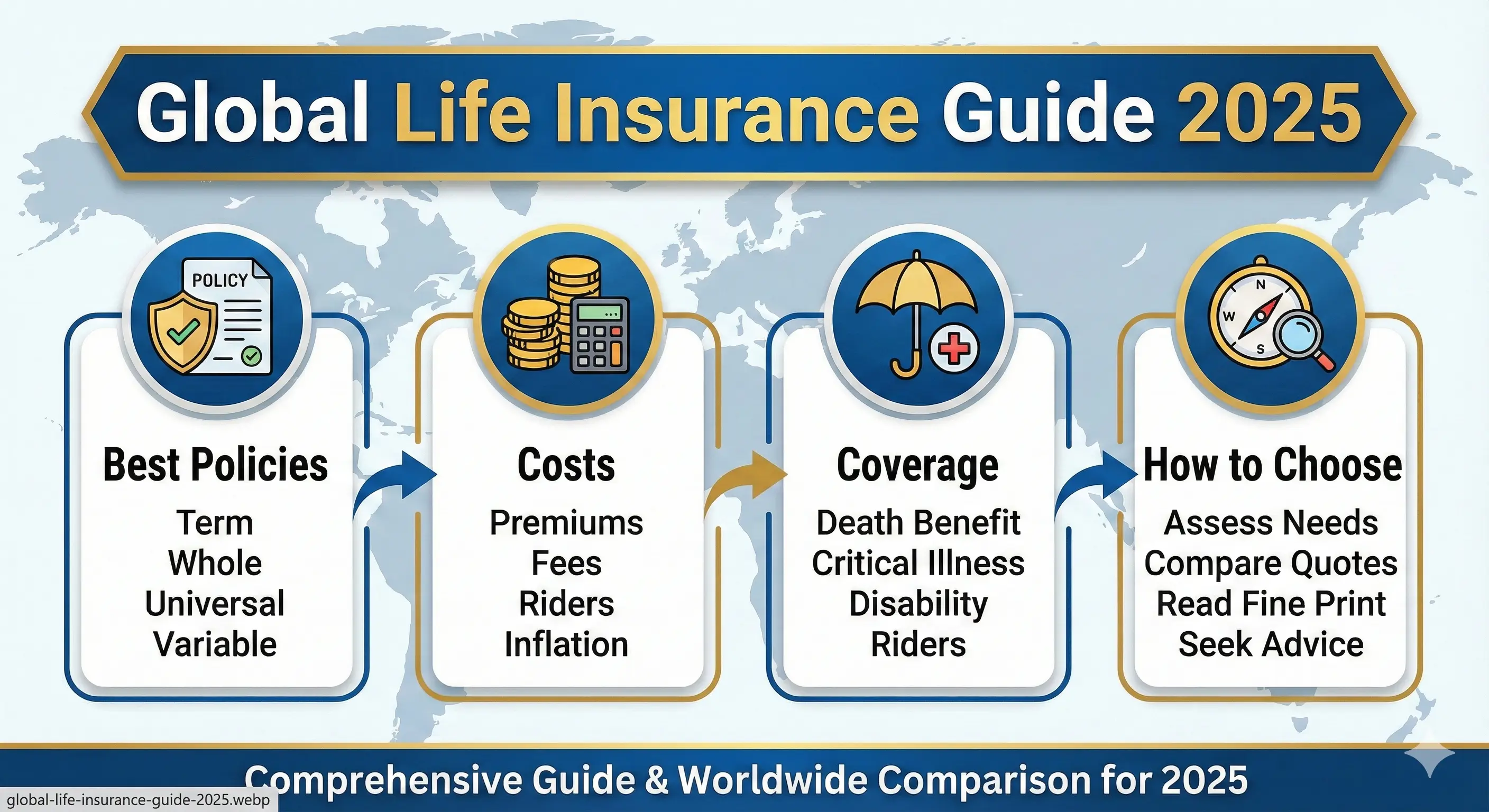

Global Life Insurance Guide 2025: Best Policies, Costs, Coverage & How to Choose the Right Plan Worldwide

Life insurance is one of the most important financial tools any individual or family can invest in. As economies grow, global mobility increases, and medical expenses rise, more people are searching for future-proof, internationally recognized, and financially stable life insurance plans.

This comprehensive 3000+ word guide explores the best global life insurance policies in 2025, the types of coverage available worldwide, cost comparisons, coverage benefits, and how to choose the right policy whether you live in Asia, Europe, the Middle East, Africa, or North/South America.

Unlike most guides that only discuss life insurance in specific countries, this article offers a truly GLOBAL perspective to help:

- Frequent travelers

- Digital nomads

- International workers

- Expats

- Remote employees

- Families moving abroad

- High-net-worth individuals

Whether you need cross-border coverage or want to protect your family anywhere in the world, this guide is for you.

