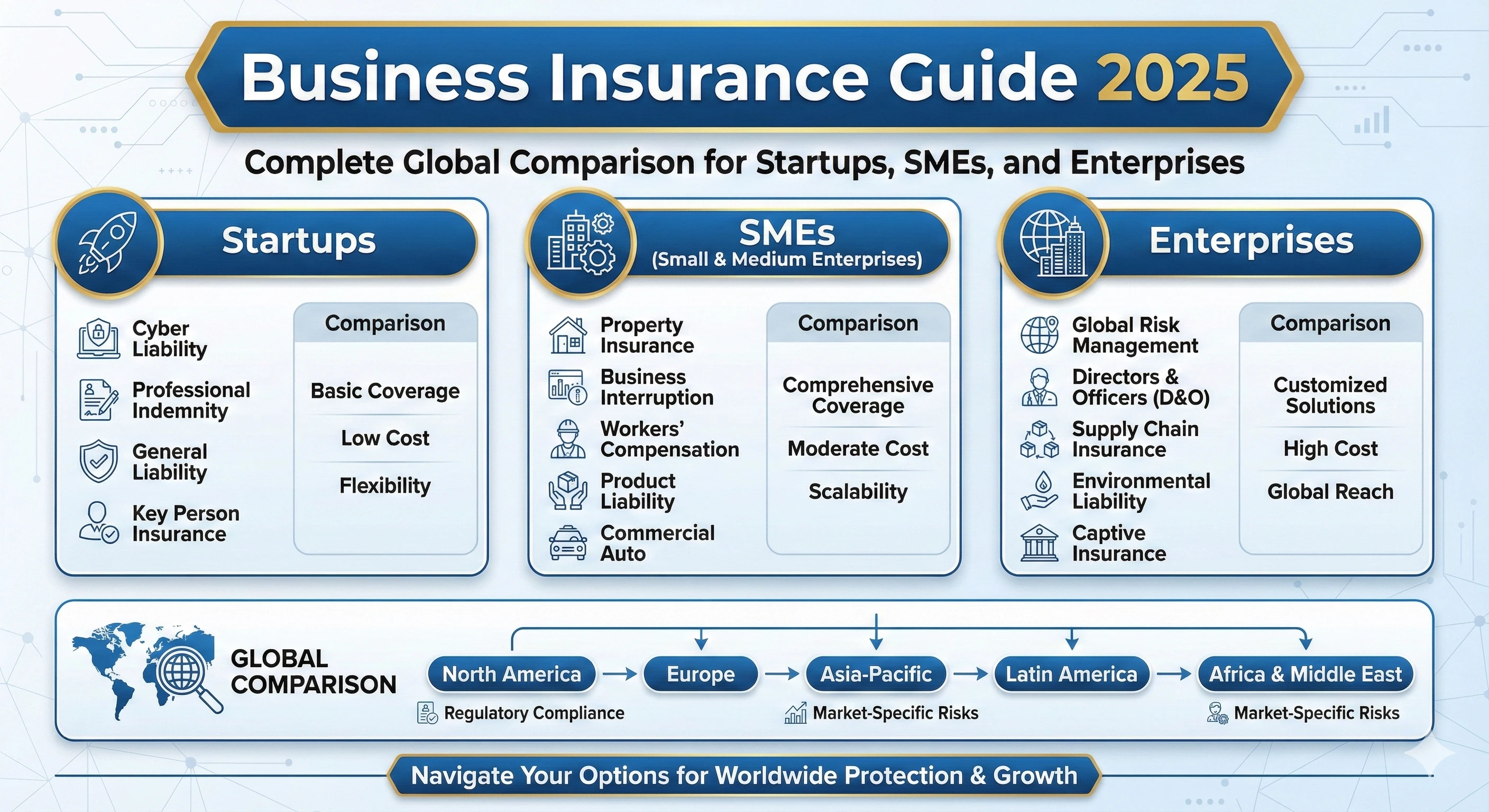

Introduction: Why Business & Commercial Insurance Is Essential Globally

Every business—large or small—faces uncertainties. From physical damage and lawsuits to cyber-attacks and employee liabilities, commercial risks can destroy a company overnight. Business & Commercial Insurance provides essential protection against financial losses, helping organizations survive disruptions and operate with confidence.

As global markets expand and regulatory environments evolve, businesses are investing more in risk management. Insurance now covers not only traditional property or liability risks but also digital threats, data breaches, and global supply chain disruptions. In this comprehensive guide, you will learn everything about commercial insurance coverage, benefits, types, premium strategies, global trends, and how to select the best provider.

