Global Guide to Mortgage & Home Insurance: Protecting Your Property, Investment & Financial Future

Buying a home is one of the most significant financial decisions any individual or family will ever make. Whether you're purchasing a primary residence, rental property, or investment home, protecting that asset is essential. Globally, mortgage and home insurance form an indispensable part of responsible homeownership, ensuring financial safety against unexpected events like natural disasters, theft, fire, or structural damage.

This extensive guide breaks down everything you need to know about mortgage insurance and home insurance worldwide — how policies work, what they cover, who needs them, premium factors, and how to choose the right plan.

Understanding Mortgage Insurance (Globally)

Mortgage insurance is designed to protect the lender in case the borrower defaults on the home loan. It doesn't directly insure the property itself but rather protects the bank or lender that provided the mortgage.

Why Mortgage Insurance Exists

- To reduce financial risk for lenders.

- To help buyers secure a home with a lower down payment.

- To expand access to home financing globally.

Types of Mortgage Insurance Worldwide

Depending on the region, terminology and structure vary, but the fundamental purpose remains the same.

- Private Mortgage Insurance (PMI) – Typically required when homebuyers pay less than 20% down.

- Lender’s Mortgage Insurance (LMI) – Popular in markets like Australia; protects lenders but paid by borrowers.

- Government-backed Mortgage Insurance – Exists in many countries to support high-risk borrowers.

- Mortgage Life Insurance – Pays off the mortgage if the borrower dies.

When Mortgage Insurance is Required

- When borrowers pay a small down payment.

- If the borrower has a lower credit score.

- When the property is categorized as high-risk or in a disaster-prone zone.

