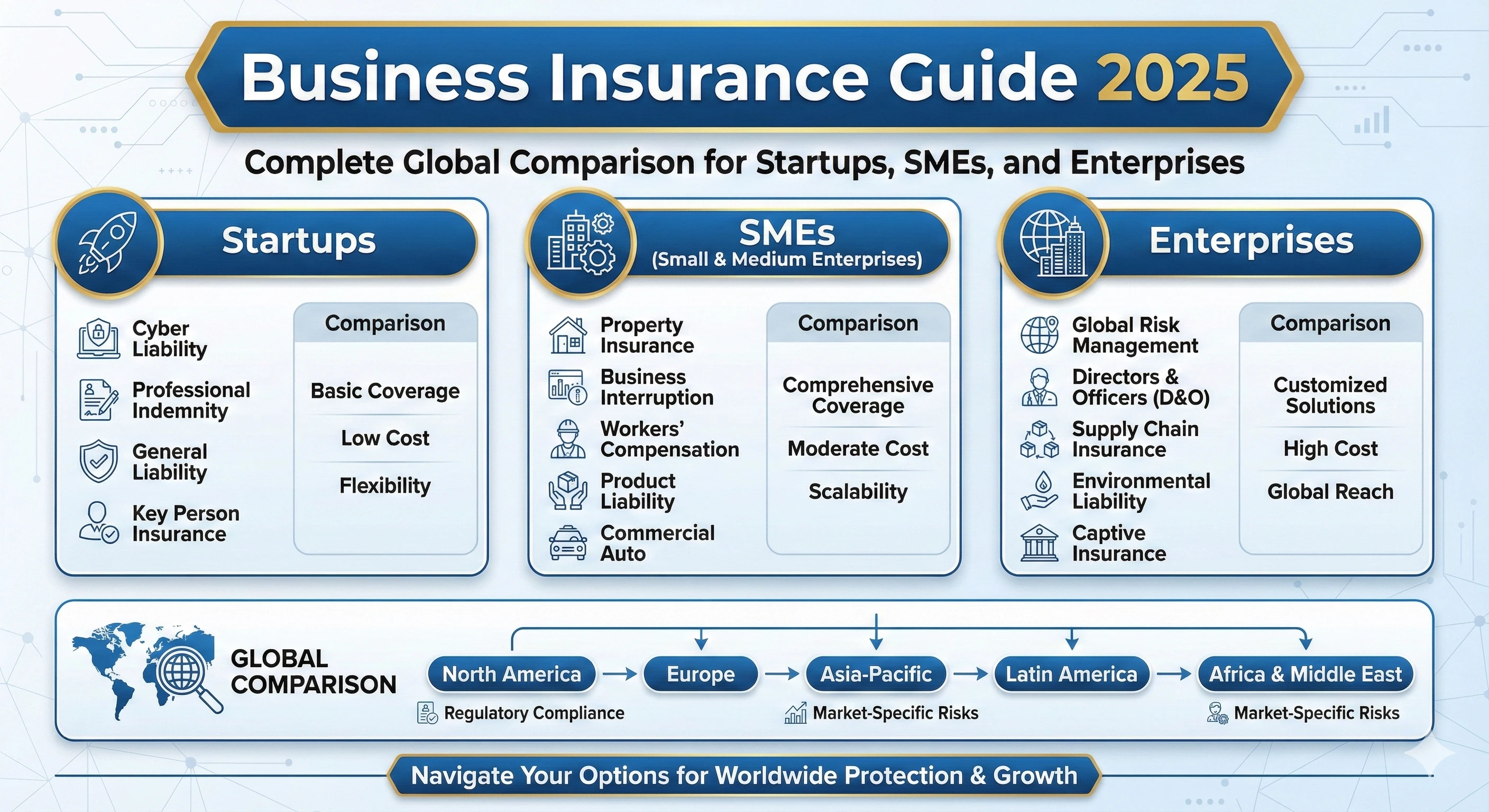

Business Insurance Guide 2025: Complete Global Comparison for Startups, SMEs & Enterprises

Business insurance is one of the most critical financial safety nets for any company operating in 2025. Whether you're a startup founder, SME owner, or large enterprise executive, the right commercial insurance policy helps protect your organization from legal risks, financial losses, cyber threats, employee liabilities, and unexpected operational disruptions.