Why Life Insurance Is Essential in 2025

With rising global financial risks, life insurance remains the strongest tool for protecting your family’s future. Global life insurance policies provide:

- Financial security for family members

- Long-term wealth building options

- Tax benefits depending on your country

- Global portability for expats and travelers

- Emergency protection during unpredictable life events

- Guaranteed payouts upon death

- Supplemental investments with cash value policies

In the modern world, especially as people frequently move between countries, having a globally recognized life insurance provider can make a massive difference.

Types of Life Insurance Available Worldwide

While terminology may vary slightly between regions, the core types of life insurance remain the same across the globe:

1. Term Life Insurance

The most common type of life insurance globally. It provides coverage for a fixed time period (10, 20, or 30 years).

- Affordable premiums

- High coverage amounts

- Simple, straightforward protection

- No cash value

2. Whole Life Insurance

A permanent policy that lasts your entire life with fixed premiums and lifelong coverage.

- Lifetime protection

- Cash value grows over time

- More expensive but stable

3. Universal Life Insurance

Flexible premium payments, adjustable death benefits, and investment-linked components.

- Great for long-term financial planning

- Potential for higher returns

4. International/Global Life Insurance

Designed for:

- Expats

- Foreign workers

- Travelers or digital nomads

- Families living in different countries

Coverage follows you globally, often offered by multinational insurers.

5. Investment-Linked Life Insurance

Popular in the UAE, Singapore, Hong Kong, and European markets.

- Part insurance, part investment

- Returns depend on market performance

6. Corporate/Business Life Insurance

Used by business owners to protect key employees, secure loans, or manage succession planning.

Best Global Life Insurance Companies in 2025

These companies offer internationally recognized, highly trusted policies available in multiple countries:

1. Allianz

Top-rated global insurer with strong financial stability and worldwide coverage.

2. AXA

Extensive global network, especially strong in Europe and Asia.

3. MetLife

One of the largest global life insurers with strong term and whole life plans.

4. Prudential

Highly preferred by expats and international workers.

5. Manulife

Major provider in Asia and North America.

6. Sun Life

Known for powerful investment-linked life insurance products.

7. AIA Group

One of Asia’s biggest insurers catering to millions globally.

8. Zurich Insurance

A strong European provider offering international expat policies.

Global Life Insurance Premiums in 2025 (Estimated)

Life insurance costs vary worldwide depending on age, country, currency, risk level, medical history, and policy type. Below is a global estimate range:

| Age | Term Life (per month) | Whole Life (per month) | Universal Life (per month) |

|---|---|---|---|

| 25 | $10–$30 | $40–$120 | $60–$150 |

| 35 | $15–$40 | $70–$180 | $100–$250 |

| 45 | $25–$80 | $150–$350 | $200–$450 |

| 55 | $40–$150 | $300–$600 | $350–$700 |

Premiums differ across regions such as Europe, Asia, the Middle East, Africa, and North America, but these ranges offer a reliable global average.

Factors That Affect Life Insurance Premiums Worldwide

- Age – younger = cheaper

- Location – premiums vary by region and healthcare costs

- Health condition

- Smoking or drinking habits

- Occupation risk level

- Policy type

- Coverage amount

For global policies, factors like travel frequency and country of residence also matter.

Best Life Insurance Plans for Different Needs

1. Best for Families

- Whole Life Insurance for long-term coverage

- Term policies for parents with young kids

2. Best for Expats

- Global term life from Allianz or AXA

- International whole life from Zurich

3. Best for High-Net-Worth Individuals

- Universal life insurance

- Investment-linked policies

4. Best for Business Owners

- Keyman insurance

- Corporate life insurance agreements

How to Choose the Best Life Insurance Policy Globally

Before selecting any life insurance plan in 2025, ask yourself:

- Do I need coverage only in my home country or internationally?

- Is my job high-risk or involves frequent travel?

- Do I want investment returns along with insurance?

- How much can I afford monthly?

- Do I need lifelong coverage or just 10–30 years?

Global Recommendations

- If you want cheapest premium: Choose Term Life.

- If you want lifetime guarantee: Choose Whole Life.

- If you want wealth building + insurance: Choose Universal or Investment-linked.

- If you travel or move countries: Choose International Life Insurance.

Frequently Asked Questions (Global Life Insurance FAQ)

1. Can I buy life insurance if I live in another country?

Yes. Many insurers provide global, expat, and travel-friendly policies.

2. Does global life insurance cover death outside your home country?

Yes—international policies specifically cover worldwide deaths.

3. What is the best global life insurance company?

Allianz, AXA, Prudential, and Zurich are top choices.

4. Do all countries allow foreign residents to buy life insurance?

Most countries do, especially regions like Europe, Asia, UAE, and North America.

Final Verdict: The Best Global Life Insurance Policy in 2025

The best life insurance plan depends entirely on lifestyle, country of residence, budget, and family goals. However, globally speaking:

- Term Life is the best for affordability

- Whole Life is best for lifetime protection

- Universal Life is best for wealth building

- International Life Insurance is best for expats & frequent travelers

Choosing a globally recognized insurer ensures your family is protected—no matter what country you are in today or where you may live tomorrow.

Admin

Admin

Admin

Admin