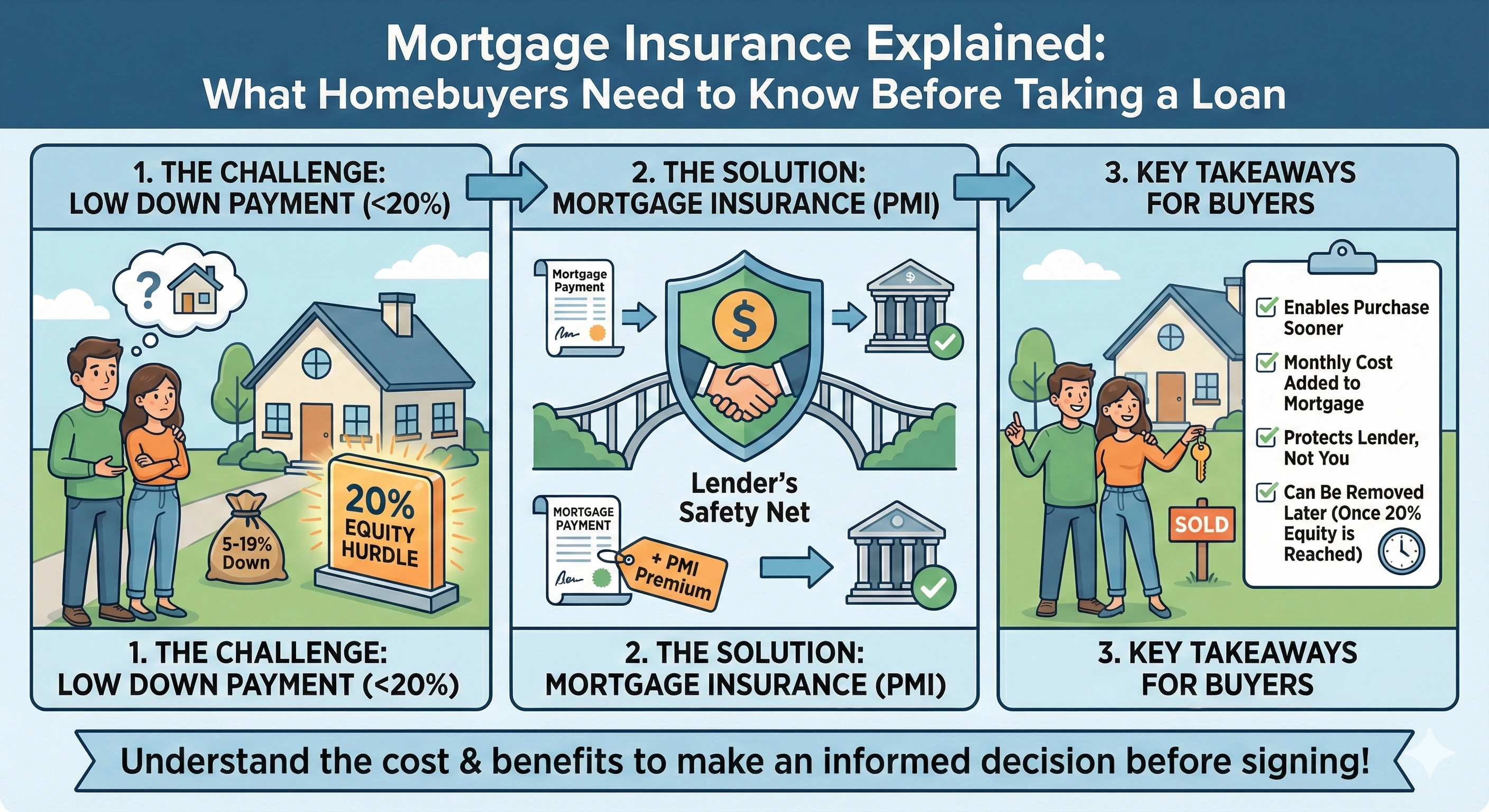

What Is Mortgage Insurance?

Mortgage insurance protects lenders when a borrower puts a low down payment on a home. If you are buying a house with less than 20% down, most banks require Private Mortgage Insurance (PMI).

Types of Mortgage Insurance

- Private Mortgage Insurance (PMI): Required for conventional loans with low down payments.

- FHA Mortgage Insurance Premium (MIP): Required for FHA government-backed loans.

- Lender-Paid Mortgage Insurance (LPMI): The lender pays the premium but increases your interest rate.