With global regulations tightening and business risks growing more unpredictable, comparing business insurance policies is more important than ever. This guide explains every major type of business insurance, compares global coverage standards, and helps you choose the right policy with confidence.

Why Business Insurance Is Essential in 2025

Businesses today face more risks than ever before. These include data breaches, lawsuits, supply-chain breakdowns, property damage, and employee-related claims. Without commercial insurance, even a single incident can lead to devastating financial loss.

Key global business risks:

- Cyber-attacks and ransomware

- Legal liability & customer lawsuits

- Property and equipment damage

- Employee injuries and HR complaints

- Natural disasters, fire, and floods

- Business interruption and operational downtime

- Product defects or malfunction claims

Business insurance protects against these risks, ensuring long-term stability and growth.

Top Types of Business Insurance Explained

Understanding commercial insurance categories is key to choosing the right coverage. Below are the core types every business should evaluate:

1. General Liability Insurance (GLI)

This is the most common form of business insurance. It protects your company against claims involving bodily injury, property damage, and advertising mistakes.

- Slip-and-fall accidents

- Customer injuries

- Damages caused by employees

- Legal defense and settlements

2. Professional Liability Insurance (Errors & Omissions)

Ideal for consultants, agencies, IT companies, SaaS businesses, financial experts, and service providers. It protects against:

- Negligence claims

- Incorrect advice

- Service delays

- Professional mistakes

3. Commercial Property Insurance

Covers physical assets such as buildings, machinery, computers, warehouses, and inventory.

4. Business Interruption Insurance

If your company temporarily cannot operate due to disaster, this insurance covers lost income and operating expenses.

5. Cyber Liability Insurance

One of the fastest-growing insurance categories due to increasing global cyber threats. Covers:

- Data breaches

- Online fraud

- Ransomware recovery

- Legal liabilities

- Customer notification costs

6. Workers’ Compensation Insurance

Provides medical and wage benefits to employees injured on the job. Mandatory in many countries.

7. Directors & Officers (D&O) Insurance

Protects company leadership from personal financial liability arising from business decisions.

8. Product Liability Insurance

Protects manufacturers, retailers, e-commerce brands, and distributors from claims related to defective products.

9. Commercial Auto Insurance

Covers company-owned vehicles used for business purposes.

Global Comparison: How Business Insurance Differs by Region

Although commercial insurance is needed everywhere, coverage types and regulations differ by region.

North America

- Strong legal protection requirements

- High cost but high coverage

- Cyber insurance widely used

Europe

- Strict data protection (GDPR)

- Comprehensive liability and employee protection

Asia-Pacific

- Growing SME insurance adoption

- Rapid expansion of cyber and property insurance

Middle East & Africa

- Business regulation modernization

- Increased focus on commercial liability coverage

How to Choose the Right Business Insurance Policy

Follow these steps to choose the best commercial insurance in 2025:

- Identify your top business risks

- Compare quotes from at least 5 insurers

- Check exclusions & coverage limits

- Evaluate claim settlement reputation

- Consider add-ons like cyber or D&O insurance

- Compare deductibles vs. premiums

Best Global Insurance Companies for Businesses

Major insurers offering global or regional commercial coverage include:

- Allianz

- AXA

- Zurich Insurance

- Liberty Mutual

- AIG

- Chubb

- State Farm (regional)

- Hiscox Insurance

How Businesses Can Reduce Insurance Costs

Smart ways to lower commercial insurance expenses:

- Bundle multiple policies with one provider

- Improve workplace safety

- Install cybersecurity protection tools

- Maintain low-risk business practices

- Adjust deductibles according to financial comfort

- Use annual payments instead of monthly payments

Final Thoughts

Business Insurance in 2025 is more critical than ever due to shifting global regulations, cyber risks, economic uncertainties, and expanding operational challenges. A well-chosen commercial insurance policy protects your business, employees, assets, and long-term success.

Always compare multiple providers, check coverage terms carefully, and choose a policy that aligns with your business goals and risk profile.

Admin

Admin

Admin

Admin