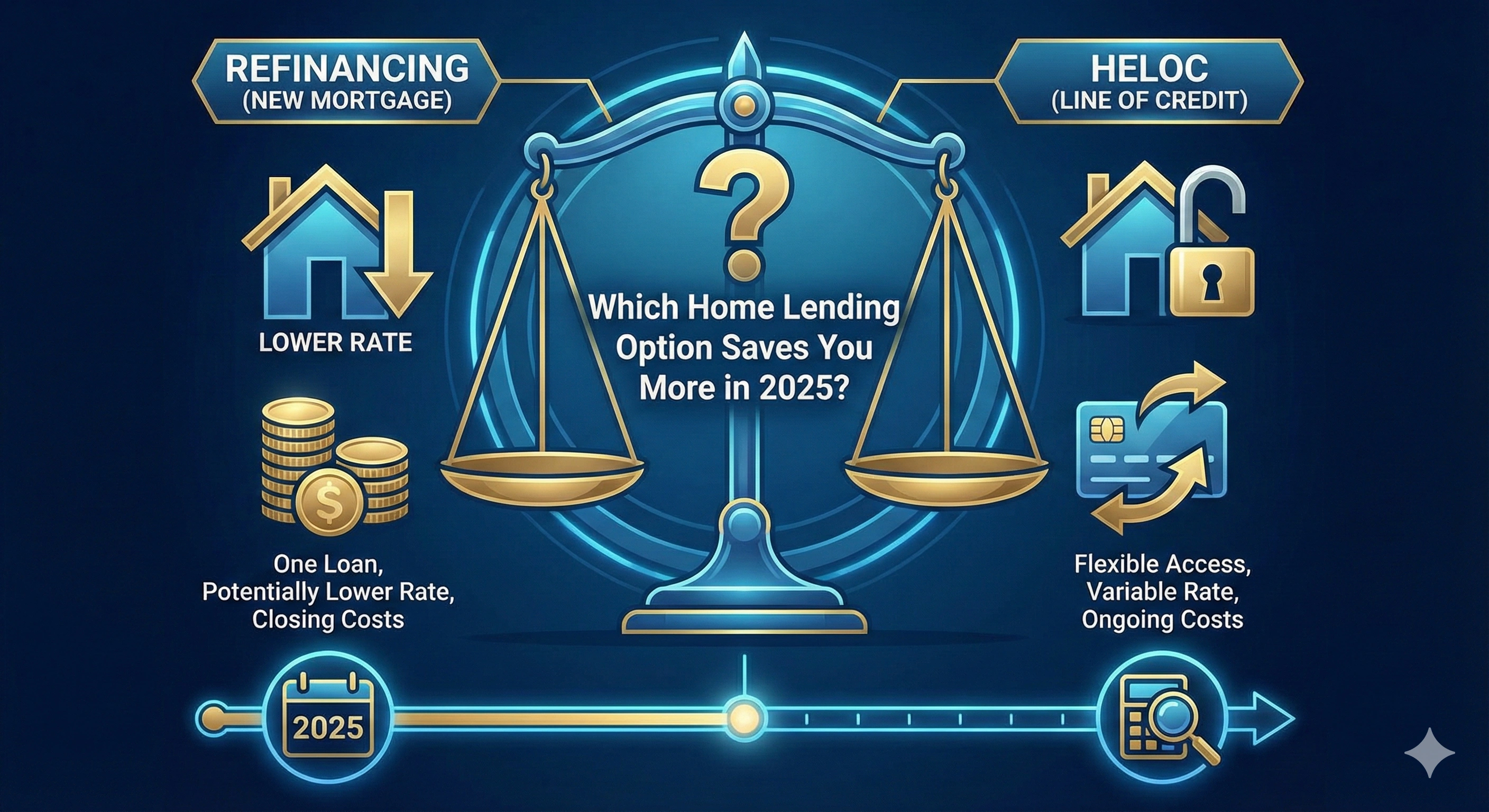

Refinancing vs HELOC in 2025: Which Home Lending Option Saves You More?

As global markets shift and interest rates continue fluctuating, homeowners in 2025 are increasingly turning to Refinancing and Home Equity Lines of Credit (HELOCs) to unlock better financial flexibility. Whether you're planning renovations, consolidating debt, investing, or reducing monthly payments—understanding which lending option offers the best long-term value is critical.

