Understanding Mortgage Amortization: How Your Home Loan Really Works

Mortgage amortization is one of the most important concepts every homebuyer should understand — yet many people sign a loan agreement without truly knowing how their payments are structured. Whether you’re buying your first home, refinancing, or planning a long-term financial strategy, understanding amortization can help you save money, shorten your loan term, and reduce interest costs.

What Is Mortgage Amortization?

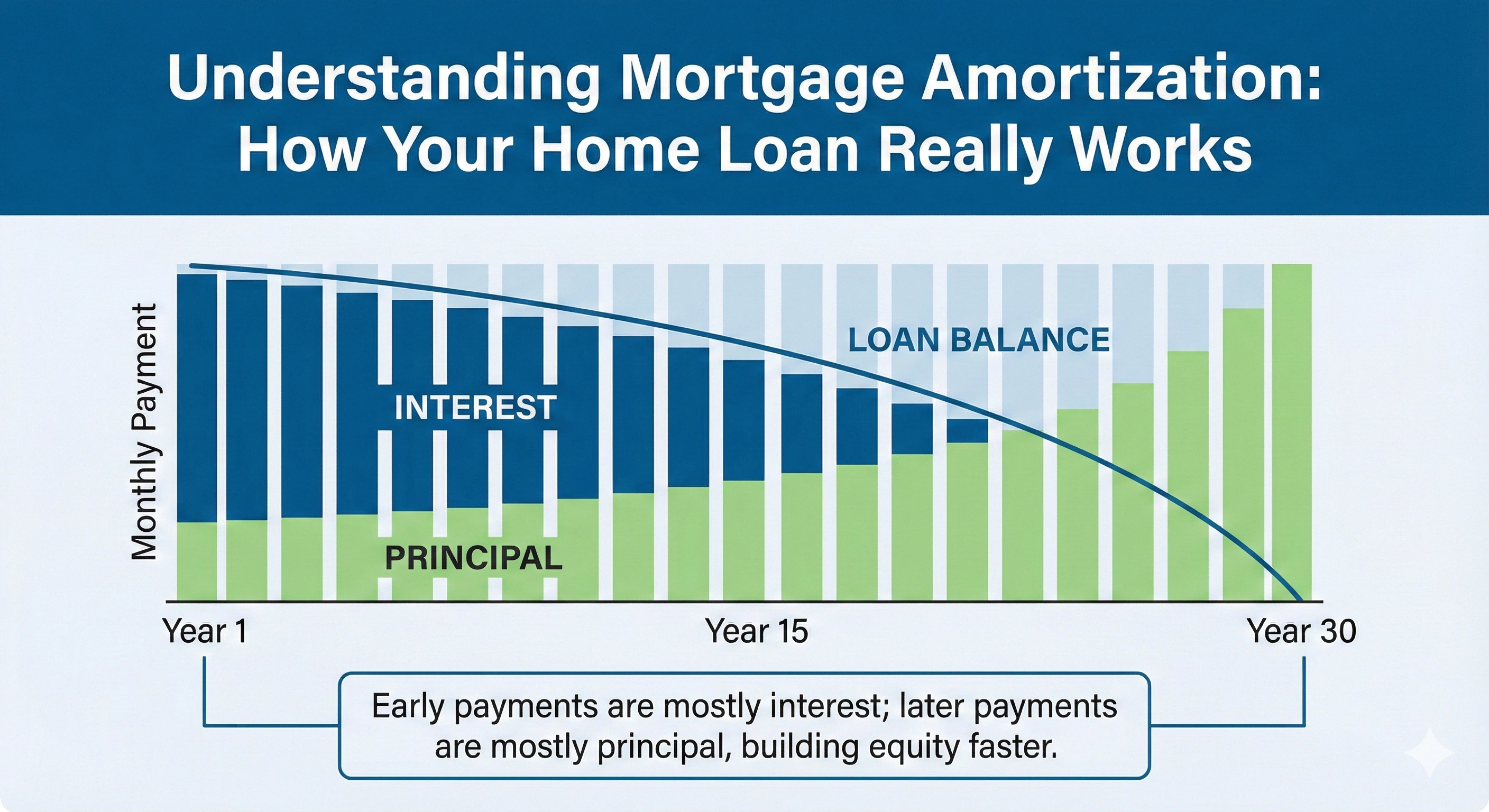

Mortgage amortization refers to the structured repayment of a home loan over a fixed term. Each monthly payment includes two parts: principal (the amount you borrowed) and interest (the cost of borrowing). Over time, the ratio of principal vs. interest in each payment changes. Early payments mostly cover interest, while later payments go more toward principal.

How Amortization Works Globally

Across countries, the structure is similar even though mortgage terms differ. In the U.S., U.K., Canada, Australia, New Zealand, Singapore, and several European and Asian countries, home loans are set up in a long-term amortized structure (typically 15–30 years). Monthly payment consistency helps buyers plan financially.

Benefits of an Amortized Mortgage

- Predictable monthly payments

- Clear repayment timeline

- Balanced principal reductions over time

- Potential interest savings with prepayments

Amortization Schedule: The Breakdown

An amortization schedule is a table that lists every payment across the life of your loan. It shows how much of each payment goes to principal and interest.

Key Components:

- Loan Amount

- Interest Rate

- Loan Term

- Monthly Payment

- Remaining Balance After Each Payment

Why Early Payments Are Mostly Interest

Mortgage lenders structure loans using simple interest calculations based on the outstanding balance. In the early years, the balance is high, so interest charges are high. Over time, as the balance decreases, the interest portion shrinks.

