often required when purchasing a home.

Do You Need Both?

Yes, in most cases:

- Mortgage insurance is mandatory for high-LTV loans.

- Home insurance is mandatory to protect the property.

Best Add-Ons to Consider in 2025

- Flood protection

- Earthquake insurance

- Extended rebuild cost coverage

- Home office equipment insurance

- Smart-home cyber protection

Final Thoughts

Mortgage and home insurance are essential to protecting your investment, financial stability, and future security. As property risks evolve in 2025, choosing the right policy can help you mitigate losses, avoid debt, and maintain long-term peace of mind.

Always compare multiple insurance providers, evaluate coverage options, and choose policies that match both your mortgage requirements and your real estate goals.

Admin

Admin

Admin

Admin