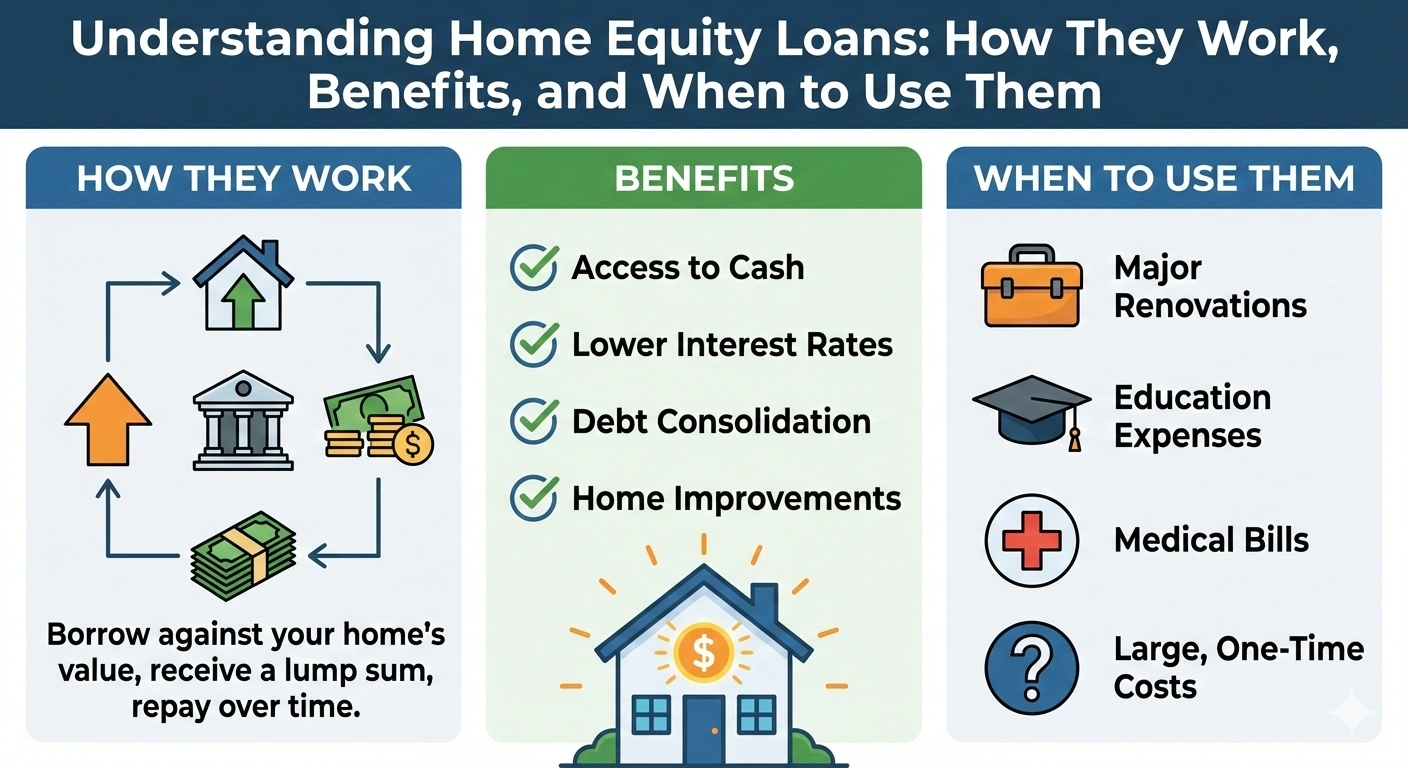

Understanding Home Insurance (Globally)

Home insurance protects the physical structure of your home and its contents. It also covers liability in case someone suffers injury on your property. Globally, home insurance is considered essential, whether required by mortgage lenders or chosen voluntarily for protection.

Core Components of Home Insurance

1. Building/Structure Insurance

Covers the physical structure — walls, roof, fixtures, foundation, garages, etc.

2. Contents Insurance

Covers personal belongings like electronics, furniture, valuables, appliances, and clothing.

3. Liability Protection

Protects homeowners if someone is injured on the property and files a claim.

4. Loss of Use/Additional Living Expenses

Covers the cost of temporary living arrangements if the home becomes uninhabitable.

Global Events Covered by Home Insurance

- Fire and explosion

- Theft and vandalism

- Water damage (non-flood events)

- Storms, wind, hail

- Earthquakes or floods (optional in many regions)

Common Exclusions in Home Insurance

- Negligence or maintenance-related issues

- Termite or pest damage

- Wear and tear

- Mold unless caused by a covered event

- War, nuclear hazards

Factors Affecting Mortgage & Home Insurance Premiums

1. Location of Property

- High-risk flood zones increase premiums.

- Earthquake-prone areas require special coverage.

- High-crime areas cost more to insure.

2. Property Value & Construction Type

- Larger homes have higher replacement costs.

- Materials like wood vs. concrete impact risk ratings.

3. Coverage Amount & Add-ons

- Higher coverage = higher premium.

- Extras like jewelry insurance or appliance protection increase cost.

4. Claims History

Frequent insurance claims can significantly elevate premiums.

5. Security Systems & Home Safety Measures

Homes with:

- Security cameras

- Burglar alarms

- Fire detection systems

- Smart locks

usually receive discounts.

Global Trends in Home Insurance

1. Climate Change Impact

Natural disasters are becoming more frequent, influencing premiums globally.

2. Rise of Smart Home Insurance

- AI-driven risk detection

- Smart sensors

- Smart security integrations

3. Parametric Home Insurance

Claims paid automatically based on predefined triggers like wind speed or earthquake magnitude.

4. Cyber Home Insurance

Growing as smart home technologies create new vulnerabilities.