How to Reduce Your Interest Costs

Homeowners can save thousands with strategic amortization hacks:

- Make extra principal payments (even small ones).

- Make biweekly payments instead of monthly.

- Refinance to a lower rate when market conditions improve.

- Select a shorter loan term (15–20 years instead of 30).

Global Factors Affecting Amortization

While the structure stays consistent, several factors differ by region:

- Interest rate policies by national banks

- Government-backed loan programs

- Housing affordability levels

- Lending regulations unique to each country

Interest-Only vs. Amortized Mortgages

Some countries offer interest-only home loans for a limited period. These typically reduce payments in the early years but delay principal repayment. Amortized loans remain the most common because they offer a steady path toward full repayment.

Should You Make Extra Payments?

Absolutely — if your financial situation allows. Extra payments go directly toward your principal, lowering the total interest paid. However, check your loan agreement to ensure there are no prepayment penalties.

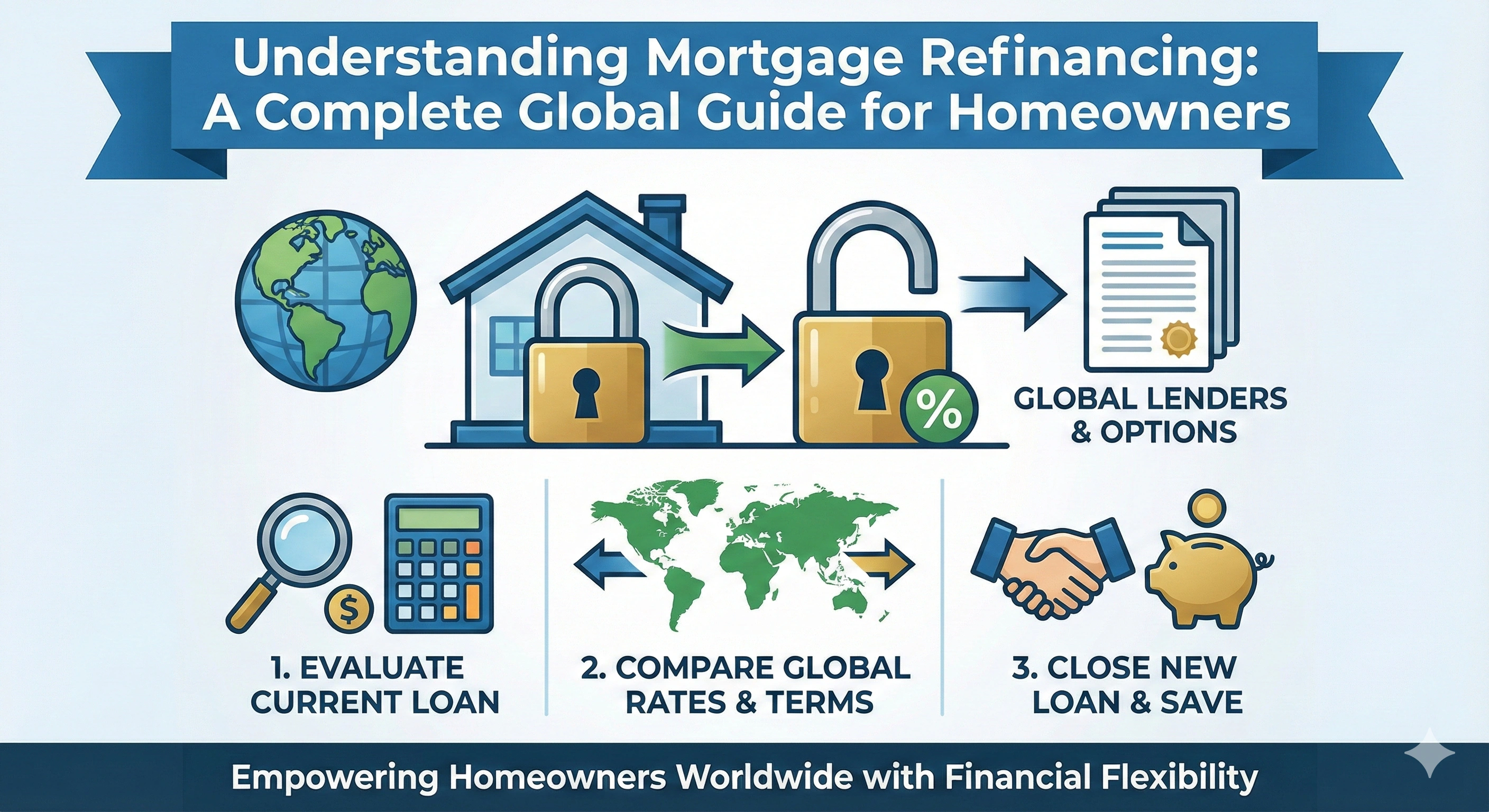

Amortization and Refinancing Strategy

A well-timed refinance can reset your amortization schedule, lower interest rates, or reduce the loan term. Many borrowers refinance after 5–7 years to capitalize on better market rates.

Final Thoughts

Understanding mortgage amortization empowers you to make smarter financial decisions. Whether buying your first home, managing investment properties, or refinancing, knowing how your payments work helps you save money and pay off your mortgage faster.

Admin

Admin

Admin

Admin