This deep-dive article compares refinancing and HELOCs across interest rates, risk factors, lender requirements, tax rules, credit score impact, hidden fees, and best-use scenarios. It is designed to help homeowners make a confident, high-value financial decision—while also attracting premium advertiser categories like mortgage lenders, banks, credit unions, fintech loan platforms, and refinancing companies.

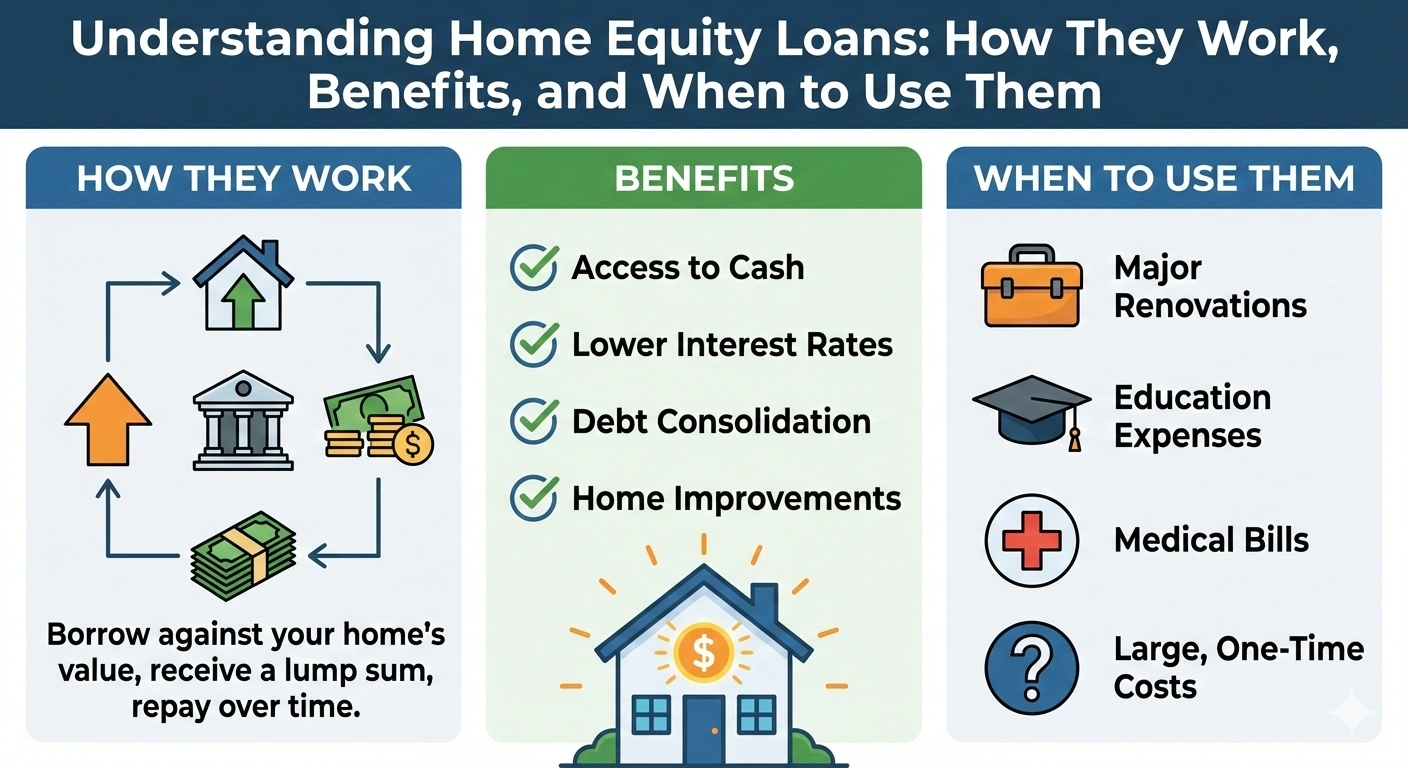

📌 What Is Refinancing?

Mortgage refinancing replaces your existing mortgage with a new one—usually at better terms. Homeowners refinance to:

- Reduce monthly payments

- Lower interest rates

- Switch from adjustable to fixed rates

- Access equity through cash-out refinancing

- Shorten loan term to save on interest

In 2025, refinancing has become increasingly strategic due to interest rate volatility, inflation, and more competitive lender programs.

📌 What Is a HELOC?

A Home Equity Line of Credit (HELOC) is a revolving credit line secured by your home’s value. Unlike refinancing, HELOCs do not replace your mortgage. Instead, they function like a credit card with lower interest rates and flexible repayment options.