1. What Is Business & Commercial Insurance?

Business & Commercial Insurance is a collection of insurance products designed to protect companies from financial loss due to internal or external risks. These policies cover physical assets, employees, legal liabilities, cyber threats, and operational interruptions. Unlike personal insurance, commercial insurance is fully customizable based on business size, structure, industry, and risk exposure.

2. Who Needs Business Insurance?

Every company needs insurance—whether it’s a freelancer working from home, a startup scaling operations, or a multinational corporation managing multimillion-dollar assets. Businesses that require commercial insurance include:

- Small businesses and startups

- Corporations and enterprise-level operations

- E-commerce and digital service companies

- Manufacturing and industrial companies

- Construction firms and contractors

- Retail stores and wholesale distributors

- Hospitality and food service businesses

- Real estate and property management companies

- Professional service firms (law, finance, consulting, tech)

3. Why Commercial Insurance Is Critical for Business Survival

Businesses operate in an environment full of uncertainties. Without insurance, a single major incident can bankrupt a company. Here’s why business insurance is essential:

- Protects against lawsuits and liability claims

- Covers property damage due to fire, theft, vandalism, or natural disasters

- Provides financial support during business interruptions

- Builds credibility with clients, lenders, and investors

- Ensures compliance with local and international regulations

- Protects digital assets and data from cyberattacks

- Helps cover employee-related risks and workplace injuries

- Mitigates supply chain risks and global trade disruptions

4. Major Types of Business & Commercial Insurance

Businesses have different insurance needs depending on the industry and scale. Below are the main categories of commercial insurance globally:

4.1 General Liability Insurance

This is one of the most essential and widely purchased commercial insurance policies. It covers:

- Third-party bodily injury

- Property damage caused by your business

- Legal fees and settlements

- Reputational harm (libel, slander)

4.2 Commercial Property Insurance

Protects physical business assets such as buildings, equipment, inventory, and furniture. It covers damages caused by:

- Fire

- Storms & natural disasters

- Theft & vandalism

- Accidental damage

4.3 Business Interruption Insurance

If operations stop due to an insured event, this policy helps cover:

- Lost income

- Employee salaries

- Temporary relocation

- Operational recovery costs

4.4 Workers’ Compensation Insurance

Required in most regions, this policy protects employees and covers:

- Medical expenses for workplace injury

- Lost wages

- Legal expenses

4.5 Professional Liability Insurance (Errors & Omissions)

Ideal for businesses offering expert services, it covers negligence, mistakes, or missed deadlines that cause financial harm to clients.

4.6 Cyber Liability & Data Breach Insurance

As cybercrime grows globally, this coverage is becoming essential. It provides protection against:

- Hacking & malware attacks

- Data breaches

- Ransomware threats

- Legal fines and customer compensation

4.7 Commercial Auto Insurance

Covers vehicles used for business purposes, including:

- Company cars

- Delivery vans

- Trucks and heavy equipment

4.8 Product Liability Insurance

For manufacturers and retailers, this covers damages caused by defective products.

4.9 Directors & Officers (D&O) Insurance

Protects company leaders from legal claims related to decisions made in office.

4.10 Trade Credit Insurance

Protects businesses when customers fail to pay invoices.

5. How to Choose the Best Commercial Insurance Policy

Selecting the right policy can save businesses significant money and avoid long-term risks. Here’s what to consider:

- Industry-specific risks

- Company size & workforce

- Annual revenue & assets

- Location-based risk factors

- Legal requirements in your region

- Past claim history

5.1 Evaluate the Insurer’s Reputation

- Claim settlement record

- Global presence

- Financial strength rating

5.2 Review Policy Exclusions

Always check what’s not covered before signing.