- Mortgage Protection Insurance: Pays off your loan if you pass away or become disabled.

Why Banks Require Mortgage Insurance

When down payment is below 20%, the lender faces higher default risk. Mortgage insurance reduces that risk and allows borrowers to secure a home loan with less upfront money.

How Much Does Mortgage Insurance Cost?

PMI typically costs between 0.2% to 2% of the loan amount annually. Factors influencing cost include credit score, loan type, down payment amount, and property value.

How to Lower or Remove PMI

- Increase your down payment to 20%.

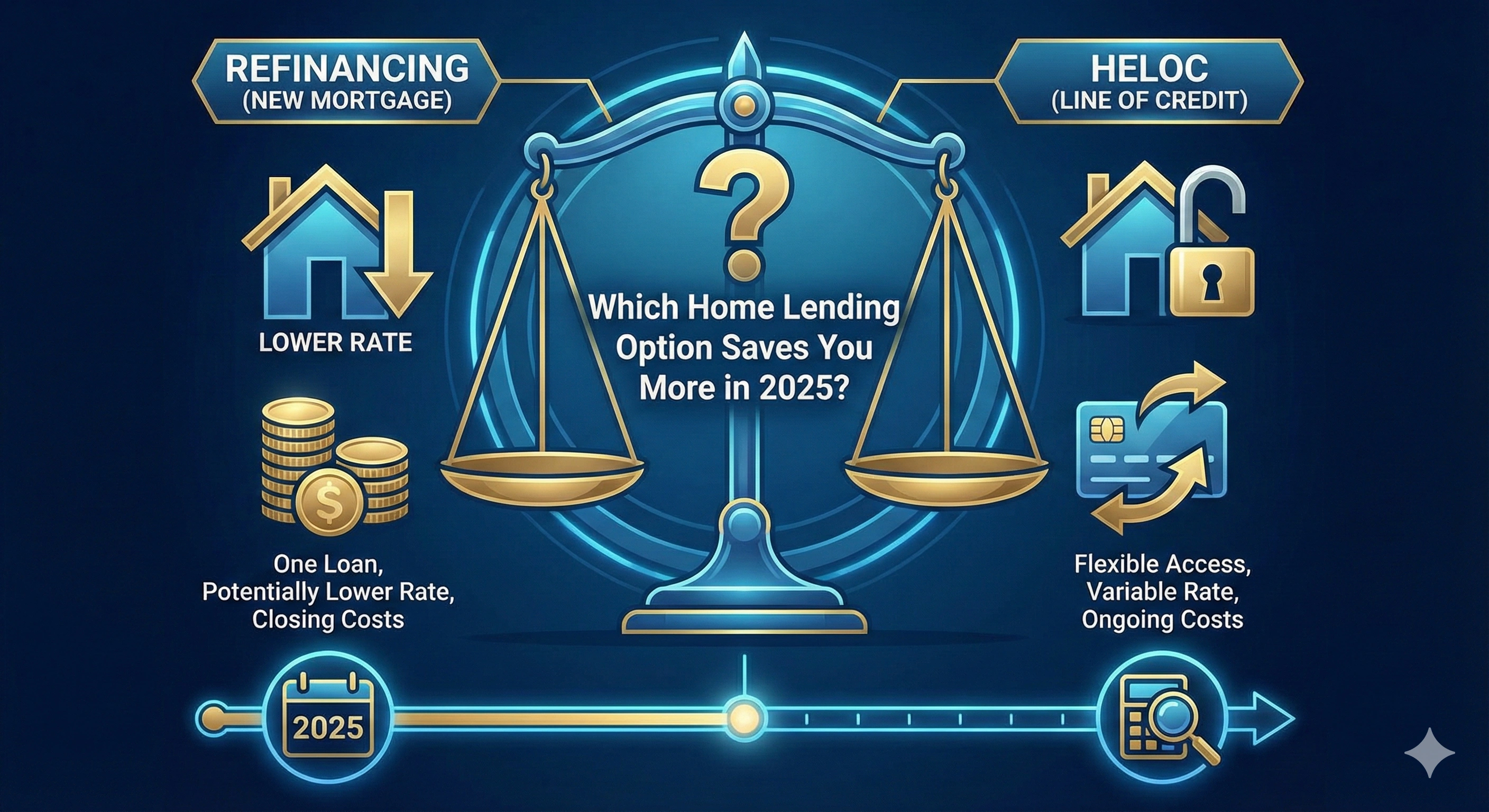