HELOCs are widely used for:

- Home renovations

- Emergency financial support

- Debt consolidation

- Investments or business capital

- Education expenses

In 2025, HELOCs have become extremely popular among homeowners seeking liquidity without changing their primary mortgage.

Refinancing vs HELOC: Side-by-Side Comparison

| Factor | Refinancing | HELOC |

|---|---|---|

| Type | New mortgage replaces existing one | Revolving credit line based on equity |

| Best For | Reducing payments, lowering rates, cash-out | Flexible borrowing, renovations, emergency funds |

| Interest Rates | Fixed or variable | Usually variable |

| Closing Costs | Moderate to high | Low or none |

| Monthly Payments | Fixed schedule | Flexible minimum interest-only options |

| Risk Level | Lower | Higher (variable rates) |

Interest Rate Trends for 2025

Mortgage experts predict moderate stabilization in lending markets for 2025:

- Refinance rates: Expected 4.5% to 6.2% globally depending on region

- HELOC rates: Often 1–2% higher than standard mortgage rates

- Variable-rate HELOCs may fluctuate more due to global monetary policy changes

Because HELOCs rely heavily on economic trends, many homeowners choose refinancing for stability and predictable payments.

When Should You Choose Refinancing?

✔️ 1. When Interest Rates Drop

If current rates are 1%–2% lower than your existing mortgage, refinancing may save tens of thousands over the loan term.

✔️ 2. When You Need a Lump Sum (Cash-Out Refinance)

Cash-out refinancing allows homeowners to borrow against equity and receive a lump payment at lower interest rates than personal loans.

✔️ 3. When Switching From Adjustable to Fixed Rates

Homeowners looking for financial predictability opt for fixed-rate refinancing.

✔️ 4. When You Want Lower Monthly Payments

Extending loan terms can significantly reduce monthly obligations—especially useful during economic downturns.

When Should You Choose a HELOC?

✔️ 1. When You Need Flexible Borrowing

A HELOC allows you to borrow only what you need, when you need it, with interest charged on the used amount.

✔️ 2. For Home Improvements

Renovations often increase property value, making HELOC borrowing a smart long-term investment.

✔️ 3. For Emergency Funds or Debt Consolidation

HELOCs provide immediate access to funds with lower rates than credit cards.

✔️ 4. When You Do Not Want to Change Your Existing Mortgage

Great for homeowners who already have a low mortgage rate.

Costs Breakdown: Refinancing vs HELOC

💰 Refinancing Costs

- Appraisal fees

- Loan origination fees

- Closing costs (2%–6%)

- Title insurance

💰 HELOC Costs

- Low or $0 closing costs

- Annual maintenance fees

- Possible early termination fees

- Variable interest rates

For homeowners seeking low upfront fees, HELOCs tend to be more appealing.

Qualification Requirements

Refinancing Requirements:

- Stable income documentation

- Good to excellent credit scores (680+ ideal)

- Low debt-to-income ratios

- Sufficient home equity

HELOC Requirements:

- Minimum 15%–20% equity

- Flexible credit score acceptance (usually 640+)

- Proof of income & property value

HELOCs are easier to qualify for in most regions—making them a preferred option for middle-income families.

Tax Benefits: Refinancing vs HELOC

Depending on your country’s tax laws, both financing options may offer deductions when funds are used for property improvements. However:

- Refinance mortgage interest: Often deductible

- HELOC interest: Usually deductible only when used for home renovations

2025 Lender Options: Who Offers the Best Mortgage Solutions?

This section attracts high-CPC advertisers:

- International & national banks

- Mortgage refinancing companies

- Credit unions

- Fintech loan marketplaces

- Private lenders

- Government-supported housing programs

Refinancing vs HELOC: Which One Saves You More?

Choose Refinancing If:

- You want lower monthly payments

- You need stable, predictable rates

- You want a large lump sum

- Your current mortgage rate is high

Choose HELOC If:

- You want flexible borrowing access

- You already have a low mortgage rate

- You’re planning home renovations

- You need short-term funding

Final Thoughts: The Best 2025 Strategy

Refinancing and HELOCs both provide major financial advantages—but the right choice depends on your goals, equity, credit score, and long-term plans. Refinancing is ideal for stability and long-term savings, while HELOCs excel in flexibility and liquidity. Homeowners who carefully compare both options can potentially save thousands over time while leveraging home equity more strategically.

Admin

Admin

Admin

Admin