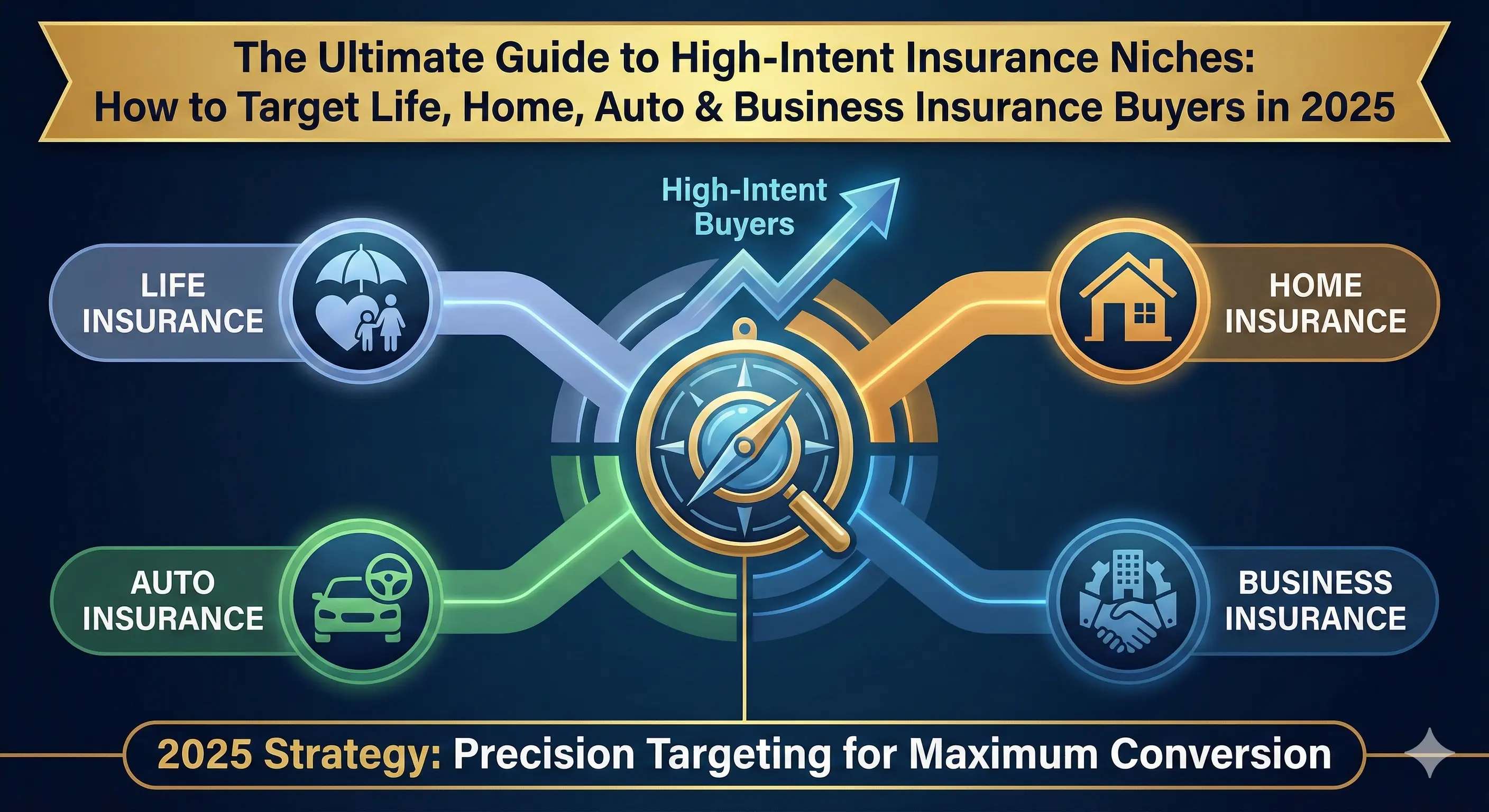

6. Global Trends in Commercial Insurance

Business insurance is evolving rapidly as new risks emerge. Key global trends include:

- Rise of cyber insurance due to digital transformation

- Growth of climate-related risk policies

- Increased demand for supply chain interruption coverage

- Use of AI in risk assessment and fraud detection

- Custom insurance for remote work environments

- Integrated commercial packages for SMBs

7. Cost of Business Insurance: What Affects Premiums?

Several variables influence commercial insurance costs:

- Business location

- Risk level of industry (e.g., construction vs. consulting)

- Company revenue

- Number of employees

- Claims history

- Insurance type & coverage limit

- Security and safety measures in place

8. How to Reduce Insurance Costs Legally

- Bundle multiple policies

- Install safety and security systems

- Improve workplace safety training

- Maintain clean financial and compliance records

- Increase deductibles for lower premiums

- Perform regular risk assessments

9. Common Mistakes Businesses Make With Insurance

- Underestimating coverage needs

- Not updating policies annually

- Failing to insure digital assets

- Ignoring global regulatory changes

- Choosing the cheapest policy instead of the best one

10. Conclusion: A Strong Insurance Strategy Builds Strong Businesses

Business & Commercial Insurance is more than just a formality—it is a financial safety net that supports growth, stability, and long-term sustainability. Companies that invest in strong risk management are more resilient in the face of economic uncertainty, environmental challenges, and evolving digital threats.

No matter your industry or location, the right commercial insurance plan protects your assets, employees, reputation, and profitability.

Admin

Admin

Admin

Admin