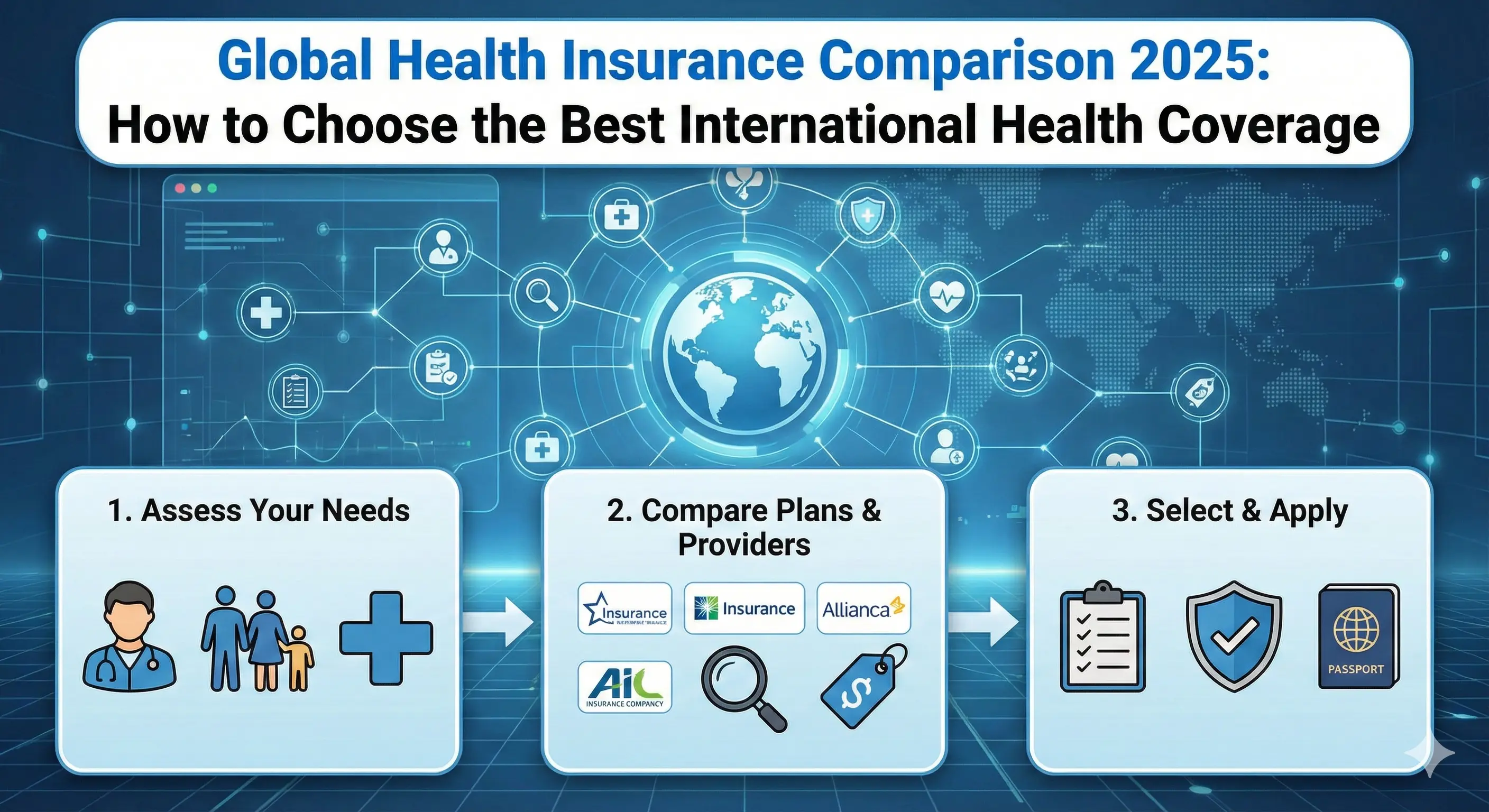

How to Choose the Best Home Insurance

1. Compare Policies from Multiple Providers

- Premiums

- Coverage limits

- Claim settlement reputation

- Add-ons

2. Understand the Insured Value

- Market value vs. replacement value

- Avoid underinsurance or overinsurance

3. Read the Exclusions Carefully

This helps avoid surprise claim rejections.

4. Look for Discounts

- Bundled insurance

- Security system installations

- Loyalty benefits

- High-deductible plans

Top Add-ons to Consider

- Earthquake insurance

- Flood insurance

- Valuables/jewelry protection

- Home office equipment coverage

- Rental income protection (for landlords)

Why Mortgage Lenders Require Home Insurance

When lenders provide a mortgage, they invest heavily in your home. To safeguard their financial stake, most lenders globally require homeowners to carry property insurance throughout the loan term.

Benefits for Homeowners

- Peace of mind

- Financial protection

- Faster recovery after disasters

- Protection of both structure and personal belongings

Tips to Reduce Home Insurance Costs

- Increase deductible

- Install fire and security systems

- Avoid small claims

- Bundle auto and home insurance

- Maintain property regularly

Conclusion

Mortgage and home insurance are essential components of global homeownership. Whether you are a first-time buyer or a seasoned property investor, understanding how these insurance products work helps safeguard your financial future. By selecting the right plan, evaluating risks, and comparing global insurers, homeowners can ensure strong protection, reduced premiums, and long-term peace of mind.

Admin

Admin

Admin

Admin