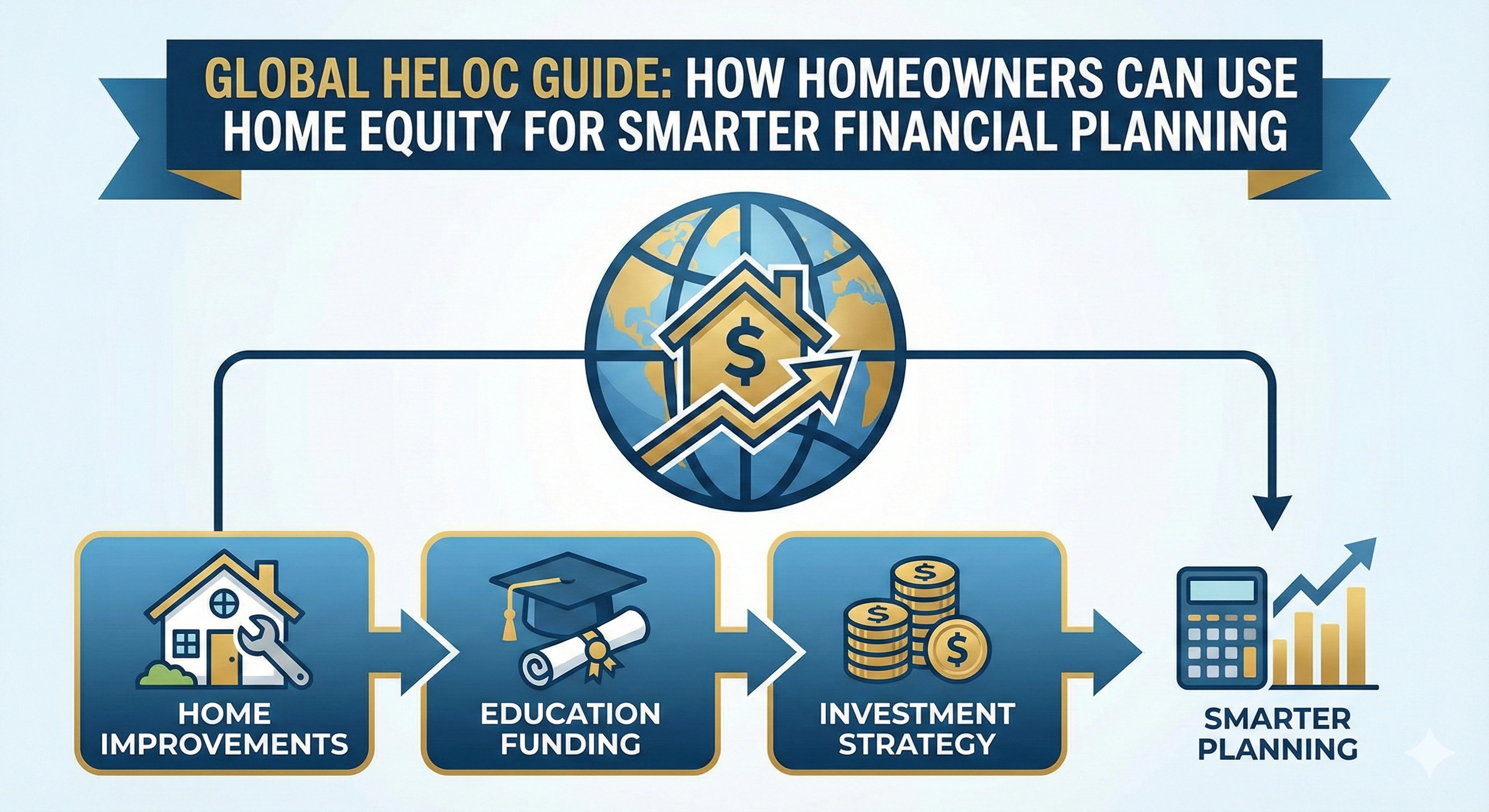

- Refinance when your home value increases.

- Improve your credit score for better rates.

- Request PMI removal once you reach 20% equity.

Do You Need Mortgage Protection Insurance?

Unlike PMI, Mortgage Protection Insurance is optional and protects your family—not the lender. It ensures your mortgage is paid if you face unexpected life events.

Final Thoughts

Mortgage insurance may not feel ideal, but it allows homebuyers to purchase a home sooner without saving a full 20% down payment. Understanding your options helps you choose the most cost-effective loan structure.

Admin

Admin

Admin

Admin